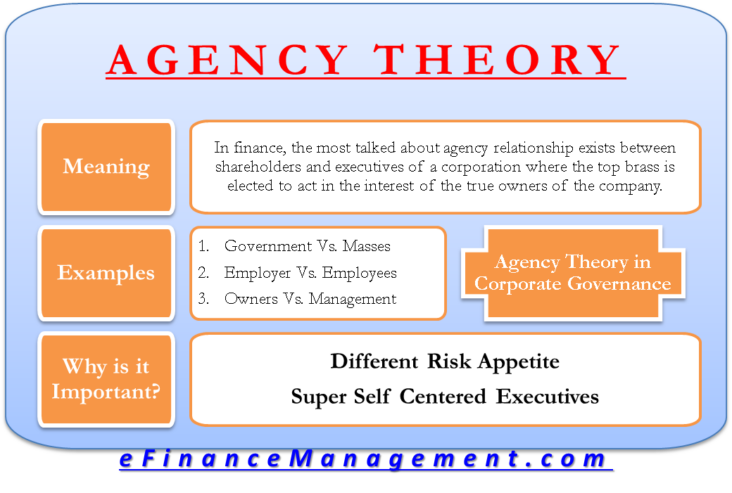

Agency Theory is an economics concept that deals with the relationship between two parties: the principal and the agent. It is a way of understanding how the principal can make sure that the agent works in the principal’s best interest. This article will explain what Agency Theory is, how it is used in the financial world, and why it is important. We will also uncover the key principles behind Agency Theory and how it is used as an effective tool for managing relationships between principals and agents.

