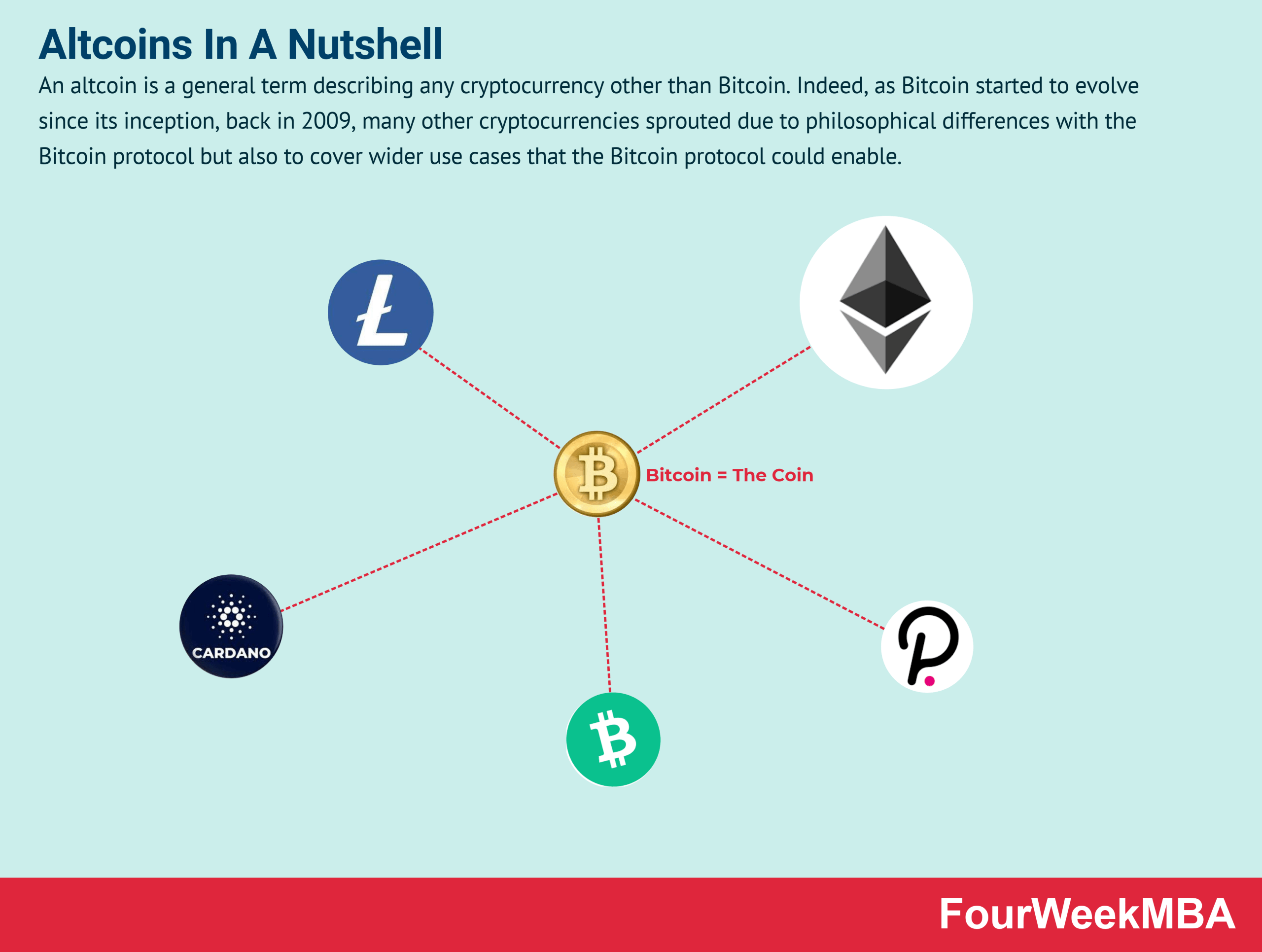

Altcoin, short for “alternative coin,” is a type of cryptocurrency that is not Bitcoin. Altcoins can vary widely in terms of their structure, purpose, and use. In this article, we will explore the definition of altcoin, explain how it works, and discuss what makes it different from Bitcoin. We will also provide tips on how to trade and invest in altcoins so you can make the most of this exciting new investment opportunity. Finally, we’ll discuss the future of altcoins and how they could impact the cryptocurrency market. So whether you’re a beginner or an experienced investor, this article will provide you with all the information you need to make the best decisions for your financial future.

