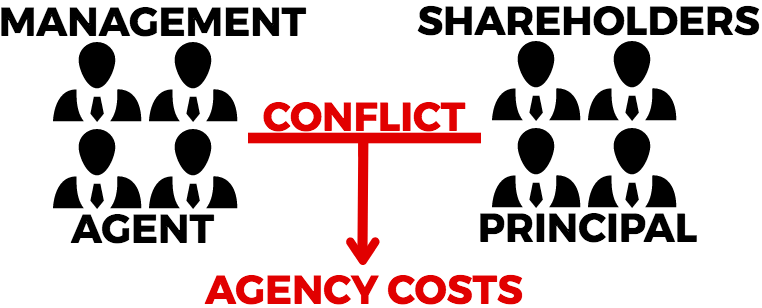

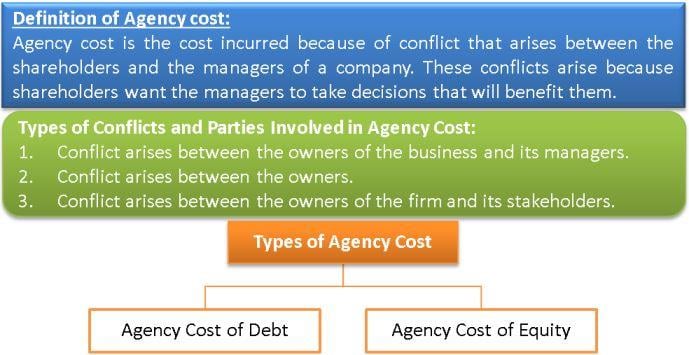

Agency costs refer to the costs incurred when there are conflicts of interest between agents and their principals. These conflicts can arise from different goals and objectives, incentives, or a lack of proper monitoring of agents. It is essential for companies to understand and manage agency costs in order to reduce risk and ensure their interests are properly represented. In this article, we will explain what agency costs are and how they can be minimized.

An Overview of Agency Costs: What to Know

Agency costs refer to the costs associated with a principal-agent relationship. In this type of relationship, the principal (or the party hiring the agent) delegates decision-making authority to the agent (or the party hired by the principal). These costs can take a variety of forms, including financial costs, time costs, and opportunity costs. As the principal, you must be aware of the agency costs associated with your decision to delegate authority. This is especially true if you are dealing with a large company or organization, as agency costs can add up quickly and can have a significant impact on the bottom line. Understanding agency costs and how to manage them is essential for any business. Knowing what to look for and how to mitigate or reduce the costs can help you make better decisions and get the most out of your business relationships.

Causes of Agency Costs and How to Minimize Them

Agency costs are a real bummer: they’re the costs incurred when one party (the principal) hires another party (the agent) to act on its behalf. The costs are typically due to misaligned incentives between the two parties, resulting in inefficient decision-making and higher costs. The good news is that there are ways to minimize these costs. It all starts with understanding the different types of agency costs, as well as the underlying causes. Common causes of agency costs include information asymmetry, risk aversion, and conflicts of interest. To minimize these costs, principals should ensure they have proper contracts in place that clearly define responsibilities and incentives. Additionally, they should ensure they have access to the same information as the agent, and that both parties are properly incentivized to make the most efficient decisions. Ultimately, the goal is to create an environment where both parties are working towards the same goal and their incentives are properly aligned.

How Agency Costs Impact Financial Statements

Agency costs can have a big impact on financial statements. These costs can arise when principals and agents have different interests, and the agent is not acting in the best interest of the principal. This can lead to decisions that are not in the best interest of the principal, resulting in an increase in costs. Agency costs can show up in the form of higher transaction costs, increased risk, and increased administrative costs. If a company fails to address these costs, it could end up losing money due to poor decision-making. It is important for companies to properly monitor and manage agency costs in order to ensure long-term success and financial stability.

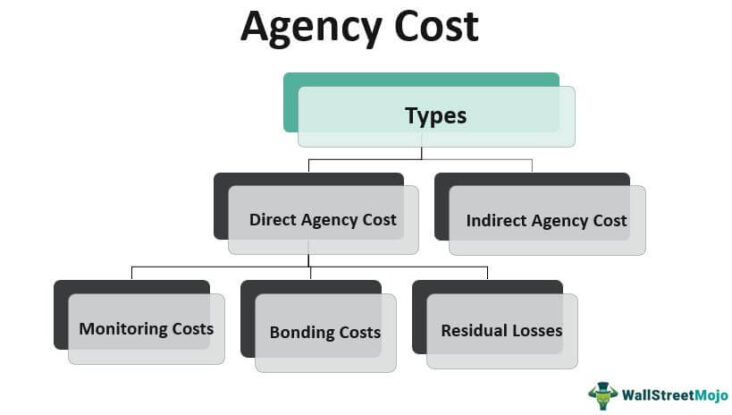

Understanding the Different Types of Agency Costs

Agency costs are costs that arise from conflicts of interest between a principal and an agent. These costs can occur in any type of relationship, whether it’s between a company and its shareholders, an employer and its employees, or a customer and a vendor. Understanding the different types of agency costs is essential for avoiding costly conflicts of interest. The most common type of agency cost is the principal-agent problem, which occurs when the agent has more information or incentives than the principal. When this happens, the agent may take actions that are not in the best interest of the principal, leading to higher costs. Another type of agency cost is agency conflict costs, which arise when the interests of two different agents (such as two shareholders) conflict. In this case, the two agents may end up competing against each other, leading to higher costs. Finally, there are transaction costs, which are costs associated with negotiating, monitoring, and enforcing contracts. These costs can be substantial, especially when the terms of the contract are complex or require frequent revisions.

Strategies to Help Avoid Agency Costs and Maximize Profits

When it comes to maximizing profits and avoiding agency costs, there are a few strategies that can prove to be effective. First, it is important to understand the roles of different stakeholders in the business, and ensure that everyone is working towards the same goal. Additionally, effective communication between all parties involved is essential for avoiding conflicts of interest. Additionally, having clear contracts in place and regularly monitoring performance can help ensure that agency costs are kept to a minimum. Finally, it is important to clearly define the roles and responsibilities of each party, and ensure that everyone is held accountable for their actions. By taking these steps, businesses can minimize agency costs and maximize profits.