Exploring the Basics of Agency Theory

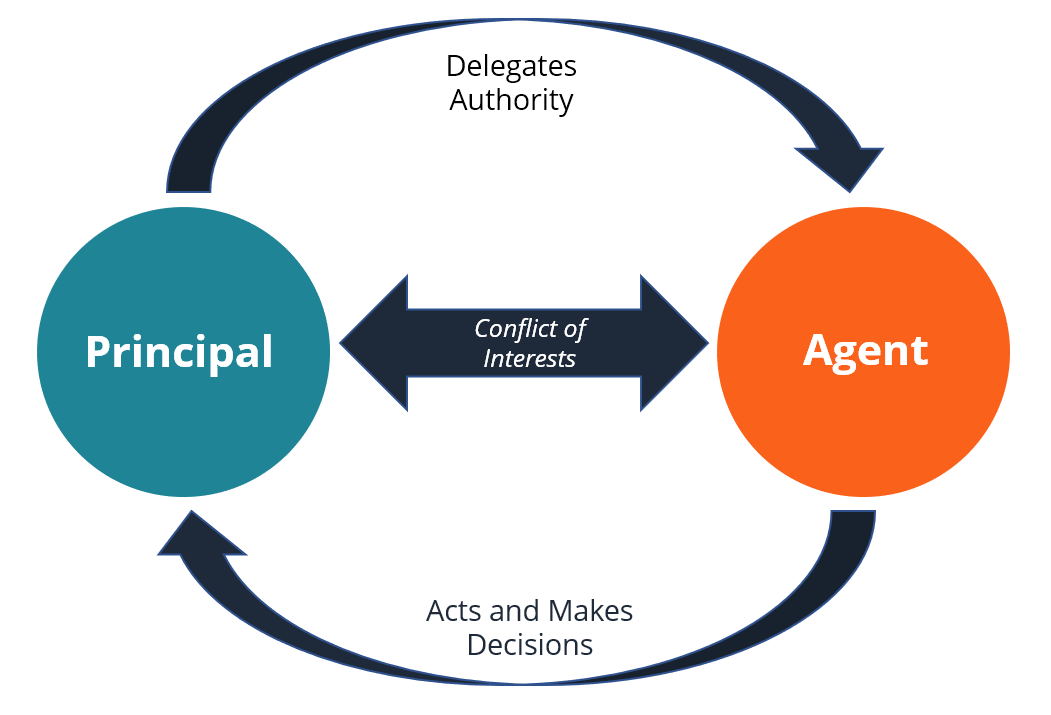

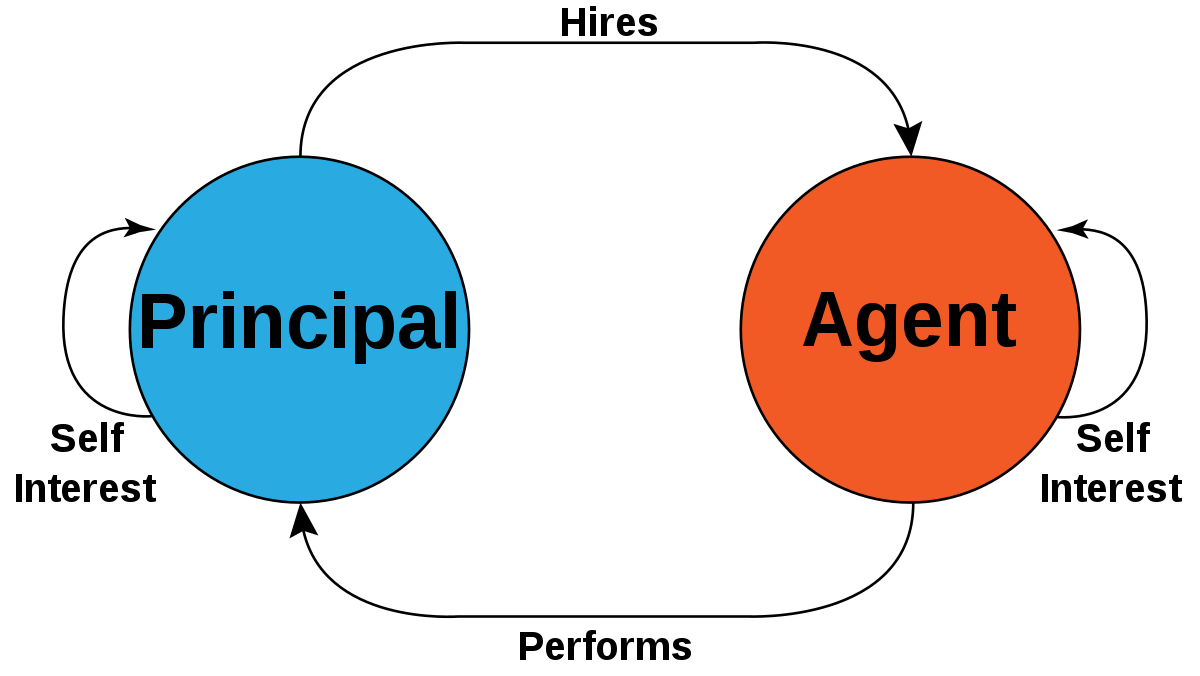

Agency theory is a concept in finance and economics that looks at the relationship between two parties in a business deal. It is used to explain the behavior of one party, known as the principal, who delegates work to another party, called the agent. The theory states that the agent will act in the best interest of themselves instead of the principal’s, which can lead to misaligned incentives. To reduce this risk, the principal can create contracts, performance measures, and other incentives to ensure that the agent acts in the principal’s best interest. Agency theory is an important concept for those in the business world, as it can help to reduce risks and increase efficiency. With a better understanding of agency theory, businesses can make sure their goals are being met and that everyone involved is working toward the same objectives.

Examining the Different Types of Agency Theory

Agency theory is all about the relationship between two parties: the principal and the agent. The principal is the person who hires the agent to act on their behalf and the agent is the person hired to do the job. Agency theory looks at how this relationship works and how it affects the principal and agent’s decisions. There are different types of agency theory out there, each with its own focus and implications. The three main types are moral hazard, incentives, and information asymmetry. Moral hazard focuses on the risk that the agent will not act in the best interest of the principal. Incentive-based agency theory looks at how incentives can be used to influence the decision-making of the agent. Finally, information asymmetry theory looks at how the principal and the agent can negotiate when there is a lack of information about the situation.

Understanding the Impact of Agency Theory on Financial Decision Making

Agency theory is a critical tool for understanding how financial decisions are made and how they impact everyone involved. It is based on the idea that when there are two or more parties involved in a transaction, each party has different objectives and interests. Agency theory helps to identify the potential conflicts of interest between a principal (the person who has control over the funds) and an agent (the person who is hired to act on behalf of the principal). By understanding how the potential conflicts of interest affect the decisions being made, financial professionals can make better decisions that benefit all parties involved. As such, agency theory is an invaluable tool for financial decision making.

How Agency Theory Is Used in Business and Corporate Settings

Agency theory is a useful tool for understanding the relationship between a principal and an agent in a business or corporate setting. It is based on the idea that an agent (such as a CEO or manager) acts on behalf of a principal (such as shareholders or owners) to achieve a certain goal or objective. This theory is widely used in business and corporate settings to ensure that the interests of the principal are properly represented and that the agent has the proper incentives in place to ensure that the goal is achieved. Agency theory is also used to assess the effectiveness of the principal-agent relationship and to make sure that the agent’s actions are in line with the principal’s wishes. In essence, it helps to ensure that the agent is acting in the best interests of the principal and not in their own self-interest.

Evaluating the Pros and Cons of Agency Theory

Evaluating the pros and cons of Agency Theory is essential to understanding the implications of its use in business. On the pro side, Agency Theory provides an effective way to align stakeholders’ interests and objectives, allowing them to focus on the same goals and objectives. This leads to greater efficiency and better decision-making. On the con side, Agency Theory has been criticized for creating a conflict of interest between the parties involved, resulting in a lack of trust and communication. It can also be costly to implement, as it often involves hiring legal and financial advisors. Despite its drawbacks, Agency Theory remains a popular and effective tool for managing and resolving various corporate disputes. For businesses looking to maximize efficiency and reduce costs, Agency Theory is worth exploring.