Alpha is a measure of performance that can be used to evaluate the success of an investment. It’s a way to compare the rate of return on an investment to a benchmark, such as a market index like the S&P 500. Alpha is one of the most important concepts in finance and investing, and can be used to measure the skill of a portfolio manager or financial advisor. In this article, we’ll discuss the definition of alpha, how it’s calculated, and how it can be used to evaluate the success of an investment.

What is Alpha in Financial Terms?

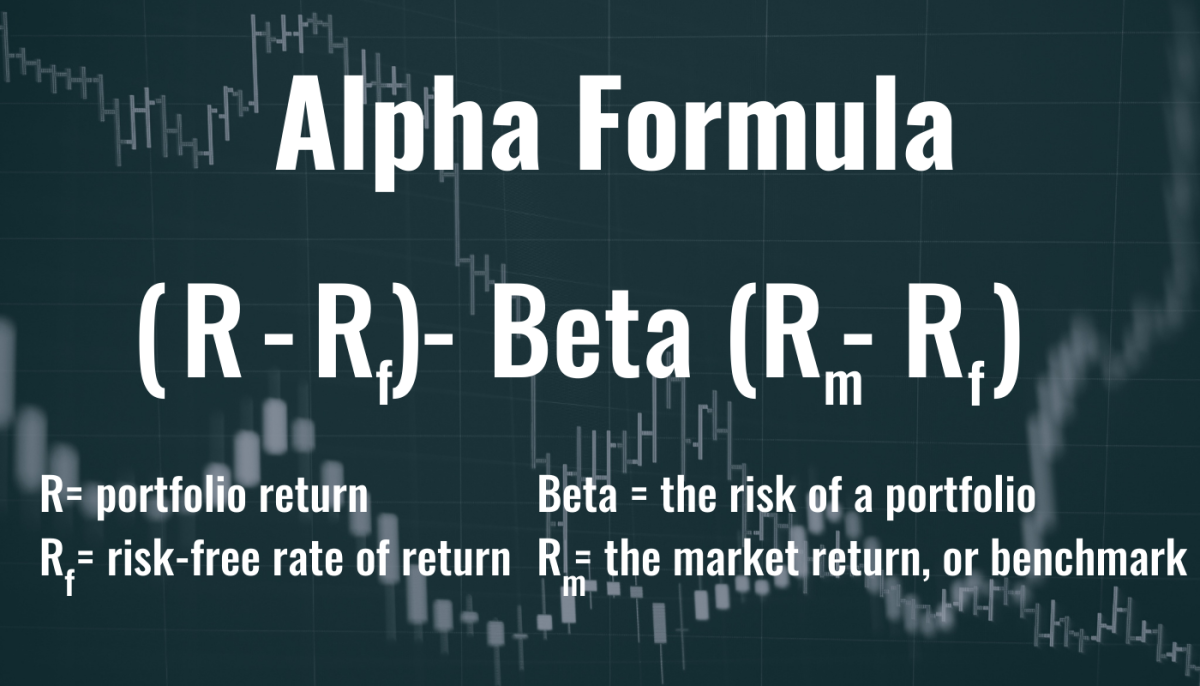

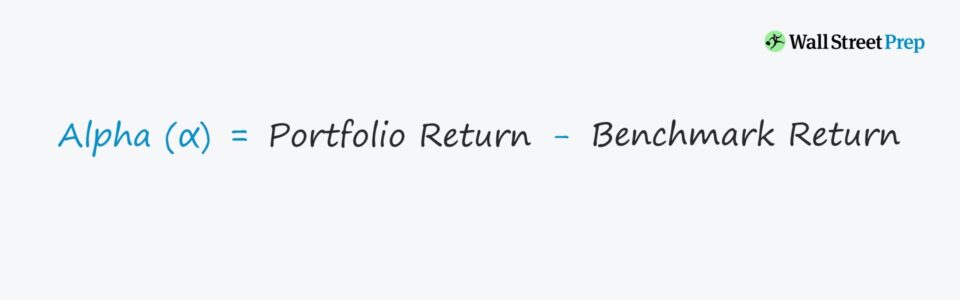

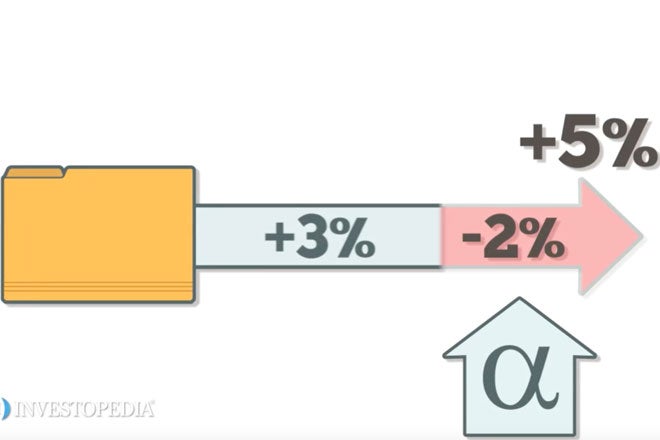

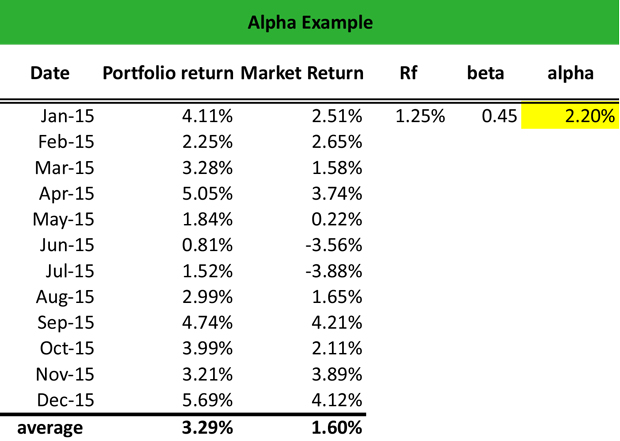

Alpha is a measure of a stock’s or portfolio’s performance relative to the market as a whole. It’s sometimes referred to as “excess return” or “abnormal rate of return.” Alpha is a measure of how well an investment has performed compared to something else, like a benchmark index. Alpha is calculated by subtracting the return of a benchmark index from the return of the stock or portfolio, and then dividing the result by the benchmark’s standard deviation. Alpha can be a great way to measure the performance of an individual stock or portfolio, and is especially useful for investors who are looking to beat the market. Knowing your alpha can help you make informed decisions when investing, as it can be an indication of how much excess return you can expect from a stock or portfolio.

How Can Investors Use Alpha to Generate Returns?

Alpha is a measure of how well an investment has performed relative to the market. It is a measure of the “excess return” an investment has generated over the course of a period of time. The higher the alpha, the better the performance of the investment compared to a benchmark or index. Investors can use alpha to determine how well their investments are performing and to identify opportunities for greater returns. Alpha can be used to evaluate and compare investments, as well as to identify potential investments or strategies that could generate above-average returns. Alpha is also used to measure the risk associated with a particular investment, helping investors to determine whether a given investment is worth the associated risk. By analyzing alpha, investors can make informed decisions about which investments to make and which ones to avoid. By using alpha to generate returns, investors can maximize their returns while minimizing their risks.

What Strategies Can Be Used to Maximize Alpha?

