The Agency Problem is a financial issue that can arise when a company’s shareholders and its management team have different interests. It’s an important concept to understand, as it can have a big impact on company performance and shareholder value. In this article, we’ll take a closer look at this issue, explore how it can be prevented and discuss why it’s so important to recognize and address it.

What Is the Agency Problem?

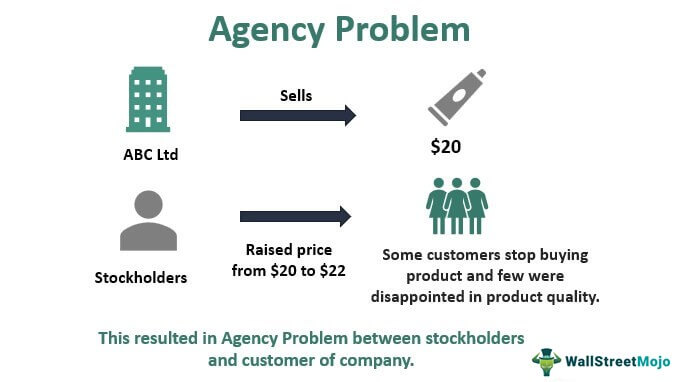

The agency problem is a situation where the goals of the agent (an individual or group acting on behalf of another person or entity) are not aligned with the goal of the principal (the person or entity being represented). It is an important issue in business and economics as it can lead to conflicts of interest and potentially costly mistakes. In the financial world, for example, the agency problem might arise when a financial advisor recommends investments that are more beneficial to him than to the client. The same can be true in a corporate setting, where managers take actions that benefit them personally rather than benefiting the company as a whole. The agency problem is a pervasive issue that can have serious implications, so it’s important to be aware of it and take steps to mitigate it.

How Does the Agency Problem Impact Financial Markets?

The agency problem is an important factor to consider when looking at the financial markets. It occurs when the agents (employees or management) of a company act in their own interests instead of the interests of the company’s shareholders. This can lead to mismanagement of funds, incorrect decision-making, and even fraud. The main impact of the agency problem on the financial markets is that it reduces the confidence of investors. If investors do not trust the management of a company, they will not invest, resulting in fewer funds available to the company. This can lead to decreased stock prices, higher borrowing costs, and can even hurt the company’s reputation. Therefore, it is important for companies to be aware of the agency problem and take steps to reduce it, such as providing oversight, increasing the transparency of decision-making, and ensuring that management is working in the best interests of the company and its shareholders.

How Can Companies Minimize the Risk of Agency Problems?

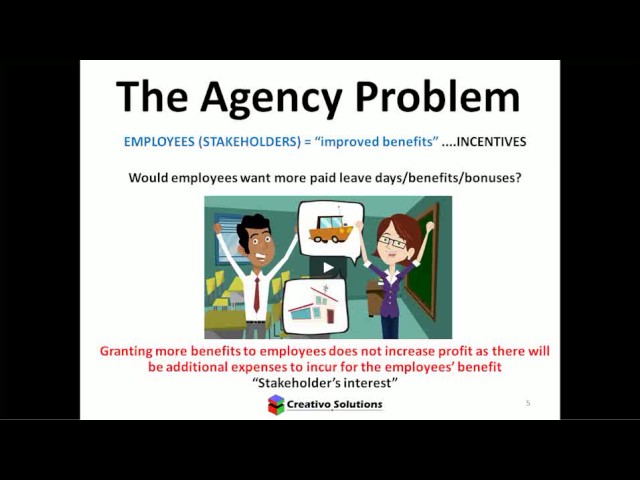

The agency problem is something that companies need to be aware of, as it can lead to serious problems between shareholders and managers. To minimize the risk of agency problems, companies should make sure that their board of directors is independent and that their shareholders are well informed. They should also make sure that executive compensation is linked to performance and that management has clear goals and objectives. Additionally, companies should ensure that there are effective systems in place to monitor and evaluate management’s performance and that adequate internal control systems are in place to detect and prevent fraud and other unethical activities. By taking these steps, companies can minimize the risk of agency problems and ensure that their shareholders and managers are working together in the best interest of the company.

What Are the Different Types of Agency Problems?

The agency problem is an issue that can arise when there is a conflict of interest between two parties in a business relationship. It’s a situation that occurs when an agent acts on behalf of a principal, but the agent’s interests don’t always align with the principal’s best interests. This can lead to a variety of costly issues and even potential legal problems. There are different types of agency problems that can occur, including principal-agent problems, agency costs, and two-tier agency problems. Principal-agent problems occur when the agent is making decisions that benefit themselves more than the principal. Agency costs arise when the agent’s fees are higher than the benefit that the principal gets from the agent. Two-tier agency problems can arise when there are multiple agents involved in the transaction, and each agent has their own interests that don’t align with the principal’s interests. It’s important for businesses to be aware of agency problems and take steps to mitigate the risks associated with them. Taking preventative measures like hiring reputable agents and conducting due diligence can help reduce the chances of an agency problem occurring.

What Are the Strategies to Avoid Plagiarism in Business Writing?

When it comes to writing for business, it is important to avoid plagiarism and make sure all content is original. Plagiarism can be a major issue for businesses, and can have serious consequences. To avoid this issue, there are a few strategies to consider. First, it is important to reference any sources that are used in the writing. Additionally, it is a good idea to read through the content before submitting it to make sure no content has been taken from other sources. Finally, using a plagiarism checker can help to identify any potential plagiarism issues. By following these strategies, businesses can ensure that their writing is original and free from plagiarism.