If you’re looking for a truly unique experience, Cuba is a must-see. With its stunning landscapes, vibrant culture, and rich history, Cuba has something to offer every traveler. Whether you’re looking to explore the bustling streets of Havana or take a relaxing beach vacation, there are plenty of amazing cities to discover in Cuba. From the lush valley of Viñales to the colonial-style streets of Trinidad, these are some of the best cities to see in Cuba.

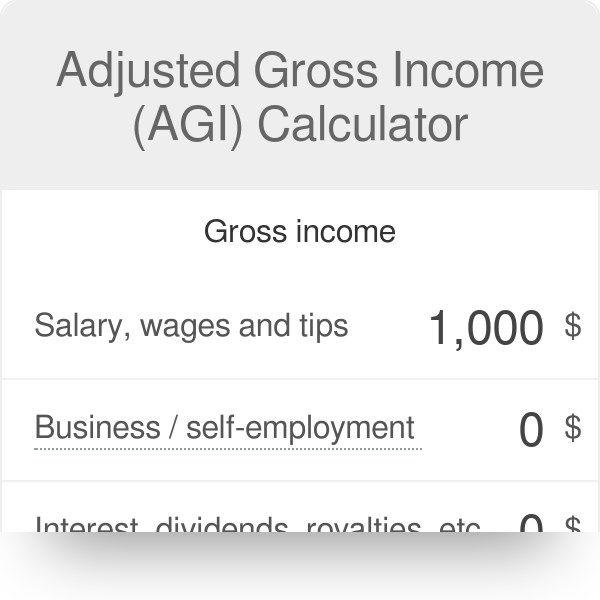

Understanding the Basics of Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) is an important number on your taxes because it helps the IRS determine how much of your income is taxable. AGI is calculated by taking your gross income, subtracting certain adjustments and deductions, and then adding back some deductions. It’s important to understand what can be deducted from your gross income and what must be added back in to arrive at your AGI. Knowing your AGI is important because it helps you to determine whether you can take advantage of certain tax deductions and credits. It also helps you to prepare for the tax season by giving you an idea of what your total tax bill might be. Understanding the basics of AGI is key for ensuring that you get the most out of your taxes.

Establishing Your Adjusted Gross Income (AGI)

When it comes to determining your Adjusted Gross Income (AGI), it’s important to first gather all of your financial information. This can include income from any jobs you hold, investments, and other sources. Once you’ve gathered all of your financial information, you can then subtract any deductions and credits you may be eligible for. These can include deductions like student loan interest, alimony payments, and IRA contributions. Once you’ve subtracted all of the deductions you’re eligible for, the amount you’re left with is your Adjusted Gross Income (AGI). It’s important to remember that your AGI is a key part of figuring out how much money you’ll owe in taxes. So make sure to take the time to accurately calculate your AGI and any deductions or credits you may be eligible for.

How Adjusted Gross Income (AGI) Can Impact Your Taxes

.When it comes to understanding how your Adjusted Gross Income (AGI) can impact your taxes, it’s important to know that it’s used to calculate your taxable income. AGI is the amount of money you earn in a year before deductions, such as 401(k) contributions and tax credits, are taken into account. It’s important to remember that the higher your AGI is, the more taxes you’ll have to pay. The good news is that there are ways to reduce your AGI and thus your tax burden. You can do this by contributing to a retirement plan, such as a 401(k), or by taking advantage of certain tax credits. Knowing your AGI can help you make informed decisions about how to save on taxes and maximize your financial situation.

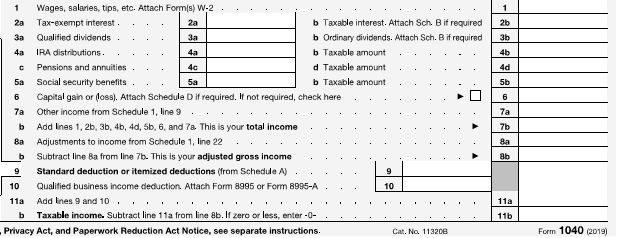

Calculating Your Adjusted Gross Income (AGI)

Calculating your Adjusted Gross Income (AGI) is an important step in filing your taxes. Your AGI is the total of your income minus certain deductions that are allowed by the IRS. This includes deductions for student loan interest, moving expenses, self-employment taxes, alimony payments, and other items. To calculate your AGI, start by gathering all of your income sources, such as wages, investments, rental income, and so on. Then, subtract any applicable deductions from your total income. Finally, add any other applicable adjustments, such as the foreign earned income exclusion or the deduction for one-half of self-employment taxes. Once you have your AGI, you can use it to complete your tax return and figure out how much money you owe or how much you will be getting back. Knowing your AGI is a key factor in understanding how much money you owe the IRS, so it’s important to make sure you calculate it correctly.

Ways to Reduce Your Adjusted Gross Income (AGI)

If you’re trying to minimize your tax bill, cutting your Adjusted Gross Income (AGI) can be a great way to do it. Reducing your AGI decreases the amount of taxable income you report and therefore reduces the amount of taxes you owe. Here are a few strategies you can use to reduce your AGI and lower your tax bill. First, you can contribute to a qualified retirement plan, such as a 401(k) or IRA. These contributions reduce your AGI and can also give you a tax break at the same time. Another option is to increase your itemized deductions. This can include things like charitable donations, medical expenses, mortgage interest, and more. You can also take advantage of tax credits, such as the Earned Income Tax Credit, which can reduce your taxable income and therefore your AGI. Finally, you can look into other tax-advantaged investment accounts, such as a Health Savings Account (HSA) or 529 College Savings Plan, which can help decrease your AGI. By reducing your AGI, you can save money on taxes and make sure you don’t pay more than you have to. All of the strategies mentioned above can help you accomplish this goal and make sure you get the