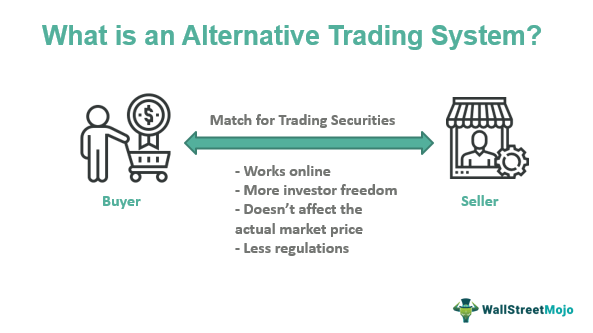

Alternative Trading Systems (ATS) are electronic trading systems used to trade stocks and other financial instruments outside of traditional stock exchanges. Designed to facilitate liquidity and reduce trading costs, these systems are often used by institutional investors, hedge funds, and large corporations. ATSs can provide investors with more efficient and cost-effective access to capital markets, and offer advantages such as increased anonymity, faster execution, and better pricing. This article provides an overview of what an Alternative Trading System is, how it works, and the benefits it can bring.

Overview of Alternative Trading Systems

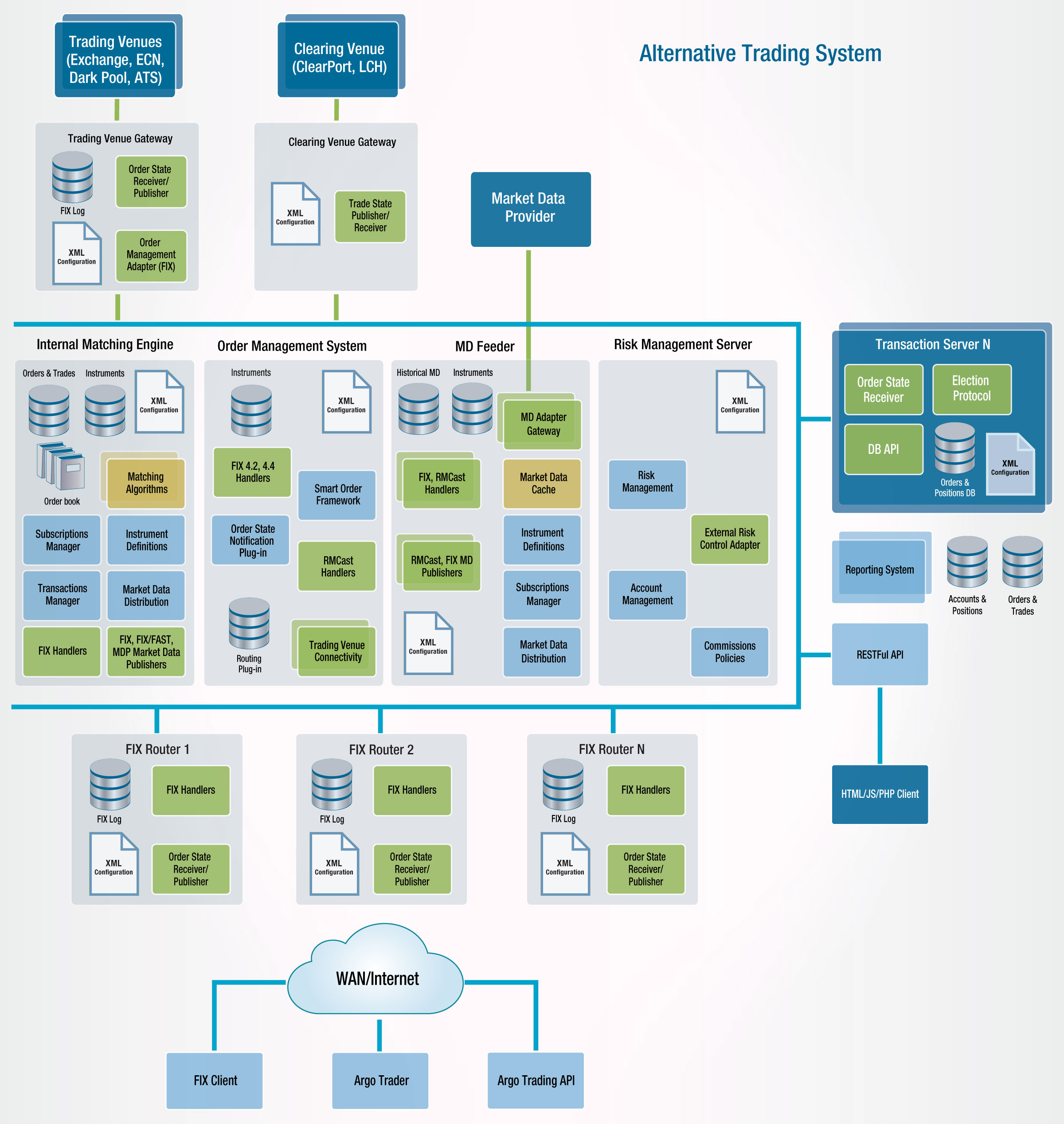

An Alternative Trading System (ATS) is an alternative way to trade securities outside of the traditional stock exchanges. ATSs are usually operated by broker-dealers and may provide investors with a way to trade securities faster and more cheaply than traditional exchanges. ATSs can also provide investors with access to otherwise hard-to-trade securities, such as those with low liquidity or low price. The main benefit of using an ATS is that it can help investors find more favorable prices than those offered on the traditional exchanges. Additionally, ATSs can provide investors with more flexibility when it comes to order types, trading times, and order sizes. While ATSs are generally seen as a more cost-effective and efficient way to trade securities, there are still some risks associated with using them, such as the potential for market manipulation and the lack of transparency.

Benefits of Alternative Trading Systems

Alternative Trading Systems (ATS) can offer some big benefits for investors. Not only do they provide an alternative to traditional exchanges, but they are often faster, more cost-effective, and more transparent than other methods. ATSs are also great for day traders, as they often provide access to a wider range of securities and a more efficient order execution process. They also provide enhanced liquidity, which can mean better prices on trades and faster settlement times. Additionally, ATSs often provide access to dark pools, which can be advantageous for those who want to buy large blocks of securities without affecting the market price. Finally, ATSs are regulated and supervised, so investors can feel secure that their investments are safe and secure.

Regulations and Restrictions on Alternative Trading Systems

