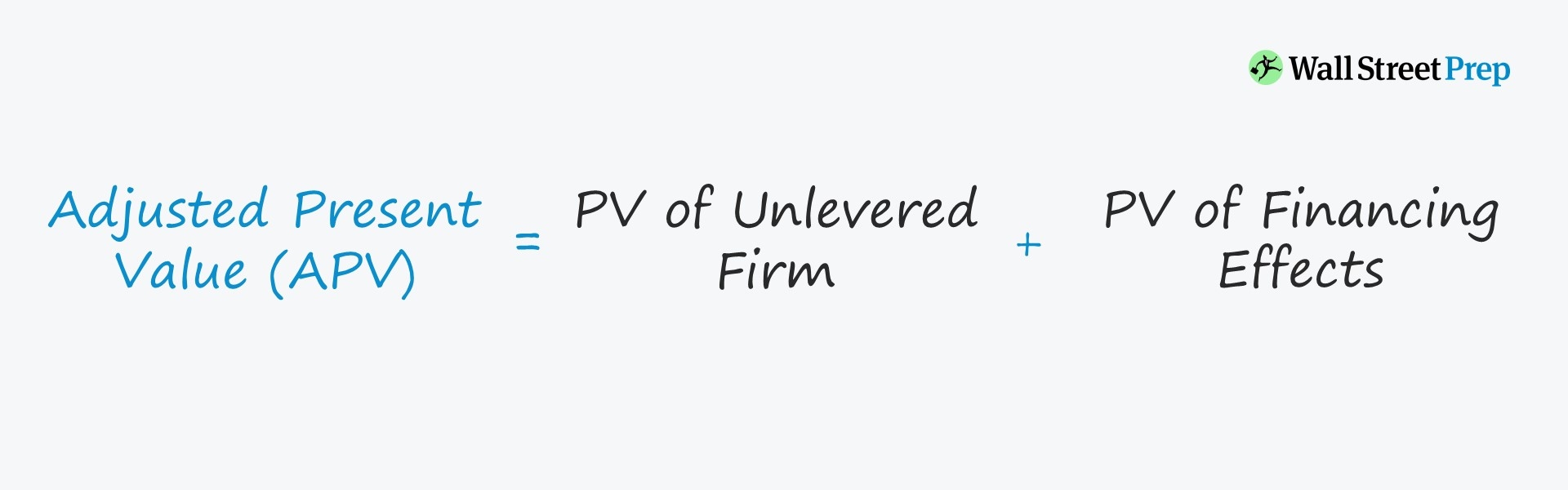

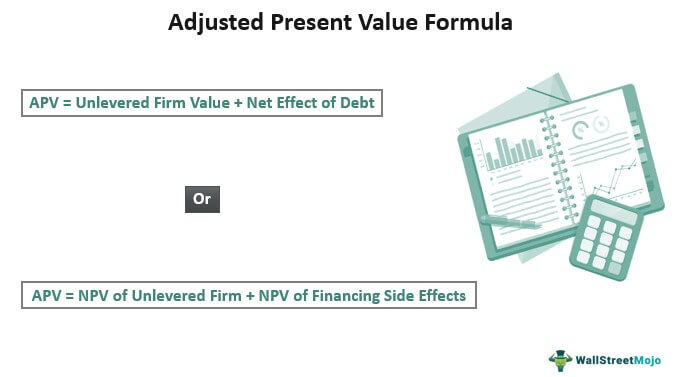

Adjusted Present Value (APV) is a financial tool used by investors to determine the true value of a potential investment. APV allows investors to consider the side effects of a leveraged transaction and the resulting tax implications in order to accurately assess the overall value of the investment. By carefully weighing the costs, benefits, and risks associated with an investment, APV helps investors make informed decisions and maximize their returns.

What Is Adjusted Present Value (APV) and How Does It Differ From Traditional Valuation Models?

Adjusted Present Value (APV) is a way of valuing a business or project that takes into account the financing structure of the company or project. It is an alternative to traditional valuation models, such as the discounted cash flow method, that don’t take into account the financing structure of the company or project. It takes into account the cost of capital, the tax implications of financing, and any other costs associated with financing. APV is useful for assessing the value of a project or company when the financing structure is complex or when the cost of capital is important. It provides investors with a more accurate view of the true value of the company or project by taking into account the financing structure. APV can be used to assess the potential profitability of a project or company, and can be a useful tool for making decisions about investments.

What Are the Benefits of Using Adjusted Present Value (APV) for Financial Analysis?

