Are you looking for new ways to diversify your investment portfolio? Alternative investments may be the way to go. Alternative investments are non-traditional investments that can provide a potentially higher return than typical stocks, bonds, and cash investments. This type of investment often carries more risk, but can also have a higher return on investment. In this article, we will dive into the definition of alternative investment, the types of investments that fall under the umbrella of alternative investments, and the advantages and disadvantages of investing in them.

Types of Alternative Investments: Exploring Different Opportunities

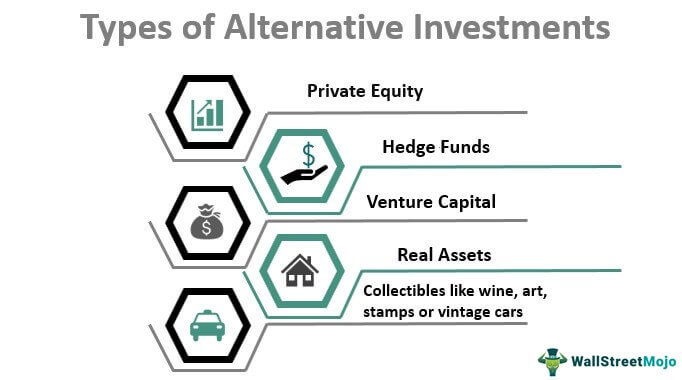

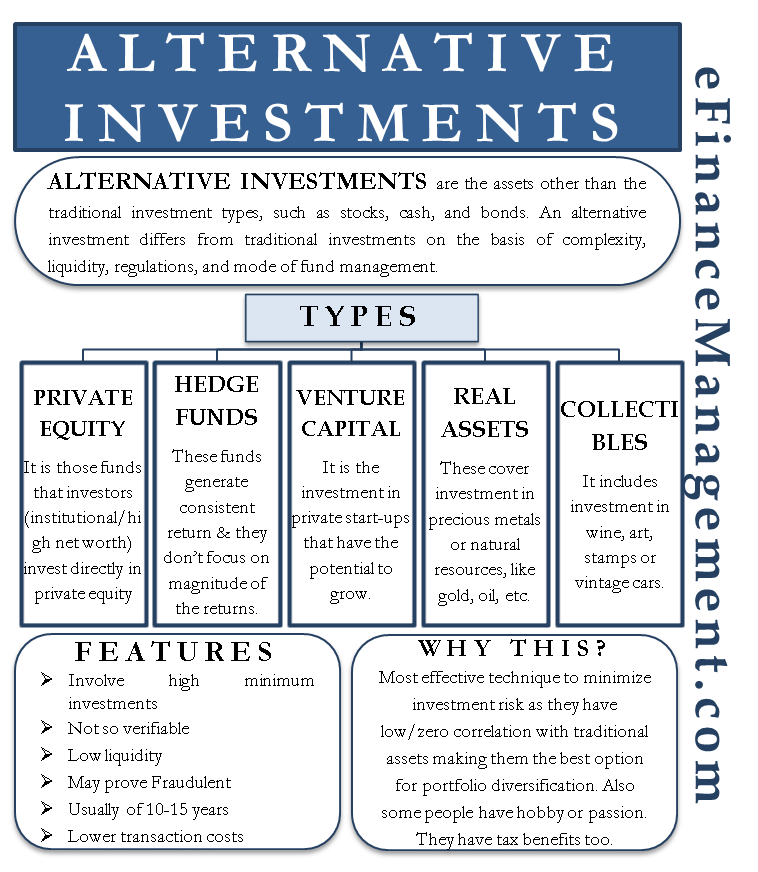

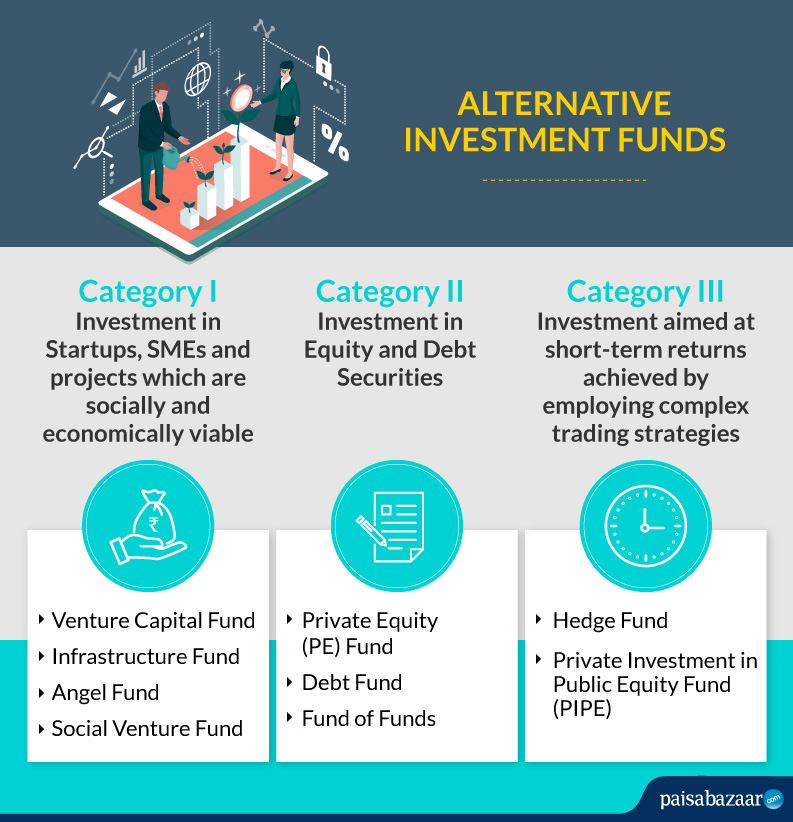

When it comes to alternative investments, there are so many different opportunities out there. From real estate to commodities, these investments can be great ways to diversify your portfolio and make money. You can invest in real estate by buying a property, or you can invest in commodities such as gold or oil. There are also different types of alternative investments such as hedge funds, private equity, venture capital and more. Each of these investments require a different level of risk, so it’s important to understand which ones are right for you. With so many options, it’s important to do your research and explore the different types of alternative investments available to you. With the right knowledge and resources, you can make an informed decision and take advantage of the potential returns these investments have to offer.

Benefits of Alternative Investing: Reducing Your Risk Profile

Alternative investments can be a great way to reduce your risk profile. By diversifying your portfolio and investing in assets outside of traditional stocks and bonds, you can reduce the amount of risk you take on in the markets and help protect yourself from any potential downturns. Investing in alternative assets can also provide you with the potential for higher returns and tax savings. You can look into investing in commodities, private equity, real estate, and other alternative investments to help diversify your portfolio and increase your returns. With the right strategy, alternative investments can be an effective way to reduce your risk profile and increase your returns.

Strategies for Successful Alternative Investment Management

