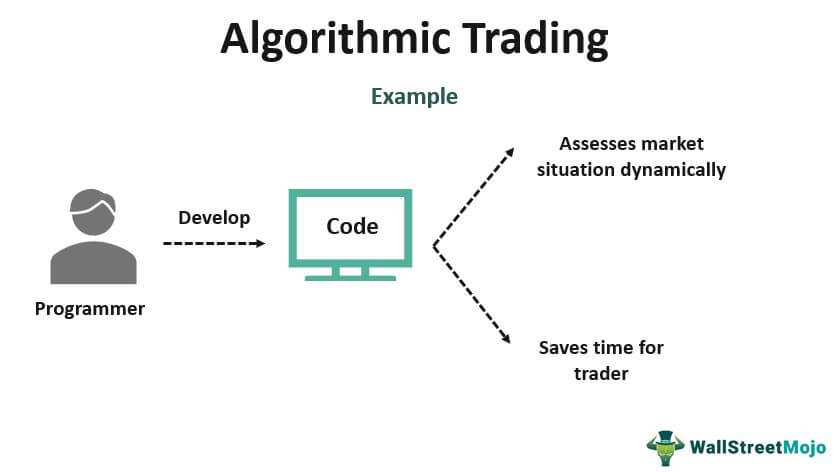

Are you an investor looking to make the most out of your money? Algorithmic trading is an automated trading process that uses complex algorithms to analyze and make decisions on financial markets. It is a sophisticated form of trading that focuses on speed, accuracy and flexibility to capitalize on short-term trading opportunities. It uses advanced mathematical models to identify patterns and trends in the markets, and can be used to execute orders in milliseconds. Algorithmic trading has become increasingly popular in recent years and is used by many major investment banks and hedge funds. In this article, we’ll look at what algorithmic trading is, how it works, and what advantages it offers.

What Are the Benefits of Algorithmic Trading?

.Algorithmic trading can be a great way to save time and money when it comes to investing. It allows traders to automate their trading decisions, so they don’t have to manually analyze and execute trades. The benefits of algorithmic trading include increased speed of execution, improved accuracy, and lower transaction costs. Additionally, it allows traders to access multiple markets and take advantage of low latency and high liquidity. Algorithmic trading also provides traders with the ability to backtest their strategies before implementation, which can help to reduce risk and increase profitability. Ultimately, algorithmic trading can be a great way to make more accurate, faster, and more profitable trades.

How Does Algorithmic Trading Work?

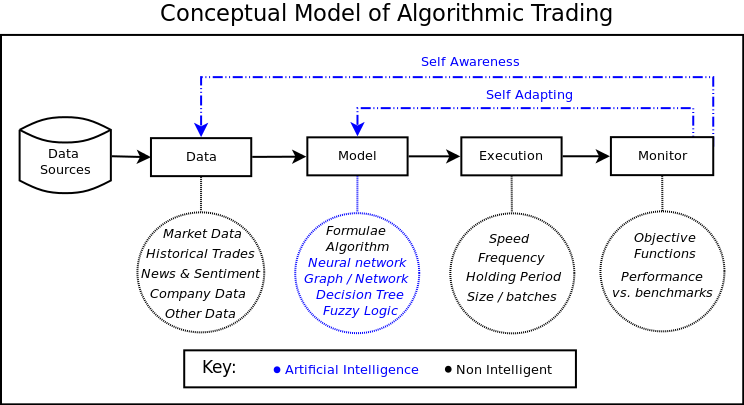

Algorithmic trading is a form of trading that uses complex computer programs and algorithms to decide when and how to buy and sell stocks, derivatives, and other financial instruments. It is a type of automated trading, allowing traders to make decisions quickly and accurately without the need for manual intervention. Algorithmic trading works by analyzing large amounts of data and analyzing it for patterns. This data can be anything from market data to news stories, and even customer behavior. Once the data has been analyzed, the algorithms can look for trends in the data and make decisions to buy or sell based on these trends. Algorithmic trading can be used for both long and short-term trading strategies, and can be used to increase profits and reduce risk. It is becoming increasingly popular among traders who want to make faster and more accurate decisions without the need for manual input.

What Are the Challenges of Algorithmic Trading?

Algorithmic trading has been around for a while now and it’s becoming increasingly popular as a way to trade on the financial markets. However, it comes with its own unique set of challenges. One of the biggest challenges of algorithmic trading is that it requires a lot of data to be successful. To make sure your trading decisions are based on accurate and up to date information, you need to have access to a lot of data, which can be difficult to come by. Additionally, algorithmic trading requires an understanding of the markets and the ability to anticipate market movements. If you don’t have the experience or knowledge, you could end up making decisions based on incorrect information. Furthermore, since algorithmic trading is done in real-time, you have to be able to make decisions quickly and accurately, which can be difficult for some traders. Lastly, algorithmic trading can be expensive to get into, as it requires a lot of technology and a high level of expertise. All of these challenges mean that algorithmic trading is not for everyone, and it should be approached with caution.

What Types of Algorithmic Trading Strategies Are There?

Algorithmic trading is all the rage when it comes to trading on the stock market. It’s a great way to make a profit fast and with minimal effort. But what is algorithmic trading, and what types of strategies can you use to get started? Algorithmic trading is a type of trading which uses algorithms and sophisticated computer programs to automatically execute trades. There are many different types of algorithmic trading strategies, each with its own set of benefits. Some of the most popular strategies include trend following, arbitrage, market making, and high-frequency trading. Trend following strategies look for trends in the market and then execute trades based on those trends. Arbitrage strategies look for price differences in the same asset or different assets and capitalize on them. Market making strategies aim to capture the bid-ask spread by providing liquidity to the market. And high-frequency trading strategies employ complex algorithms to identify and capitalize on small inefficiencies in the market. With all these strategies, there are plenty of options to choose from when it comes to algorithmic trading.

How to Get Started With Algorithmic Trading?

If you’re looking to get started with algorithmic trading, the best place to start is by doing some research and diving into the basics. There are tons of great resources out there to help you get started, including books, websites, and even online courses. Once you have a solid understanding of the basics, you can begin to look into specific strategies and techniques. You’ll want to explore the different types of algorithmic trading, such as momentum trading, mean-reversion trading, and arbitrage. You’ll also want to consider the tools and software you’ll need to get up and running with algorithmic trading. It’s important to do your due diligence here and make sure the software you choose is reliable and has the features you need. Once you have everything in place, you can start testing your strategies and see how they perform in the real world. Algorithmic trading can be a great way to boost your profits and increase your trading knowledge. With the right resources and a bit of practice, anyone can become a successful algorithmic trader.