Using Adjusted Present Value (APV) for financial analysis offers a number of benefits compared to other methods of valuing a company. One of the biggest advantages of using APV is that it allows for a more accurate valuation of a company because it takes into account the value of the company’s assets and liabilities. It also looks at the potential cash flows of the company, which can be beneficial when making decisions about investments. Additionally, APV allows for a more detailed analysis, as it allows for the separation of financing and investing decisions, which can help to identify potential areas of risk or opportunities for improvement. Finally, APV is a great tool for helping to determine the overall value of a company, as it takes into account the present value of cash flows and the potential for future growth. Investing with an APV approach can be beneficial for both investors and businesses alike.

What Are the Risks Involved with Adjusted Present Value (APV) Valuation Models?

When it comes to using Adjusted Present Value (APV) valuation models, there are some risks that need to be taken into account. One of the biggest risks is the fact that, since APV models are based on forecasts and assumptions, they can be subject to inaccuracies that can lead to incorrect valuations. This can be especially risky when forecasting future cash flows and other variables as these can be difficult to predict. Another potential risk with APV models is that they can be complex to use and interpret, which can lead to errors if not used correctly. Finally, APV models may also be subject to changes in the market, which can affect the accuracy of the model and the valuation that is provided. All of these risks should be taken into consideration when using an APV valuation model.

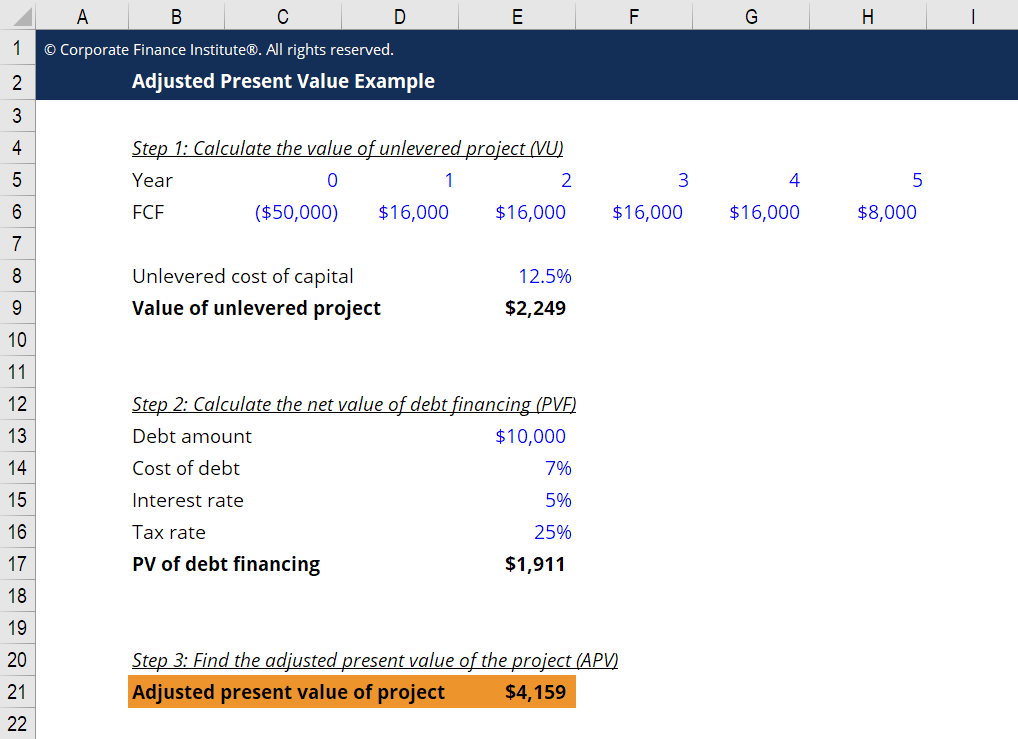

How Do I Calculate Adjusted Present Value (APV) for a Business?

