Amalgamation is a financial term used to describe the process of combining two or more entities into one. It is a powerful tool that can be used to create a stronger organization with increased operational efficiency, cost savings, and greater market share. This article will explore what amalgamation is and how it can benefit businesses, as well as the potential risks associated with it.

Overview of Amalgamation and Its Benefits

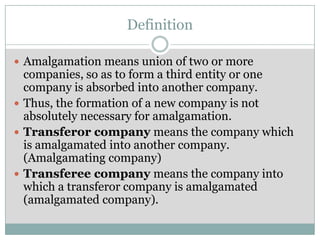

Amalgamation is a great way to combine resources and create a stronger, more efficient business. It’s the process of merging two or more companies into one, creating a larger, more profitable and powerful organization. Amalgamation can be done through a variety of methods, such as a merger, acquisition, joint venture, or consolidation. The benefits of amalgamation are numerous; it can reduce costs, create new markets and opportunities, increase efficiency, and improve economies of scale. Additionally, it can help create a more cohesive and consistent brand image, as well as help reduce debt and increase the value of the newly formed entity. Amalgamation can also help to strengthen the competitive advantage of the new entity, as well as make it easier for the two companies to share resources. Ultimately, amalgamation can help create a more cohesive and profitable business.

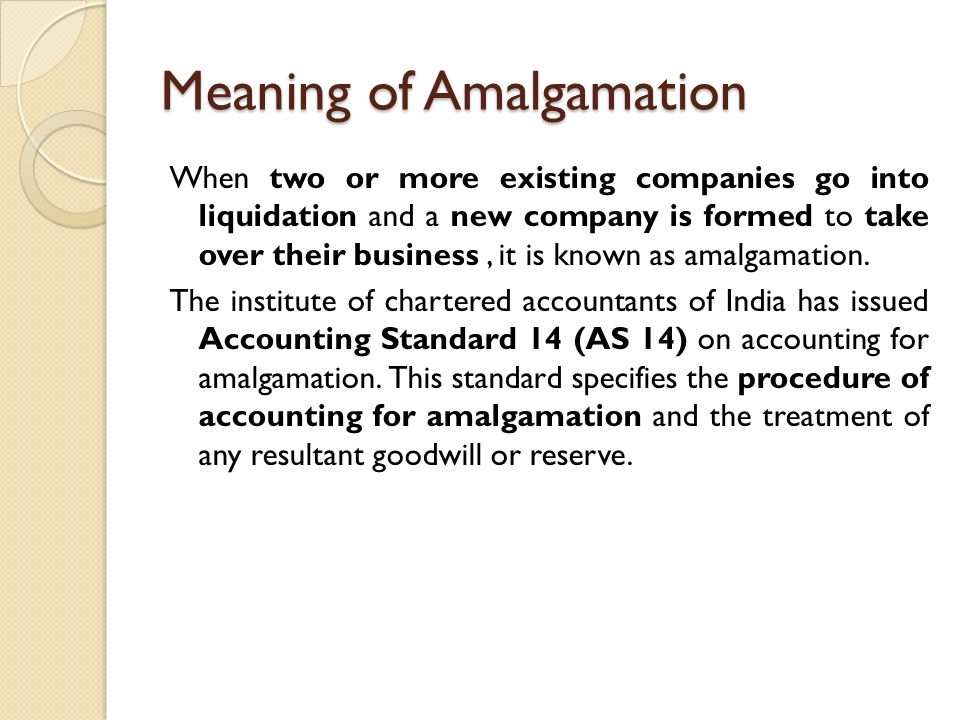

Understanding the Financial Definition of Amalgamation

Understanding the financial definition of amalgamation is key to understanding how businesses can combine resources to form a larger, more efficient organization. Amalgamation is the process of combining two or more organizations into one, and the resulting entity is typically larger than the original components. This process can be beneficial for both organizations, as it can help them take advantage of economies of scale, strength in numbers, and other synergies that come from joining forces. For example, combining two companies into one can help reduce operating costs, as the new entity can spread out the cost of resources across its larger base. Additionally, it can result in new opportunities for growth and expansion, as the newly formed company can now access larger markets, increased capital, and a larger pool of talent. Ultimately, amalgamation can be a great way for companies to combine resources and generate more value for their stakeholders.

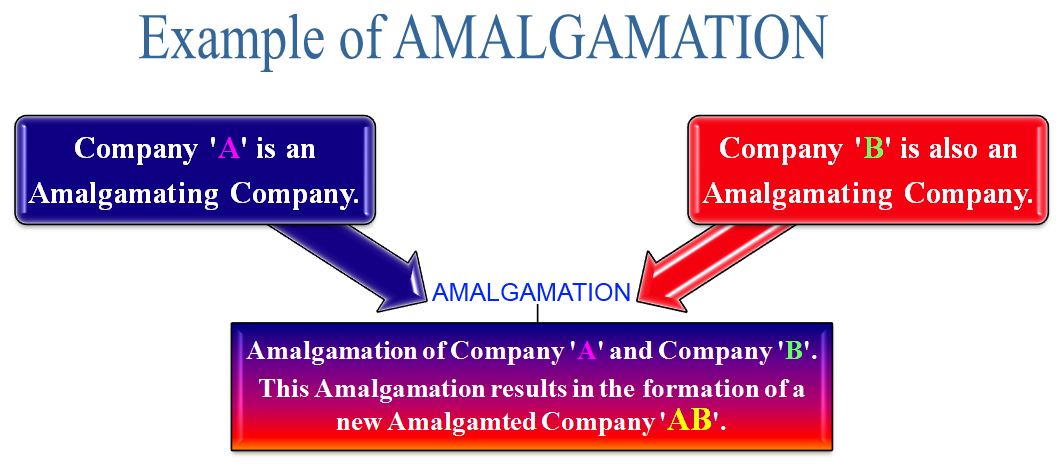

Common Types of Amalgamations

Amalgamation is a term used to describe the combination of two or more entities into one. It’s a type of business combination that usually results in the creation of a new company. Common types of amalgamations include merger, consolidation, absorption, and joint venture. In a merger, two or more existing companies combine to form a single entity. In a consolidation, two or more existing companies merge to form a new entity with a new name. An absorption occurs when one company absorbs another. Finally, a joint venture is a form of amalgamation in which two or more parties collaborate on a specific project. Amalgamations are often used as a way to increase market share, reduce costs, and create more efficient organizations.

The Pros and Cons of Amalgamation

When it comes to deciding whether amalgamation is the right option for your business, it’s important to weigh the pros and cons. On the plus side, amalgamation can be a great way to increase efficiency and reduce costs by combining multiple companies into one entity. It can also help to streamline operations, making it easier to manage, and can provide access to new markets and resources. On the downside, amalgamation can also create legal and financial complexities, and it can be difficult to manage the different interests of the companies involved. Ultimately, it’s important to consider all of the potential risks and rewards before making a decision about amalgamation.

Tips for Avoiding Plagiarism When Writing About Amalgamation

When it comes to writing about amalgamation, it’s important to make sure you’re not committing plagiarism. Plagiarism is a serious offense that can have serious consequences, so it’s important to make sure you’re properly citing any information you use. Here are some tips to help you avoid plagiarism when writing about amalgamation: cite your sources, use your own words, and don’t copy anyone else’s work. If you’re unsure of how to cite a source, make sure to check the style guide you’re using for guidance. Additionally, try to avoid using too much technical language when writing about amalgamation, as this can make it difficult for readers to understand. Lastly, if you use someone else’s work, make sure you get their permission first. Following these tips will help ensure that your writing is both accurate and original.