Alternative Depreciation System (ADS) is an accounting method used to spread the cost of certain depreciable assets over their estimated useful life. ADS is used to reduce the amount of taxable income for a given period of time, making it a popular method for businesses to use when managing their finances. This article will explore the concept of ADS in more detail, from what it is to how it works and its benefits. We’ll cover why it’s important for businesses to understand ADS and the potential tax implications.

What Are the Benefits of Using the Alternative Depreciation System (ADS)?

Using the Alternative Depreciation System (ADS) can be really beneficial for the financial health of your business. By using ADS, you can spread out the cost of your assets over a longer period of time, which can help you save money in the long run. You can also take advantage of the lower tax rates associated with ADS, which can result in significant savings. Additionally, ADS can help you to take advantage of tax deductions that you may not have been able to take advantage of otherwise. Ultimately, using the Alternative Depreciation System can be a great way to help make sure that your business is able to stay financially healthy and save money in the long run.

Who Is Eligible to Use the Alternative Depreciation System (ADS)?

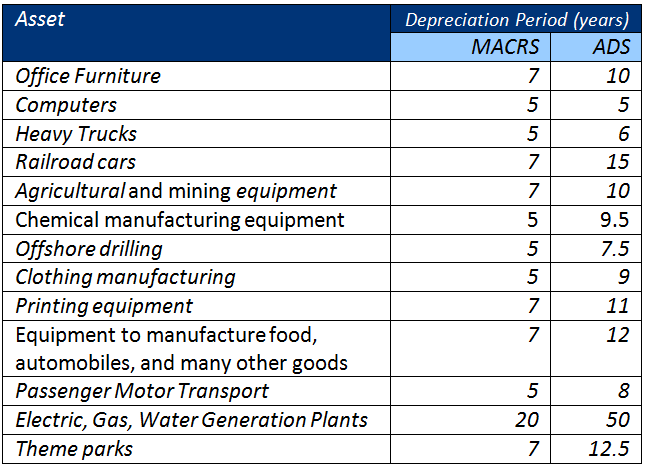

If you’re a business owner, you might be wondering who is eligible to use the Alternative Depreciation System (ADS). ADS is a depreciation method that allows businesses to claim accelerated depreciation deductions for certain assets. To be eligible to use the Alternative Depreciation System, a business must meet the criteria set out by the IRS. Generally, those businesses that have assets with a useful life of 20 years or more are eligible to use the ADS. The items that qualify for the ADS must also have a cost basis of more than $2,500. In addition, businesses must use the ADS for all assets in the same class, meaning that if a business chooses to use ADS for one asset, they must use it for all assets in that class. Business owners should consult with a tax professional to determine if their business is eligible to use the ADS before claiming any deductions.

How to Calculate Depreciation Under the Alternative Depreciation System (ADS)?

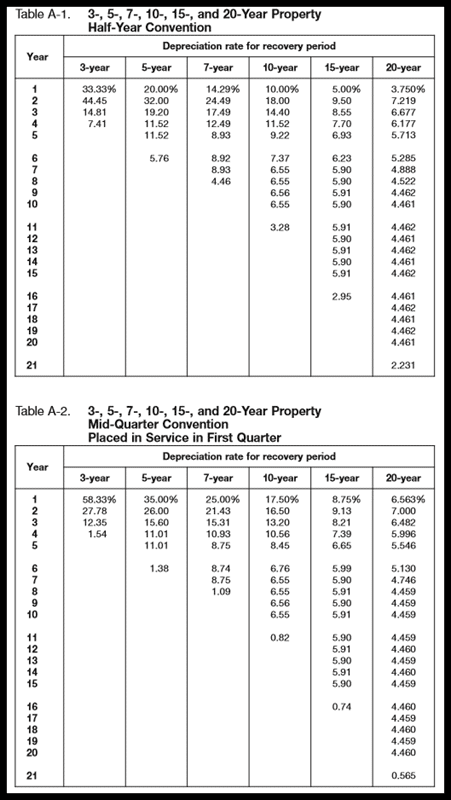

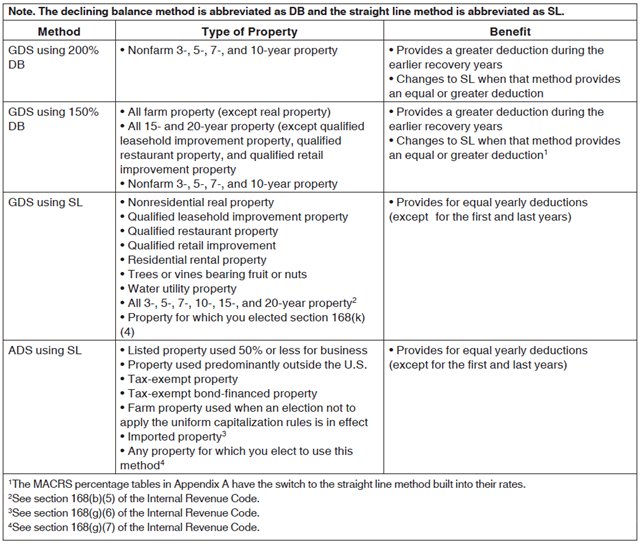

Calculating depreciation under the Alternative Depreciation System (ADS) can seem intimidating, but it doesn’t have to be. All you need is a basic understanding of the rules and regulations that govern the system, and you’ll be on your way to properly calculating your depreciation expenses. ADS is generally used for tax purposes and requires the taxpayer to use a set of recovery periods, applicable conventions, and applicable depreciation methods. To calculate depreciation under ADS, you need to first determine the applicable recovery period for the asset, and then use the applicable depreciation method and applicable conventions to calculate the depreciation expenses. The most common method used for calculating depreciation under ADS is the straight line method, which takes the cost of the asset and divides it by the applicable recovery period to determine the depreciation expense for each year. The other methods for calculating depreciation under ADS include the declining balance method and the 150% declining balance method. Once you’ve determined the applicable methods, conventions and recovery periods, you’ll be able to easily calculate your depreciation expenses accurately and efficiently.

What Is the Difference Between ADS and Straight-Line Depreciation?

ADS and straight-line depreciation are two different methods of calculating the depreciation of an asset. With straight-line depreciation, you calculate the value of an asset over time using an even annual rate. With ADS, you can instead opt to use an accelerated rate, meaning that the asset will depreciate faster in the earlier years. This is beneficial for companies who need to claim more of the costs of the asset in the earlier years, such as those with high tax rates. The difference between ADS and straight-line depreciation is important to consider, as it can influence the amount of tax you owe and how much of the asset’s cost you can write off in a given year.

What Are the Potential Drawbacks of Using the Alternative Depreciation System (ADS)?

If you’re considering using the Alternative Depreciation System (ADS) for your business, it’s important to be aware of the potential drawbacks. ADS may result in a higher initial deduction for the cost of an asset, but it also decreases the amount of your deductions over time. This means that you’ll be able to take larger deductions for the cost of the asset initially, but those deductions will gradually decrease over time, resulting in a smaller overall tax deduction. Additionally, when it comes to assets like buildings and equipment, the ADS may not be as beneficial as other depreciation methods, since it does not take into account the expected life of the asset. Ultimately, it’s important to weigh the pros and cons of using the ADS before you decide to use it for your business.