Alternative Trading Systems (ATS) face a lot of regulations and restrictions, mainly to ensure that the trades are fair and secure. The U.S. Securities and Exchange Commission (SEC) regulates ATSs to protect investors and promote fair and orderly markets. All ATSs must register with the SEC as either a broker-dealer or an alternative trading system. In addition to SEC regulations, many ATSs are subject to state-level regulations and restrictions. For example, some state regulations require ATSs to disclose certain information regarding their operations and any conflicts of interest they may have. ATSs are also required to comply with the Financial Industry Regulatory Authority (FINRA) rules, which set certain standards for how ATSs must conduct their business. Finally, many ATSs have their own internal policies and procedures in place to ensure that their operations are in compliance with all applicable laws and regulations. All of these regulations and restrictions ensure that ATSs are providing a safe and secure environment for their customers to trade in.

Types of Orders Executed in Alternative Trading Systems

.Alternative Trading Systems (ATS) are a great way to get your trades executed quickly and efficiently. ATSs are electronic trading networks that allow investors to buy and sell securities without going through traditional stock exchanges. These systems allow orders to be placed in either a manual or automated fashion, so you can customize your strategy to fit your needs. There are a variety of types of orders that can be executed in ATSs, including limit orders, market orders, stop orders, and trailing stop orders. Limit orders allow you to specify the maximum or minimum price you’re willing to pay or accept for a security, while market orders allow you to buy or sell a security at its current market price. Stop orders are used to execute trades at a specific price, while trailing stop orders are designed to limit losses by automatically adjusting the stop price as the security moves in the desired direction. ATSs provide investors with greater flexibility, speed, and control over their trades, which can help them make smarter and more informed decisions.

Strategies for Utilizing Alternative Trading Systems

When it comes to using alternative trading systems (ATS), there are a few strategies you should consider. Firstly, you should research the various ATSs available to you to make sure you’re using the one that best fits your trading style. Secondly, you should familiarize yourself with the rules and regulations of the ATS you choose to use. This will help you understand how it operates and what fees you may incur. Thirdly, you should consider using ATSs for certain types of trades, such as large block trades, or for trades that require anonymity, speed, or complexity. Finally, you should look into ways to reduce costs associated with using an ATS, such as using limit orders, which could result in lower fees. By taking the time to understand the various ATSs and their associated fees, you can ensure you’re getting the best possible deal and making the most of the opportunities available.