A aleatory contract is an agreement between two parties where one or both parties must fulfill a certain obligation, the outcome of which is dependent upon random or chance events. In other words, it is a contract with uncertain outcomes. Aleatory contracts are used in a variety of contexts, from insurance policies to gambling. In this article, we’ll explore what aleatory contracts are, their advantages and disadvantages, and how they are used in the financial world.

Overview of Aleatory Contracts: What Are They?

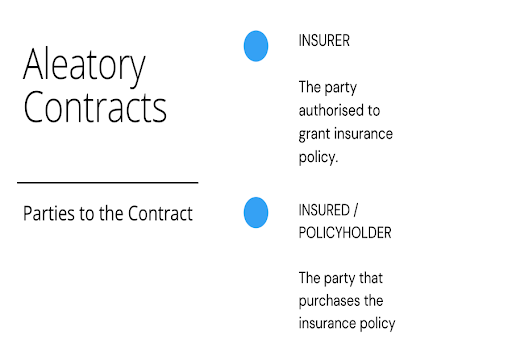

An aleatory contract is a type of financial contract where two parties agree to a certain set of conditions that depend on the occurrence of an uncertain event. This event could be anything from a natural disaster to a change in market conditions. The contract usually contains provisions that determine how the parties will be compensated in the event of the occurrence of the uncertain event. Aleatory contracts are commonly used in insurance and reinsurance agreements, as well as in certain derivative contracts. They are an important tool for managing risk and providing protection for both parties involved in the contract. Aleatory contracts are also known as aleatory agreements or aleatory obligations.

Advantages and Disadvantages of Aleatory Contracts

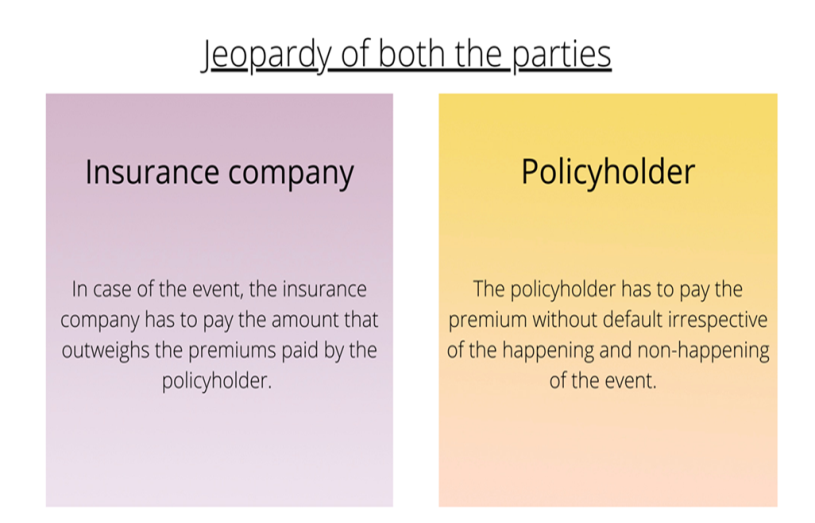

.Aleatory contracts can be an incredibly useful tool in financial transactions. They provide a way for parties to engage in a binding agreement, while still allowing for some uncertainty and variability. The advantages of aleatory contracts are that they can help to protect parties from unexpected changes in circumstances, such as changes in the market or changes in the needs of the parties. They also provide a way for parties to distribute risk more evenly. Disadvantages of aleatory contracts include the fact that they can be difficult to agree upon, as parties need to come to an agreement on how to handle the variables involved. Additionally, the uncertain nature of aleatory contracts can make it difficult to set expectations and can lead to confusion if not properly managed. Ultimately, aleatory contracts can be a great way to protect both parties involved in a financial transaction, as long as all parties understand the risks and rewards associated with them.

Different Types of Aleatory Contracts

Aleatory contracts are a type of agreement that involves some element of chance, usually in the form of a payment that is triggered by an event that is uncertain. They can come in many different forms, such as insurance policies, gambling agreements, and even some types of financial instruments. There are several types of aleatory contracts that are commonly used in the financial world. Insurance policies are the most common type of aleatory contract, as they involve the transfer of risk from one party to another. Gambling agreements are another type of aleatory contract, where one party agrees to pay out a certain sum of money in the event that a certain event or outcome occurs. Financial instruments, such as options and futures, also use aleatory contracts to manage the risk associated with their investments. These contracts can help both parties to manage their risk in a way that is more beneficial to them, allowing them to make better decisions and maximize their returns.

How to Draft an Aleatory Contract

Drafting an Aleatory contract can seem like a daunting task, but with the right guidance, it can actually be quite straightforward. The most important thing to remember when drafting an Aleatory contract is to make sure it complies with all applicable laws and regulations. Additionally, it is important to make sure that all parties involved have a clear understanding of the terms of the contract and that all parties are in agreement. When drafting an Aleatory contract, it is also important to make sure that all parties understand the consequences of any breach of contract. This includes knowing what will happen if one party fails to fulfill their obligations under the contract. Lastly, it is important to ensure that the contract is clear and easy to read. This will ensure that everyone involved in the contract is on the same page and that all parties are aware of their respective rights and obligations. By following these steps, you can rest assured that your Aleatory contract will be legally binding and enforceable.

Steps to Avoid Plagiarism When Writing About Aleatory Contracts

When writing about aleatory contracts, it’s important to make sure you don’t fall into the trap of plagiarism. Plagiarism can be a huge issue, so it’s important to make sure you properly cite any sources you use, and make sure all of the content you write is original. If you’re having trouble coming up with original content, try brainstorming different ideas or topics and researching them thoroughly to ensure your content is unique. Additionally, you can use online tools such as Grammarly to help you check for plagiarism and make sure all of your content is original. Writing about aleatory contracts can be a daunting task, but with the right tools, you can make sure you’re creating content that is 100% original and free of plagiarism.