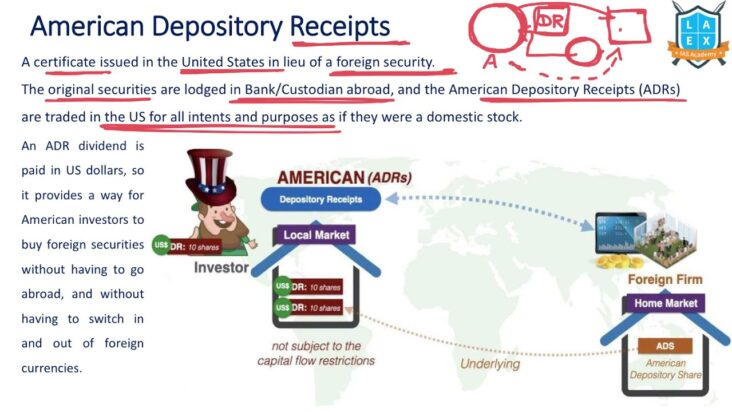

Do you want to learn more about American Depositary Share (ADS)? ADS is a type of financial instrument that allows foreign companies to list their shares on US stock exchanges, providing investors with access to foreign-listed securities. It also allows foreign companies to raise capital from the US markets. This article will explain the definition of ADS, its benefits, and the process of investing in them. We will also discuss the risks associated with ADS and why investors should consider them. By the end of this article, you will have a better understanding of American Depositary Share and how it can be used to diversify your portfolio.

What Are the Benefits of Investing in American Depositary Shares (ADS)?

Investing in American Depositary Shares (ADS) can be a great way to gain exposure to foreign stocks. ADSs provide investors with a convenient way to buy and sell foreign stocks without having to open a foreign brokerage account. Additionally, ADSs can provide investors with access to some of the most popular stocks from around the world. Some of the biggest benefits of investing in ADSs include: diversification, access to an international pool of stocks, and the ability to buy and sell without the hassle of foreign currency conversions. Furthermore, ADSs offer investors access to some of the most liquid stocks on the planet and can provide a higher return than investing domestically. By investing in ADSs, you can gain exposure to the global market and the potential to benefit from returns that are not available in the domestic market. If you’re looking to diversify your portfolio and gain access to international stocks, investing in ADSs may be the perfect solution.

What Are the Risks of Investing in American Depositary Shares (ADS)?

Investing in American Depositary Shares (ADS) can be a great way to get exposure to international companies, but there are some risks involved. First, the cost of buying and selling ADS may be higher than buying stocks in the company’s domestic market. This is because there are often extra costs associated with the depository and exchange fees. Second, the liquidity of ADS may be lower than the domestic shares, and the price of the ADS may be more volatile than the domestic stock. Finally, there may be differences in the dividends and other distributions that are paid out to the ADS holders compared to the domestic shareholders. It’s important to do your research and understand the risks before investing in ADS so you can make the best decision for your financial goals.

How to Trade American Depositary Shares (ADS)?

