Alphabet Stock is an exciting investment opportunity for those looking to get involved in the stock market. As the parent company of Google, Alphabet has a diverse portfolio of ventures and investments that offer investors a great way to diversify and maximize their returns. This article will give you an overview of Alphabet Stock, including what it is, how it works, and why it could be a beneficial investment for you. Keep reading to learn more about Alphabet Stock and how it can help you reach your financial goals.

What Are Alphabet’s Stock Performance and Prospects?

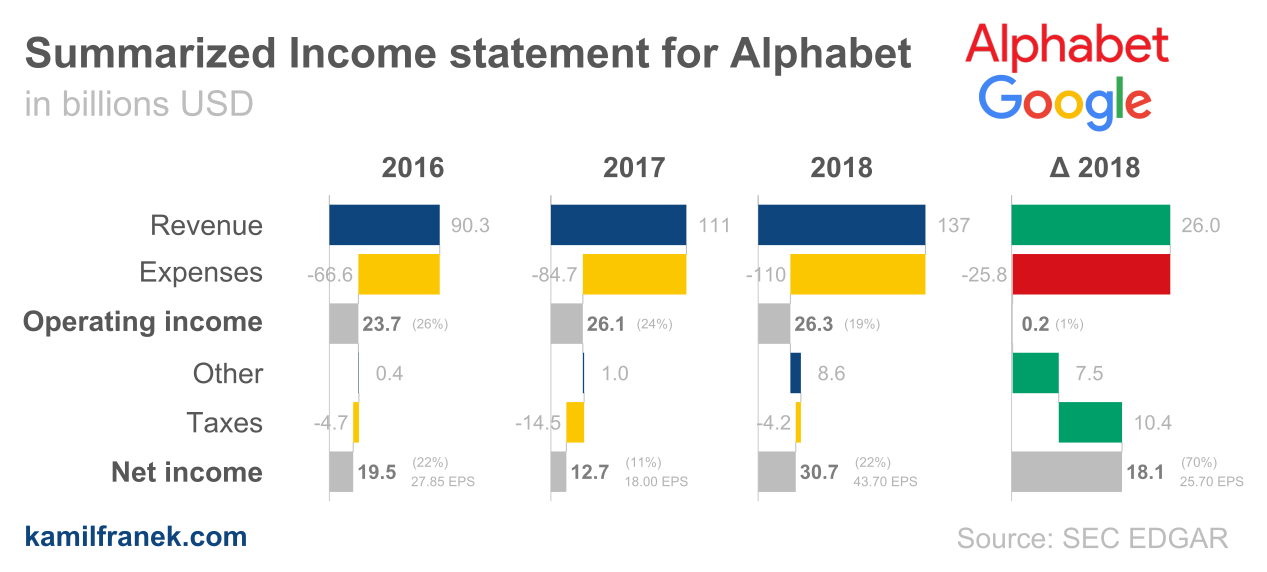

Alphabet Inc. (GOOGL) stock has been on a rollercoaster ride since its inception in 2015. After hitting a high of $1,550 in July of 2018, Alphabet’s stock dropped drastically to a low of $1,071 in December of that same year. After that point, it has gradually been climbing back up, hitting new highs in the past year. As of April 2021, Alphabet’s stock is trading at $2,309, nearly doubling its 2018 high.With its stock performing so well, it’s no surprise that Alphabet’s prospects are looking bright. The company’s main source of income is through its Google segment, which includes its search engine, YouTube, and Google Ads. As the largest search engine in the world, Google is continuing to grow and expand its market share, bringing in more and more revenue for Alphabet. Additionally, Alphabet has recently expanded into cloud computing, artificial intelligence, and hardware, all of which are expected to help boost profits in the future. With Alphabet’s prospects looking strong, it’s no surprise that investors are bullish on the stock.

How Do Alphabet Stock Profits Benefit Investors?

Alphabet Stock is a great way for investors to benefit from the company’s profits. As Alphabet continues to grow, its stock prices tend to increase, allowing investors to reap the rewards of their investments. Not only can investors benefit from their stock purchases in terms of capital gains, but they can also benefit from the dividends paid out by Alphabet. By buying Alphabet stock, investors can enjoy the long-term growth of the company, as well as the short-term profits of dividends. Investing in Alphabet stock is a great way to diversify your portfolio and make the most of your money. Whether you’re a beginner investor or a seasoned pro, Alphabet stock is an excellent option for anyone looking to increase their profits.

