Understanding the concept of Allowance for Doubtful Accounts can help business owners and financial managers make better informed decisions about their accounts receivable. Allowance for Doubtful Accounts is a financial term used to describe an estimation of the amount of money a business may not collect from its customers due to their inability to pay. This concept is used to manage uncertain receivables in order to minimize losses. This article will discuss what Allowance for Doubtful Accounts is, how to calculate it, and how it affects financial statements.

What is an Allowance for Doubtful Accounts?

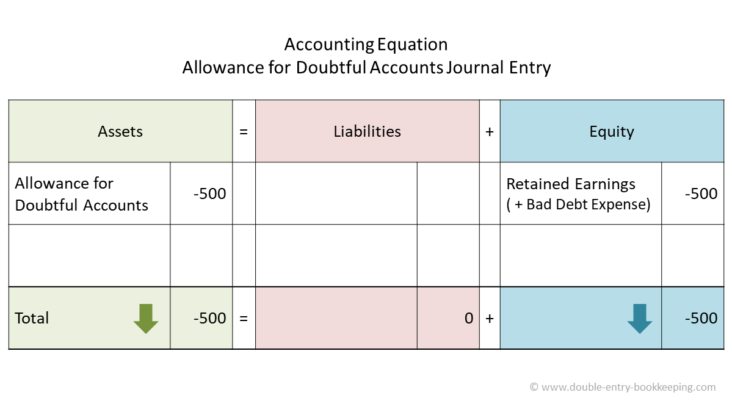

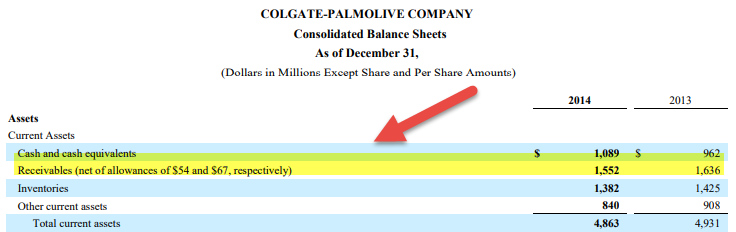

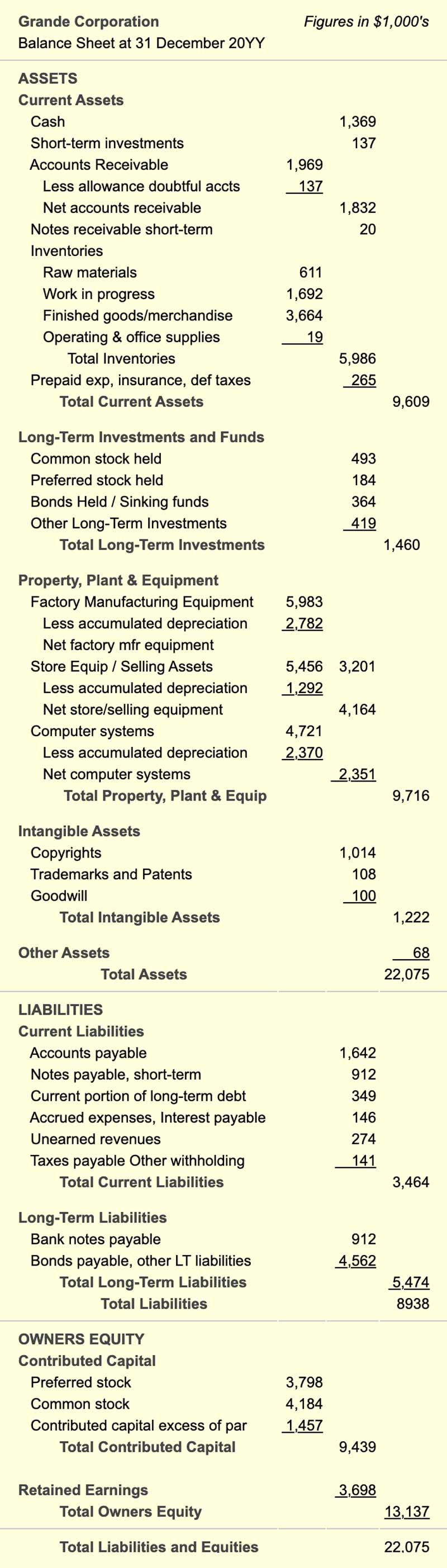

An Allowance for Doubtful Accounts is a contra account that businesses use to offset accounts receivable. It’s a way to protect the company from losses that might come from customers not paying their bills. The amount of the allowance is based on the company’s estimate of how much of their receivables won’t be paid. Companies create the allowance by subtracting the estimated bad debt amount from their accounts receivable figure. The Allowance for Doubtful Accounts is an important part of sound financial management. By setting aside money for potential bad debt losses, businesses can protect themselves from unexpected losses due to customers not paying their bills. This helps them stay financially stable and make sure their books are accurate.

Understanding the Allowance for Doubtful Accounts

The Allowance for Doubtful Accounts (ADA) is an important concept to understand if you are managing a business’s finances. The ADA is a reserve account that businesses keep to protect themselves from bad debts and unpaid customer invoices. This reserve account is based on a percentage of the total receivables and is created to account for potential losses that the business may incur. It is important for business owners to understand the ADA and how it works in order to properly manage their finances and protect themselves from losses. By having an ADA, businesses can be more prepared for potential losses and be better able to plan for the future.