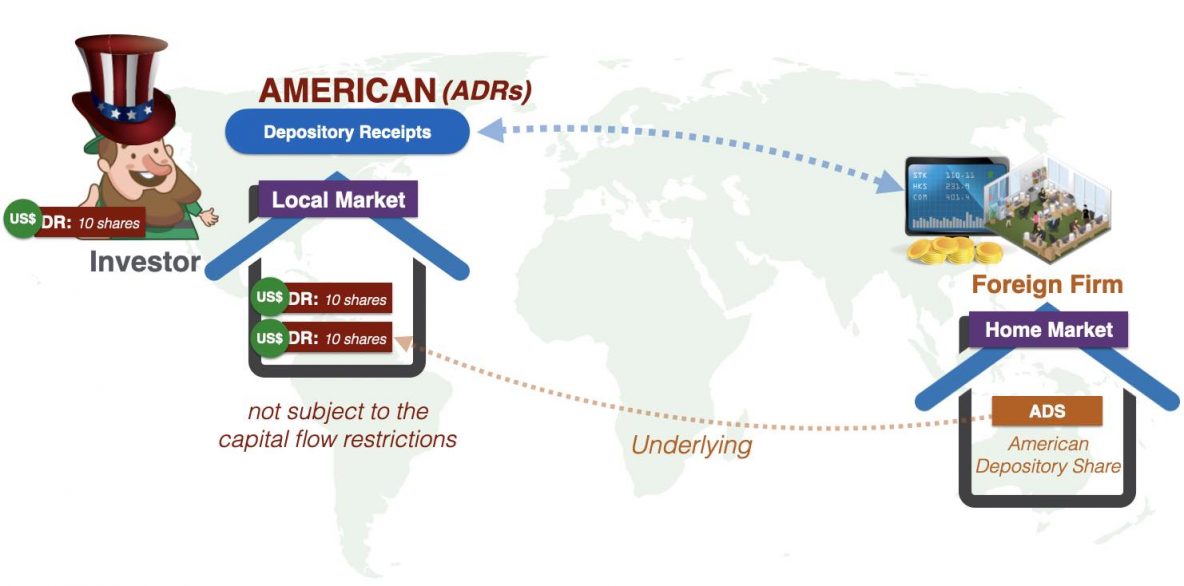

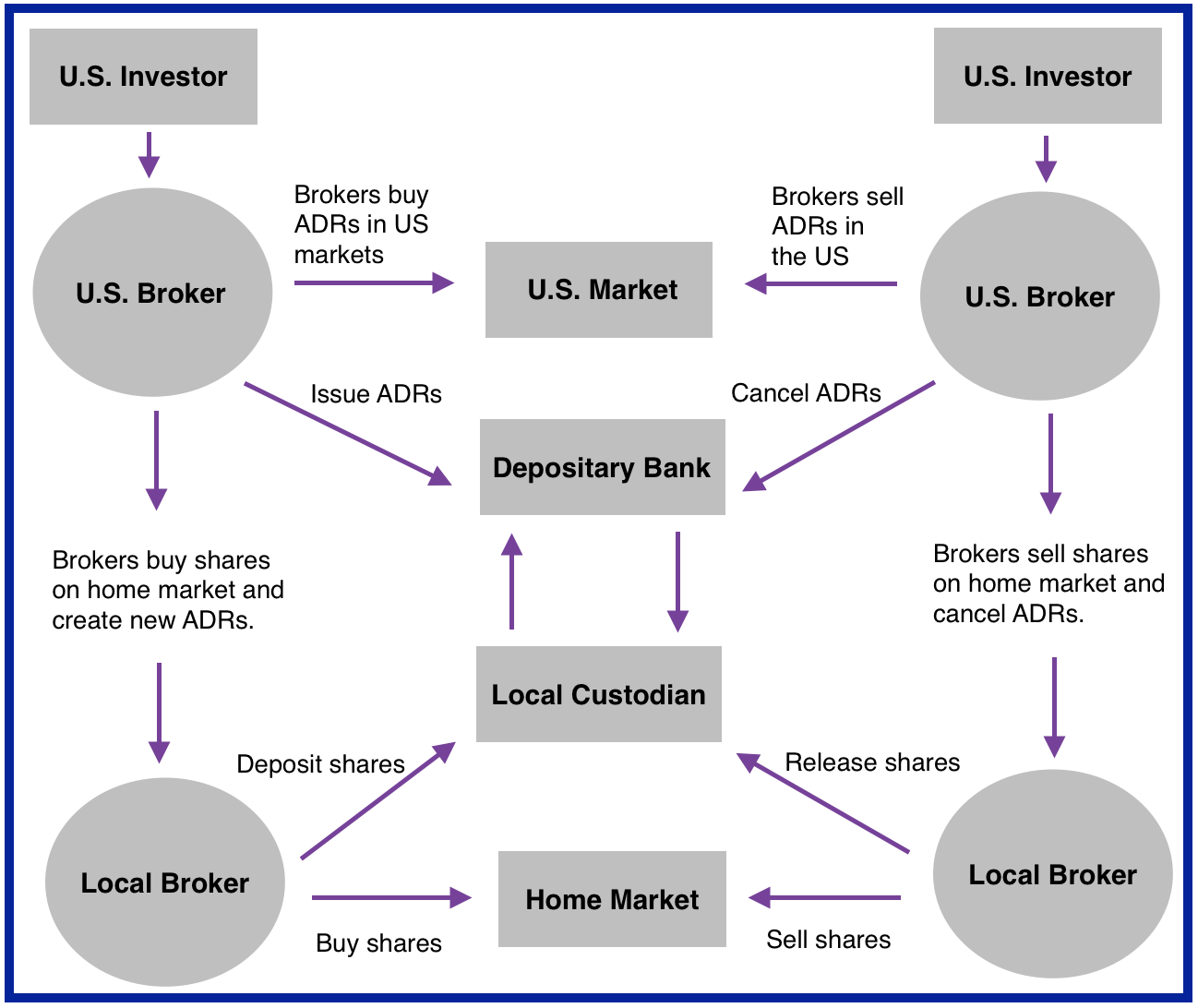

Trading American Depositary Shares (ADS) is a great way to participate in the stock markets of foreign countries. ADSs are essentially foreign stocks that are held in the U.S. by a depositary bank. This allows investors to buy and sell foreign stocks without having to worry about the complexities of currency conversions and international trading regulations. To trade ADS, you can use the same methods you would use to trade domestic stocks, such as online brokerages. Before investing, it is important to research the country and the company whose stock you are buying to make sure it is a sound investment. Additionally, it is important to understand the implications of trading foreign stocks, such as potential currency fluctuations and differences in regulations. By properly researching and understanding the risks, you can make informed and profitable trades with American Depositary Shares.

How Are American Depositary Shares (ADS) Different from Regular Shares?

ADS are different from regular shares in a few key ways. For starters, ADSs are usually traded on foreign stock exchanges, while regular shares are typically traded on domestic stock exchanges. Also, ADSs are designed to make it easier for investors to buy and sell shares of foreign companies. Finally, the price of ADSs is typically based on the price of the underlying foreign stock, which means that the value of the ADS may fluctuate if the underlying stock price changes. Ultimately, ADSs offer a convenient way for investors to gain exposure to foreign stocks without having to deal with the complexities of foreign markets.

What Is the Process of Issuing American Depositary Shares (ADS)?

American Depositary Shares (ADS) are an innovative financial instrument that can help companies expand their global presence and increase their liquidity. The process of issuing ADS begins with a company deciding to list its shares on a stock exchange in the US. The company then partners with a US bank or trust company, which acts as the depositary for the shares. The bank or trust company issues receipts to investors in the US, which represent ownership of the company’s shares. The company then pays a fee to the depositary and is responsible for providing the depositary with periodic financial statements, press releases and other relevant information. The depositary then makes the information available to investors in the US and can also distribute dividends, if any. ADS can help companies expand their global presence, allowing investors to access the company’s shares through their local stock exchange. This makes it easier for investors to buy and sell the company’s shares, and can also help increase their liquidity.