Investing in alternative investments can be a great way to diversify your portfolio and increase returns. With the right strategies, it can be a lucrative and rewarding investment. To ensure success, it’s important to understand the different types of alternative investments, the risks associated with them, and the strategies for successful alternative investment management. Developing a comprehensive investment plan that includes risk management strategies is essential for minimizing risk and maximizing returns. Additionally, it’s important to have a well-diversified portfolio that is tailored to your individual financial situation. Researching potential investments and understanding the market can help you make informed decisions and reduce your risk. Finally, it’s important to have a reliable financial advisor to help guide your investment decisions and provide guidance on the best strategies for successfully managing your alternative investments. With the right strategies in place, alternative investments can be a great way to increase your returns and diversify your portfolio.

Common Pitfalls of Alternative Investment and How to Avoid Them

Alternative investments can be a great way to diversify your portfolio and potentially increase your returns. However, it’s important to be aware of the potential pitfalls and how to avoid them. One of the most common mistakes is assuming that all alternative investments are safe. This isn’t necessarily true, as some investments may be more volatile than others and carry more risk. It’s also important to remember that alternative investments may be less liquid than traditional investments, so you should make sure you understand the terms and conditions of the investment before putting your money into it. As well, be sure to research the investment thoroughly, read reviews and do your due diligence. Lastly, it’s important to remember to diversify your investments and not to put all your eggs in one basket. By following these tips, you can ensure that you make the most of your alternative investments and reap the rewards.

Alternative Investment Opportunities: Making the Most of the Market’s Uncertainty

Alternative investments are a great way to capitalize on the uncertainty of the market. With traditional investments like stocks and bonds becoming increasingly volatile, alternative investments offer investors a chance to diversify their portfolios and gain exposure to assets that are often less affected by market fluctuations. From real estate to commodities to private equity, there are countless alternative investment opportunities that can help you make the most of the market’s uncertainty. With careful research and a bit of strategy, you can use alternative investments to build a secure financial future that’s immune to the volatility of the market. Whether you’re just getting started or looking to diversify an existing portfolio, alternative investments are a great way to assure your financial success.