What Are the Different Types of Altcoin?

When it comes to altcoins, there are a ton of different types to choose from. Whether you’re looking for a privacy coin, a stablecoin, or a platform coin, there’s an altcoin out there to suit your needs. Privacy coins, like Monero, are designed to allow users to transact anonymously. Stablecoins, such as Tether, are designed to remain stable in value and minimize the volatility of the crypto markets. Platform coins, like Ethereum, are designed to allow developers to build decentralized applications. All of these types of altcoins offer unique advantages and features, so it’s important to do your research before investing. With so many different altcoins available, it’s easy to get overwhelmed. However, once you know what you’re looking for, it’s easy to find the one that’s right for you.

The Benefits of Investing in Altcoin

Cryptocurrencies are becoming increasingly popular, and one of the most exciting investments you can make is in Altcoin. Altcoin is a form of digital currency, similar to Bitcoin, but with some distinct advantages. Investing in Altcoin offers investors the potential for greater returns and a more secure form of digital currency. Altcoin is faster, more secure, and easier to use than many other forms of digital currency. It is also more decentralized, meaning that it is not controlled by any single entity. This makes Altcoin an ideal investment for those looking for a secure, reliable form of digital currency. Additionally, Altcoin transactions are more private and secure than other forms of digital currency, making it a great choice for those who value their privacy and security. With Altcoin, you can make secure payments and transfers without having to worry about your transactions being tracked or monitored. Investing in Altcoin offers investors the potential for great returns and a secure form of digital currency.

Understanding Altcoin Financial Terms

Altcoins are an exciting new way to invest your money. They are alternative cryptocurrencies to the more popular Bitcoin. With Altcoins, you can diversify your portfolio and access new markets. Altcoins are also much more affordable than Bitcoin and other established cryptocurrencies, meaning that you can get in at a lower cost and still make a sizable return. Additionally, Altcoins often have more features, such as smart contracts and more robust networks, which can make them more attractive to traders and investors. Altcoins are a great way to dip your toes into the cryptocurrency world without having to put in too much money. With all the different Altcoins out there, you can find a currency that appeals to you and start trading right away.

How to Choose an Altcoin Investment Strategy

Choosing an altcoin investment strategy can be a daunting task, especially if you are new to the cryptocurrency market. With so many different altcoins out there, it can be hard to decide which ones to invest in. However, there are a few key things you should consider when deciding on an altcoin investment strategy. First, you should research the altcoin’s market capitalization, liquidity, and volatility. Market capitalization tells you how much the altcoin is worth relative to the entire market, liquidity tells you how easy it is to buy and sell the altcoin, and volatility tells you how much the altcoin’s price is expected to fluctuate. You should also look into the altcoin’s technology, team, and roadmap. Make sure the altcoin is using the latest technology and that the team behind it has a good track record. Additionally, make sure the altcoin has a clear roadmap for the future. Finally, make sure the altcoin is in line with your goals. Are you looking to make a short-term profit or are you looking to build a portfolio for the long-term? Depending on what you are looking for, some altcoins might be better than others. Taking the time to research and decide

The Risks and Rewards of Trading Altcoin

Altcoin trading can be both rewarding and risky, depending on your knowledge of the market and the coins you choose to invest in. While some traders might see this as a great opportunity, others might be a bit more hesitant. It’s important to understand the risks and rewards associated with trading altcoins before you decide to invest. The rewards of trading altcoins include being able to access a greater selection of coins than you would find on a traditional exchange and having the potential to make more money in the volatile crypto market. However, the risks are just as prominent, as altcoins are often more volatile than those on a traditional exchange and the market is often less regulated. As with any investment, it’s important to do your research and and understand the risks associated before investing in altcoins. If you’re prepared to take on these risks, trading altcoins can be an exciting way to diversify your portfolio and potentially increase your wealth.