One of the key strategies for maximizing alpha is to diversify your investments. Diversifying your investments will help you reduce risk and spread out your risk over different asset classes. Additionally, you should focus on high-performing stocks with a good track record and a low cost-of-entry. This will help you maximize your return on investment and make sure that you’re getting the most out of your alpha investments. Additionally, you should also look into alternative investments like commodities, options, and ETFs, as these can provide you with higher returns than traditional stocks and bonds. Finally, you should do your research to make sure you understand the risks involved with each of your investments and make sure you stay informed on the latest market news and trends. By doing this, you can make sure that you’re making the best decisions possible to maximize your alpha.

Common Pitfalls to Avoid When Implementing Alpha Strategies

If you’re looking to get into alpha investing, there are some common pitfalls you should avoid. One of the biggest mistakes people make is trying to implement alpha strategies without doing their research. It’s important to understand what alpha is and how it works before diving in. You also need to be aware of the risks associated with alpha investing. Another mistake is not considering the costs associated with alpha investing. Alpha strategies can be expensive and the cost should be taken into consideration before implementing any strategy. Lastly, it’s important to have a plan for exiting an alpha strategy. You need to be aware of the risks and have a plan in place for when things don’t go according to plan. By avoiding these common pitfalls, you can make sure that you’re investing in alpha strategies in a smart and responsible way.

What Is Plagiarism and How Can You Avoid It?

Plagiarism is a big no-no when it comes to writing. It’s taking someone else’s work and passing it off as your own without giving them credit. It’s not only unethical, but it’s also illegal. To avoid plagiarism, make sure you cite any sources you use. If you’re quoting someone directly, make sure to use quotation marks. When paraphrasing, make sure to use your own words, and be sure to cite the source. It’s also important to keep track of the sources you use. If you’re ever unsure if something is plagiarism, it’s better to err on the side of caution and cite the source anyways. Writing is an art, and having a unique voice is key. So don’t be afraid to let your own voice shine through in your writing.