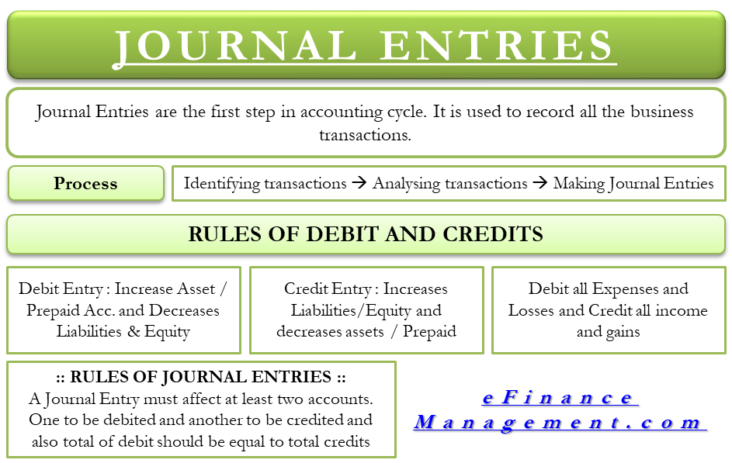

Adjusting journal entry is an accounting practice used to modify the financial records of a business. It is a crucial element of the bookkeeping process as it ensures that all transactions are accurately recorded and all accounts are up-to-date. Adjusting journal entries may be made to correct errors, adjust for depreciation, or to record accrued expenses and revenues. At the end of the accounting period, adjusting journal entries are made to ensure the financial statements are accurate and reflect the true financial position of the business. This article will explain the purpose of adjusting journal entries and the various types of adjusting entries used in bookkeeping.

Understanding the Basics of Adjusting Journal Entries

Adjusting journal entries are important for keeping your books accurate and up-to-date. Adjusting journal entries are used to make sure that your books reflect the current state of your finances. Adjusting entries are used to record transactions that have occurred since the last accounting period ended. This is especially important when it comes to recording depreciation expenses, accruing income, and making sure that your financial statements reflect the most current information. Adjusting journal entries are also used to correct errors that may have been made in previous accounting periods. By keeping your adjusting journal entries up-to-date, you can ensure that your books accurately reflect the financial situation of your business.

