Allowance for Credit Losses (ACL) is an essential element of financial accounting, and it’s important for any business that borrows money or has loans outstanding. ACL is a provision set aside to cover potential losses from debtors not repaying their debts. It’s an important part of the loan process, as it helps ensure that lenders are protected in the event of non-repayment. This article will explain the meaning of Allowance for Credit Losses and the key considerations when setting up an ACL. It will also discuss the benefits of having an ACL in place and how it can help protect lenders from potential losses.

What is an Allowance for Credit Losses and How Does it Work?

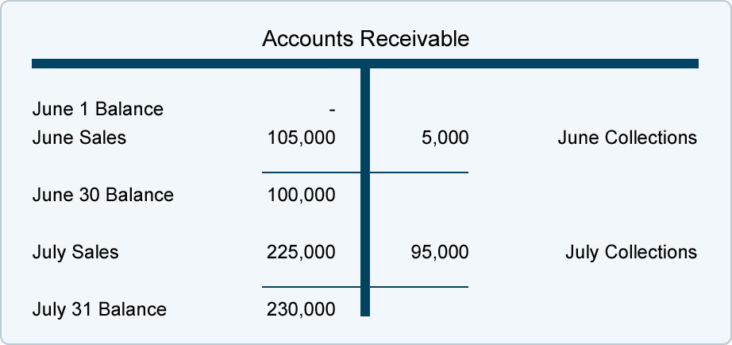

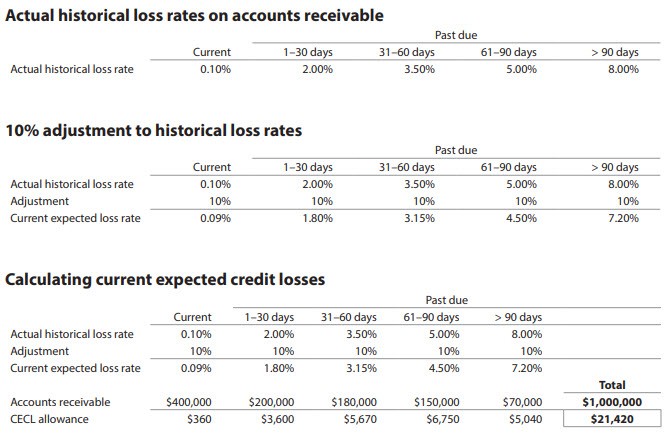

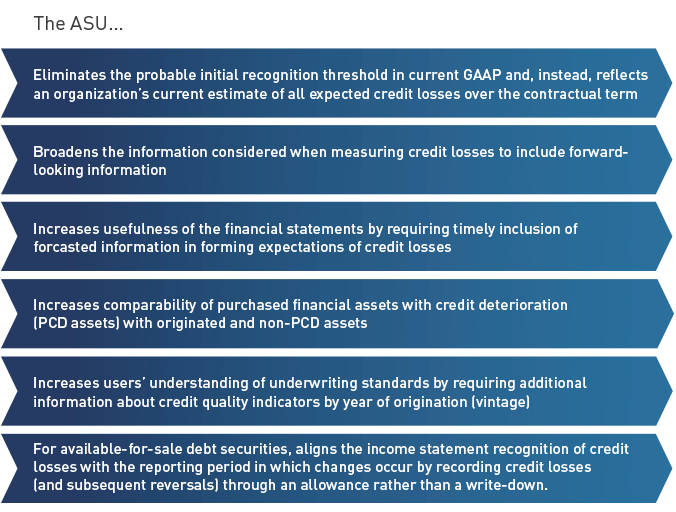

An allowance for credit losses, also known as an allowance for doubtful accounts, is a provision set aside by businesses to protect against losses due to customers not paying their debts. This allowance is a result of businesses being unable to predict when a customer will default on their debt and can be used to cover the cost of unpaid invoices. To calculate an allowance for credit losses, businesses will usually look at past due accounts and historical trends to estimate the likelihood of bad debt. Businesses may also take into account the size and type of customer, the length of time the debt has been outstanding, and the creditworthiness of the customer. Once an allowance for credit losses is set, businesses can then use it to cover any losses incurred from defaulted payments. This process helps businesses remain financially stable and better plan for future losses.