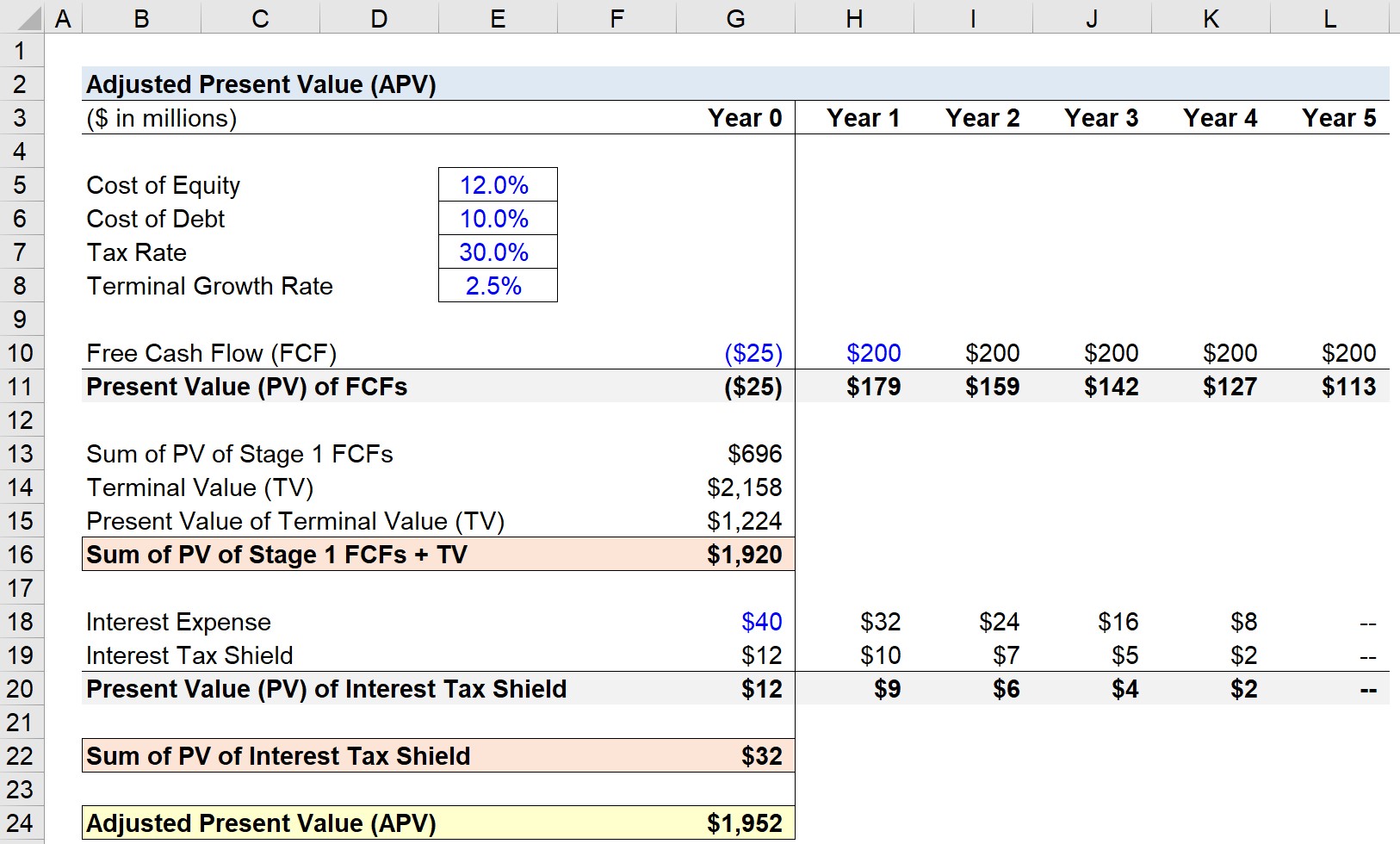

Calculating Adjusted Present Value (APV) for a business requires you to break down the business into its individual components. To begin, you’ll need to calculate the net present value of the business’s cash flows. Then, you’ll need to deduct the financing costs associated with the debt used to finance the business, as well as any potential tax savings associated with the debt. Finally, you’ll add any potential non-operating cash flows to the net present value, such as proceeds from the sale of assets or income from investments. This final figure is the Adjusted Present Value (APV) of the business. It’s important to remember that the APV calculation does not consider the cost of equity financing, so this must be accounted for separately. With all of this information, you’ll be able to accurately calculate the Adjusted Present Value of your business and make informed decisions based on your findings.

Best Practices for Implementing Adjusted Present Value (APV) for Financial Analysis

When it comes to implementing Adjusted Present Value (APV) for financial analysis, the best practices are to consider the full range of elements that make up a company’s value. This includes both the tangible assets as well as the intangible elements such as brand recognition, customer loyalty, and marketability. Additionally, it’s important to consider the value of future cash flows when determining the APV. This means taking into account the current and projected cash flows, as well as any potential risks that could affect the future performance of the company. Finally, it’s important to ensure that any assumptions made are realistic and well-supported. By following these best practices, you can ensure that the APV is an accurate reflection of the company’s value and that it is used to make informed decisions.