Examples of Adjusting Journal Entries

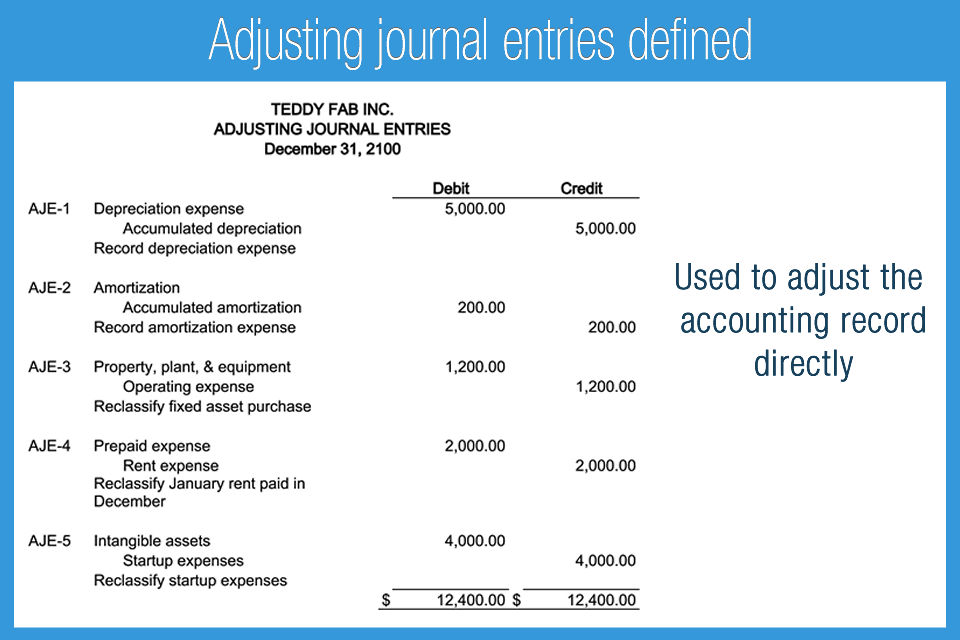

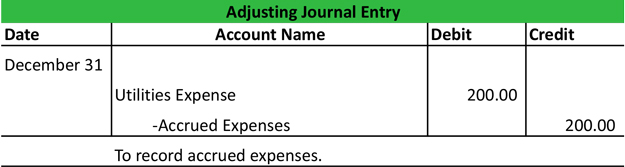

Adjusting journal entries are entries made at the end of an accounting period to ensure that the financial statements accurately reflect the transactions that have occurred during the period. Examples of adjusting journal entries include the reversal of accruals, the recognition of depreciation, and the recognition of revenue or expenses that were previously recorded in a different period. Adjusting journal entries are important to ensure that the financial statements accurately reflect the true financial status of the business. They can also help to reduce the amount of taxes owed, as some adjustments are tax deductible. Adjusting journal entries are an important part of any accounting system, and they should be reviewed regularly to ensure accuracy.

Benefits of Adjusting Journal Entries

Adjusting journal entries are an important part of keeping your financial records up-to-date. Adjusting entries are used to record any changes to an account that have taken place since the last accounting period. These entries provide an accurate summary of your financial status for the current period, and help you to make informed decisions about the future of your business. One of the major benefits of adjusting journal entries is that they help you to save time and money. By adjusting your financial records regularly, you can quickly and accurately make decisions about how to best use your resources. Moreover, adjusting entries allow you to identify any errors or discrepancies in your accounts, so that you can take steps to correct them. Additionally, adjusting entries can help you to identify trends in your business, so that you can make informed decisions about where to invest or how to improve your operations. Adjusting journal entries are an important part of ensuring accurate and up-to-date financial records, and can help you to save time, money, and make informed decisions.

How to Execute an Adjusting Journal Entry

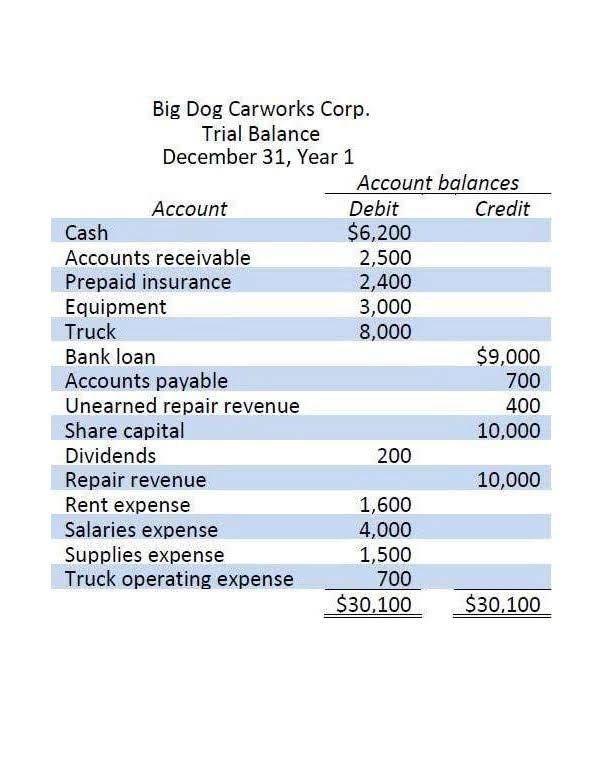

Adjusting journal entries are used to make sure your financial records are up to date and accurate. Adjusting journal entries are used to adjust the accounts in the general ledger to reflect the correct balances. They are usually made at the end of the accounting period to ensure that all transactions are recorded correctly and to update the accounts to the correct balances. To execute an adjusting journal entry, you need to identify the accounts that need adjusting and the amounts to be adjusted. Once you have determined this, you can make the entry in your accounting system. Be sure to include the date and the reason for the adjustment as well as the amount being adjusted. Adjusting journal entries are important for staying organized and keeping your financial records accurate.

Tips for Avoiding Plagiarism When Writing About Adjusting Journal Entries

It’s important to remember the importance of avoiding plagiarism when writing about adjusting journal entries. Plagiarism is an act of stealing someone else’s work and passing it off as your own. It can have serious consequences and can damage your reputation and credibility. To avoid plagiarism, make sure to give credit where credit is due, properly cite any sources you use, and use your own words to explain the concepts. When in doubt, it’s best to double-check and make sure you are not unintentionally plagiarizing someone else’s work. Being aware of the implications of plagiarism can help ensure that you stay on the right side of the law and write with integrity.