Calculating an Allowance for Credit Losses

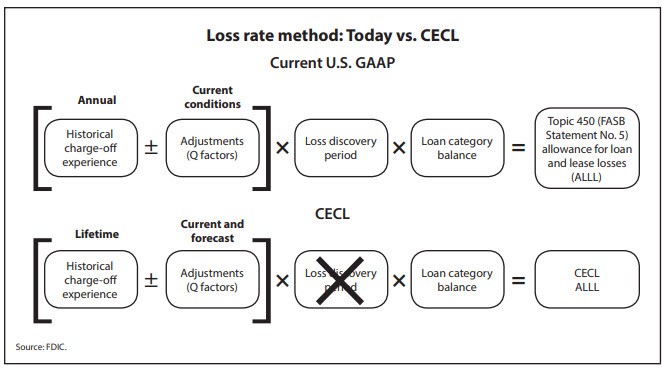

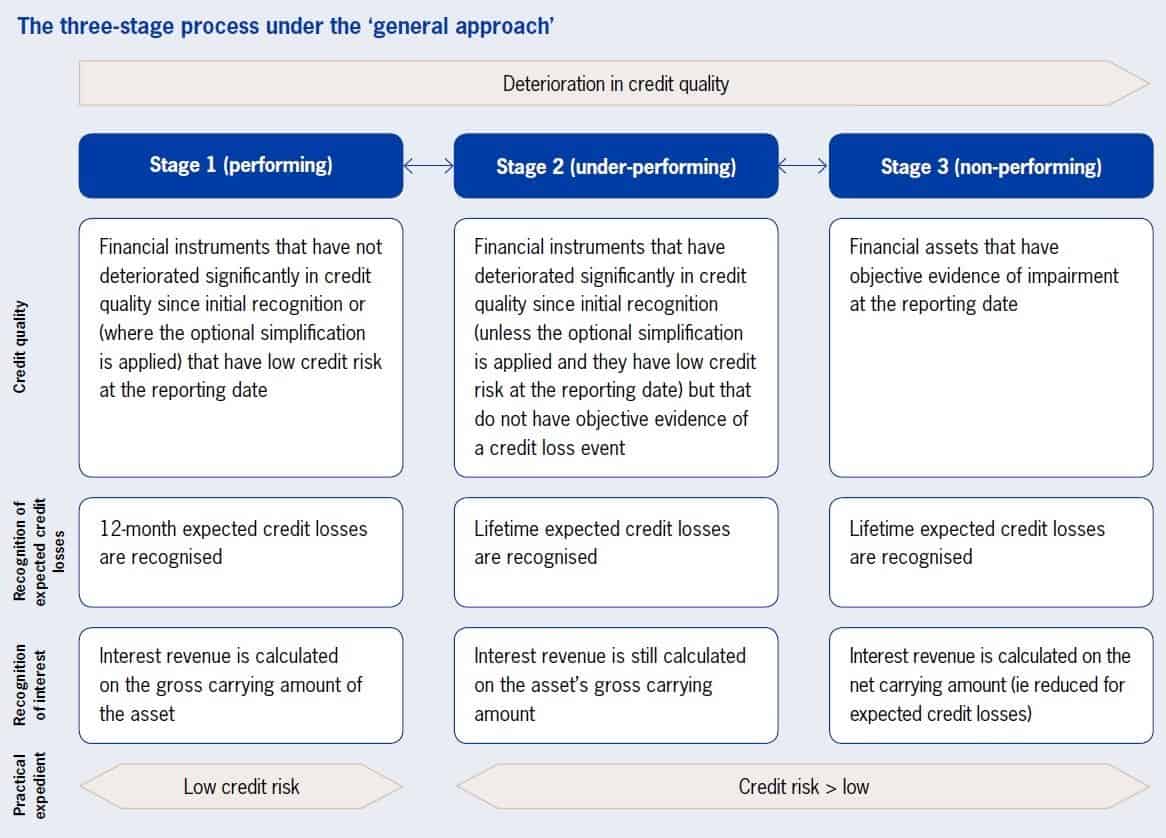

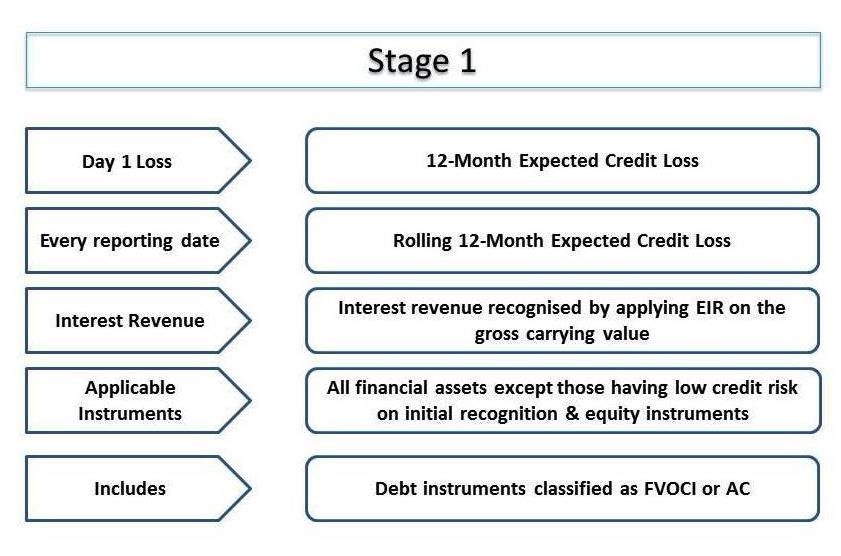

Calculating an Allowance for Credit Losses is a key factor in managing risk for a company. Developing an accurate estimate of the amount of losses that a company can expect to incur is important for ensuring that it has enough liquidity to cover unexpected losses. The allowance for credit losses is based on historical credit data, as well as an analysis of the current economic environment and the company’s current portfolio of loans. Companies use a variety of methods to calculate their allowance, including the loan loss reserve method, the historical loss method, and the probability of default method. These methods allow companies to make an educated guess of their future losses so that they can better manage their risk. A company’s allowance for credit losses should be monitored and adjusted regularly to ensure that it is accurately accounting for potential losses.

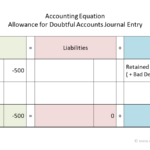

The Impact of an Allowance for Credit Losses on Financial Statements

.An allowance for credit losses can have a huge impact on a company’s financial statements. This allowance is an estimate of the potential losses a company might incur due to nonpayment or default on loans or other forms of credit. It is recorded as an expense on the income statement, which can affect the company’s net income and overall profitability. The allowance also reduces the value of the company’s assets, which can have an impact on the balance sheet. Additionally, it can have an effect on the company’s cash flow, as it requires them to set aside a portion of their funds in order to cover any potential losses. All in all, an allowance for credit losses can have a major impact on a company’s finances and should be taken into account when making any financial decisions.