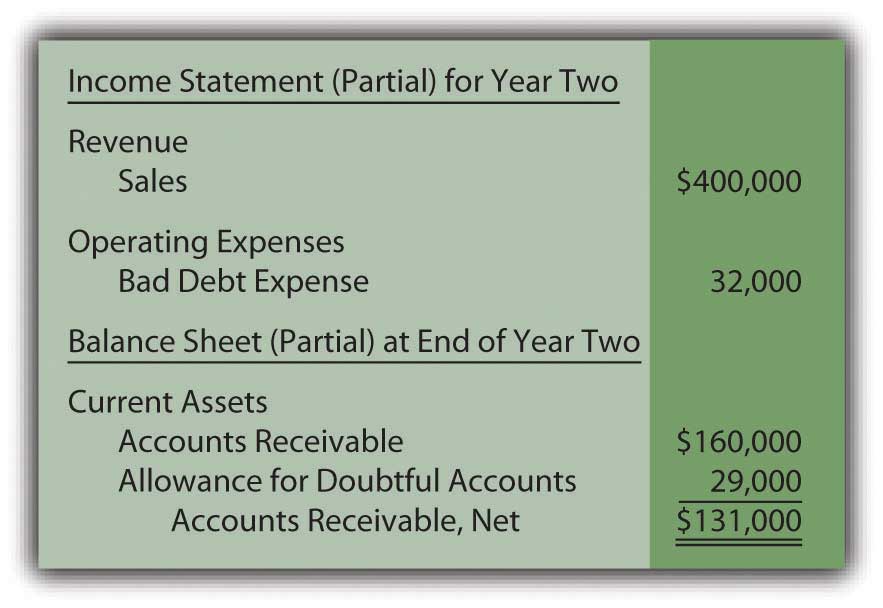

Calculating the Allowance for Doubtful Accounts

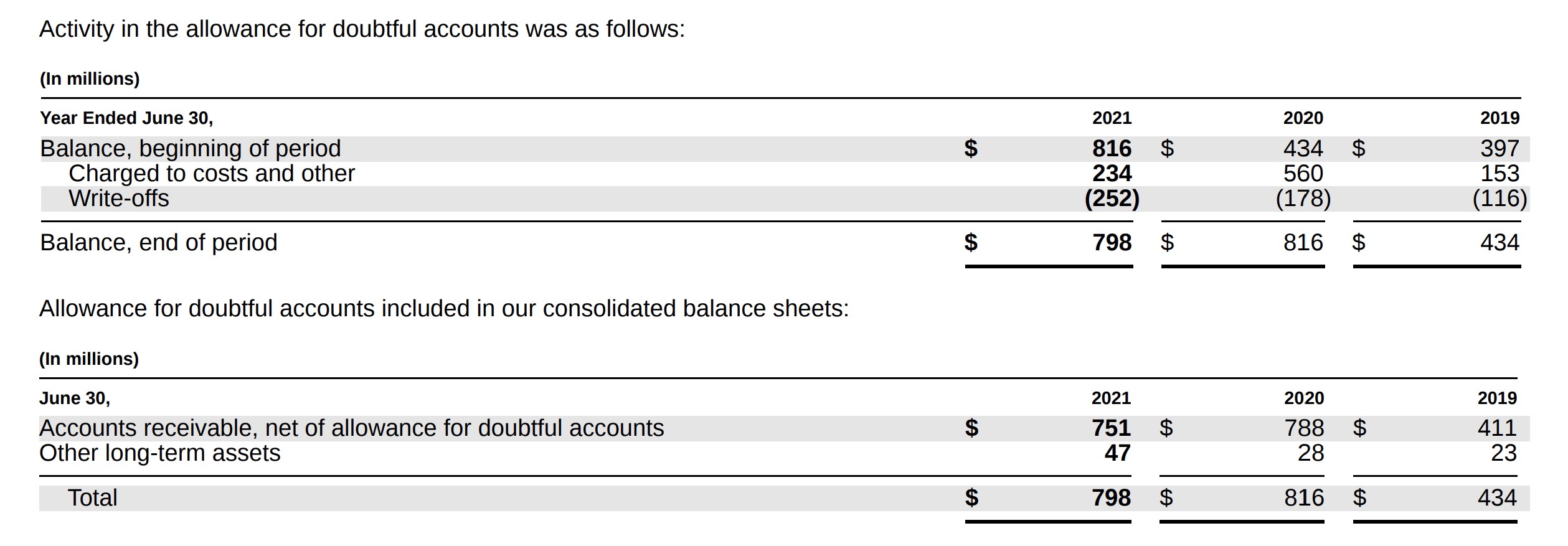

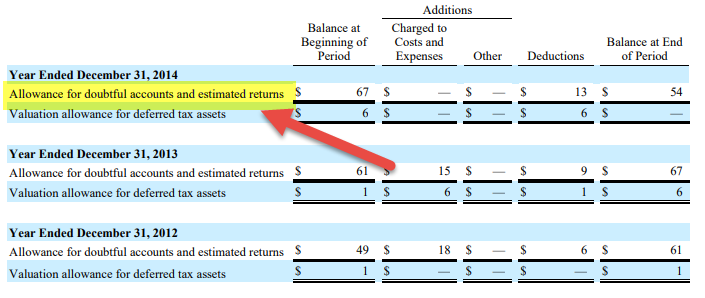

Calculating the Allowance for Doubtful Accounts is an important step in keeping your finances in check. The allowance for doubtful accounts is an estimate of the amount of customer debts that may not be collected in the future. To calculate the allowance, you will need to analyze the age of customer balances to determine the percentage of uncollectible accounts. Once you have determined the percentage, you can multiply it by the total customer accounts receivable to get your allowance for doubtful accounts. This process of calculation is important to ensure that your financial statements accurately reflect the risk associated with receivable accounts. Additionally, it helps to keep your business prepared for any unexpected losses in customer debts.

Reasons for Having an Allowance for Doubtful Accounts

Having an allowance for doubtful accounts is an important part of having a healthy financial situation. The allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected due to customers not paying their bills. This estimate is calculated through an analysis of past customer payment histories and current customer payment trends. Having an allowance for doubtful accounts helps businesses plan for potential losses and ensures that they are not overstating their accounts receivable balance. Additionally, it helps businesses ensure that they are maintaining sufficient cash flow to cover any potential losses from uncollectible accounts receivable. An effective allowance for doubtful accounts helps businesses protect their finances and maintain accurate financial statements.

Strategies to Reduce the Allowance for Doubtful Accounts

Having a high Allowance for Doubtful Accounts (ADA) can be a major financial burden for any company. To reduce this burden, there are a few strategies that businesses can employ. One of the most effective strategies is to ensure that credit approval processes are thorough and that credit reporting is current. Doing so will help to minimize the amount of bad debt that a company has to write off. Additionally, businesses should also take steps to collect overdue payments as quickly as possible. This can include implementing a system of payment reminders and follow-ups, or even offering incentives for customers to pay on time. Additionally, businesses should also review their Customer Master files regularly to ensure that all of their customer accounts are up to date. Finally, businesses can also review their bad debt reserves and adjust them accordingly. By taking these steps, businesses can minimize the amount of money they need to set aside for ADA and ultimately improve their overall financial performance.