How Has Alphabet Stock Performed Since Its Initial Public Offering?

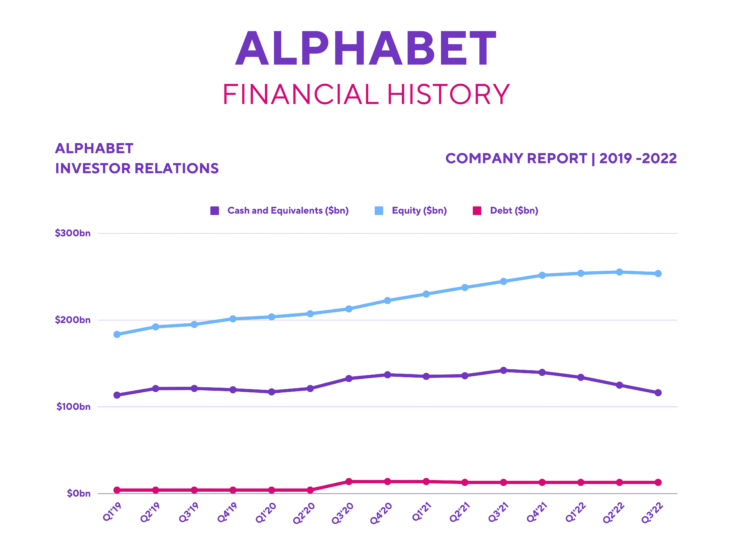

Alphabet Inc. (GOOGL) stock has been performing well since its initial public offering (IPO) in 2004. Since then, the stock has seen a steady increase in share price, with a peak of nearly $1,400 in 2019. Since then, the share price has experienced some drops, but still remains strong. The company’s growth has been driven by its diversified portfolio of businesses, which includes Google search, YouTube, Android, and its cloud computing business. The company’s focus on creating innovative products and services has been a key factor in its success, as well as its continued investments in research and development. Alphabet Inc. also continues to invest in emerging technologies such as artificial intelligence, machine learning, and autonomous vehicles. All of these factors have helped Alphabet Inc. become one of the most successful tech companies in the world, making it an attractive stock for investors.

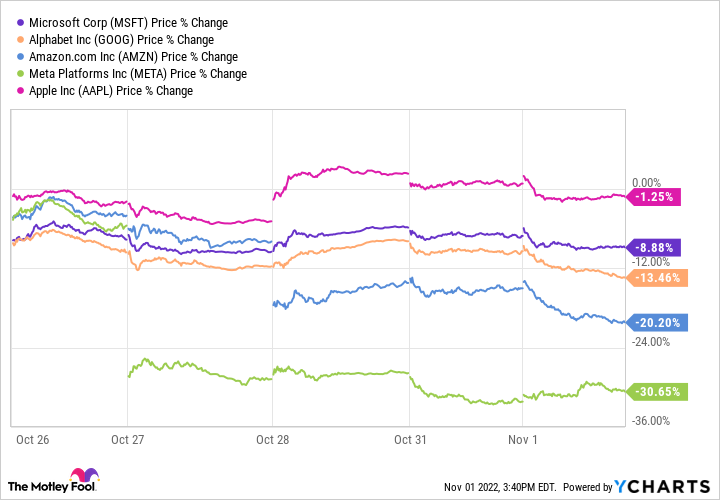

What Are the Risks of Investing in Alphabet Stock?

Investing in Alphabet stock may seem like a great way to make a profit, but it’s important to be aware of the risks associated with investing in any stock. Alphabet is an incredibly successful tech company, and the stock has been on an upward trend for some time. However, with any stock, there are always potential risks to consider. Alphabet is subject to the same macroeconomic and geopolitical events as other stocks, so investors need to consider those potential risks when investing in Alphabet stock. Additionally, Alphabet is a large and complex company, so its stock is subject to many different types of risk. For example, Alphabet may be exposed to technological, competitive, marketing, and legal risks, so investors need to be aware of these potential risks before investing in Alphabet stock.

How to Find the Best Prices When Buying Alphabet Stock?

If you’re looking to invest in Alphabet stock, you’ll want to make sure you’re getting the best price. One way to do this is to look around and compare prices from different sources. You can search online to find out the current market price and compare it to what other brokers are offering. Keeping an eye on the stock’s performance can also help you find the best prices. You could even set up alerts to let you know when the stock’s price drops so you don’t miss out on buying it for a lower price. Being informed about the stock’s performance will help you get the best deal when you’re ready to purchase Alphabet stock.