Factors to Consider When Establishing an Allowance for Credit Losses

When establishing an allowance for credit losses, it’s important to consider a few key factors. First, you need to understand the types of losses that are likely to occur, such as losses due to non-payment or bad debts. You should also take into account the current economic conditions and any changes that may affect the payback of debt. Finally, you need to assess the creditworthiness of your customers and their ability to repay their debt. Taking all of these factors into consideration can help you create an allowance that accurately reflects the amount of credit losses you can expect. By doing this, you can ensure that you have enough money set aside to cover any potential losses and still remain profitable.

Best Practices for Managing Allowance for Credit Losses

When it comes to managing allowance for credit losses, it’s important to keep best practices in mind. The most important best practice is to ensure that the allowance for credit losses is set up correctly. This includes having a system in place that allows for accurate tracking of customer credit and timely updates to the system when changes occur. Additionally, a process should be in place to identify and address any potential credit losses as early as possible. It’s also important to have a policy in place to review credit losses and determine appropriate action. This includes making sure that any decisions related to credit losses are well-supported and communicated to all relevant stakeholders. Finally, it’s important to ensure that the allowance for credit losses is adjusted on a regular basis to reflect any changes in customer credit. By following these best practices, businesses can ensure that they are accurately managing their allowance for credit losses and mitigating potential risks.