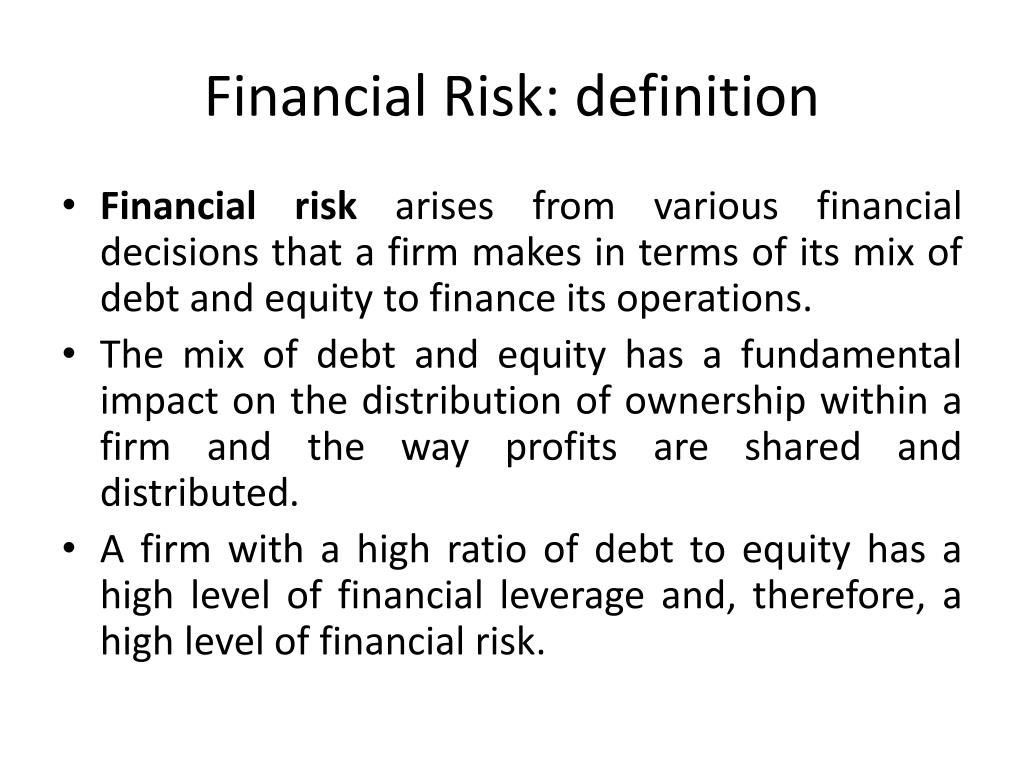

All Risks insurance is an often-misunderstood type of insurance that covers a wide range of potential losses. It is a popular choice for businesses and individuals alike, as it provides a high level of coverage that ordinary policies do not. It is important to understand what All Risks insurance covers and how it differs from other types of policies in order to make an informed decision about the best coverage for your specific needs. In this article, we will discuss what All Risks insurance is and how it works, as well as its advantages and disadvantages.

What Does All Risks Insurance Coverage Include?

All-Risks insurance coverage is a comprehensive form of insurance that offers protection against most risks, except for those that are specifically excluded from the policy. This form of insurance is designed to cover a wide range of losses that can occur due to unexpected events, such as property damage, fire, theft, and other losses. All-Risks insurance can provide protection for a variety of items, including personal belongings, business property, and even vehicles. When it comes to All-Risks insurance coverage, it’s important to understand what is and isn’t included. Generally speaking, coverage will include losses resulting from incidents such as fire, lightning, wind, hail, theft, vandalism, and flood. It may also cover losses from natural disasters, such as earthquakes and hurricanes. However, it’s important to check the specifics of your policy, as some policies may exclude certain types of losses, such as those from intentional acts or from wear and tear. It’s important to have a clear understanding of what is and isn’t covered by your all-risks insurance policy so that you can be sure you’re fully protected in the event of damage or loss.

What Are the Advantages of an All Risks Policy?

Having an all risks policy is a great way to ensure you’re covered in any situation. It’s the most comprehensive form of insurance out there, so you know that you’re protected no matter what. The advantages of having an all risks policy include having extensive coverage, including coverage for damage and loss caused by unforeseen circumstances. Additionally, these policies provide coverage for any type of loss, whether it’s accidental or intentional. This means you can rest assured that you’re covered in any and all situations. Plus, all risks policies are often more affordable than other types of insurance, making them a great option for budget-conscious consumers. So if you’re looking for a comprehensive and cost-effective way to protect yourself, an all risks policy could be the best option for you.

What Are the Disadvantages of All Risks Insurance?

One of the biggest drawbacks of all-risks insurance is the cost. It can be significantly more expensive than other types of insurance policies, making it difficult for some people to afford. Additionally, all-risks insurance does not cover all kinds of losses, so you may find yourself with some losses that you weren’t prepared for. In some cases, you may even have to pay out of pocket for certain damages. Finally, all-risks insurance may not be the best choice for people who have a lot of valuable items that need to be insured. You may have to pay a much higher premium in order to get the coverage that you need. All of these factors should be taken into consideration when deciding if all-risks insurance is right for you.

How To Choose the Right All Risks Policy

When it comes to getting an all risks insurance policy, it’s important to go beyond the basics and make sure you are choosing the right coverage for your needs. To do this, you need to consider several factors, including the type and amount of coverage you need, the terms of the policy, the insurance company’s reputation, and the cost of the coverage. Take the time to research all of your options and compare quotes to make sure you are getting the best deal. Be sure to ask questions to better understand the policy and what it covers, so you can make an informed decision about which policy is right for you.

How To Avoid Plagiarism When Discussing All Risks Financial Definition

When discussing All-Risks, it’s important to make sure that you avoid plagiarizing and instead express your own opinions and ideas. To ensure you don’t plagiarize, make sure you cite any sources you use, including quotes and statistics. Whenever you use someone else’s words, make sure to enclose them in quotation marks and add a citation note. Additionally, be sure to cite any facts and figures, and always give credit to the original source. If you’re not sure if something you’re writing needs to be cited, it’s best to be safe and include a citation. Avoiding plagiarism is essential to maintain the credibility of your work and to stay on the right side of the law.