Allowance for Bad Debt is an important concept for businesses to understand when it comes to managing their finances. It’s a way of accounting for losses that result from unpaid debts and allows for a more accurate picture of a company’s financial health. By understanding what Allowance for Bad Debt is, businesses can make sure their books are balanced and that losses are properly accounted for. This article will give a detailed overview of what Allowance for Bad Debt is, how to calculate it, and the importance of keeping it in mind for businesses.

Defining Allowance for Bad Debt and Its Importance

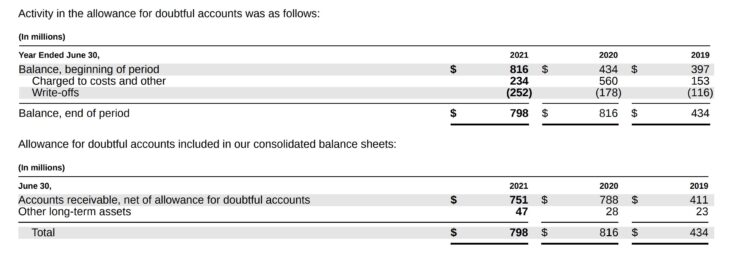

Allowance for bad debt is an important accounting concept that helps businesses account for uncollectible accounts receivable. It’s a way to protect a business from losses due to customer nonpayment. The allowance for bad debt is an estimated amount of a business’s accounts receivable that won’t be collected and must be written off. For example, if a customer has an unpaid balance of $500, the business can set aside a portion of that amount as an allowance for bad debt. This way, the business can reduce the amount of accounts receivable on its financial statements. By accounting for bad debt, businesses can keep their financial statements accurate and up-to-date. By doing this, businesses can better track their cash flow and make sure they’re staying profitable.

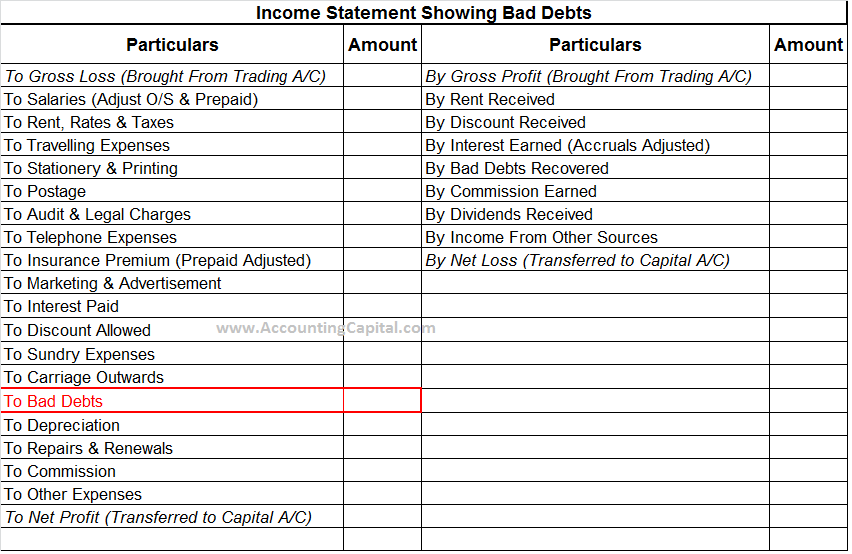

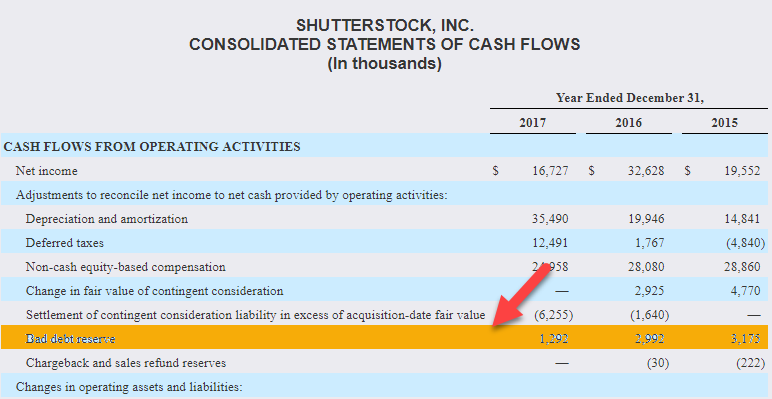

Accounting Treatment for Allowance for Bad Debt

If you’re a business owner, you’re probably familiar with the term “Allowance for Bad Debt.” Bad debt is money owed to a business that can’t be collected. It’s money that’s been written off as a loss, so businesses need to account for those losses in their financial records. Accounting Treatment for Allowance for Bad Debt is an important process to ensure that a business is accurately accounting for losses due to bad debt. When a business records an Allowance for Bad Debt, it means that the business is estimating the amount of losses it will experience due to bad debt. This involves calculating the amount of money that is likely to remain uncollected and then creating an account to reflect this amount. This account is then used to adjust the receivables account, in order to accurately reflect the amount of money owed to the business. Recording Allowance for Bad Debts is an important part of keeping accurate financial records and managing funds properly. It’s important for businesses to understand how to record Allowance for Bad Debt and to keep up with the process in order to ensure accurate financial records.

Factors to Consider When Estimating Allowance for Bad Debt

When it comes to estimating allowance for bad debt, there are a few important factors to consider. First, take a look at the size of your customer base. The larger the customer base, the larger your allowance for bad debt should be. It’s important to take into account the likelihood of some customers not paying their debts, and to make sure that your allowance is enough to cover those bad debts. Additionally, look at the payment history of your customers. If you have customers who have a history of not paying their debts, you may need to increase your allowance for bad debt. Finally, consider the amount of time that it takes for customers to pay their debts. If it takes a long time for customers to pay, you should increase your allowance for bad debt to ensure that you are adequately covered. Taking all of these factors into account will help you to accurately estimate your allowance for bad debt and ensure that you are prepared for any bad debt that may come your way.

Best Practices to Avoid Bad Debt Losses

Bad debt losses are an unfortunate reality of running a business, but there are best practices that can help you minimize the risk of not getting paid. One of the most important things to do is to do your due diligence when it comes to assessing the creditworthiness of your customers. Make sure to review their credit reports, financial statements and payment history before extending credit. Additionally, you should also set up clear payment terms and make sure that your customers are aware of them. You should also consider offering incentives for early payments, such as discounts, as this can be an effective way to encourage clients to pay on time. Finally, it’s important to have an allowance for bad debt in place, which will help you cover any losses in the event of a customer defaulting on a debt.

Tips for Making Allowance for Bad Debt More Efficient

Making allowance for bad debt is something that all businesses need to do to remain profitable. It can be a tricky process, especially if you don’t have the right systems or processes in place. To make allowance for bad debt more efficient, there are a few tips you can follow. Firstly, it’s important to keep accurate records of all debts and payments made. Doing this will help you identify any potential bad debts quickly and easily. Secondly, it’s a good idea to review your bad debt allowance regularly. If there are any changes in the number or size of bad debts, you’ll be able to adjust your allowance accordingly. Finally, ensure that you communicate with customers who owe you money. If you stay in contact with them, you can work out a payment plan or other arrangement that works for everyone. Following these tips will help you make allowance for bad debt more efficiently, so you can keep your business running smoothly.