Adjustable-Rate Mortgages, commonly known as ARMs, are a popular home loan option for many homebuyers. ARMs offer borrowers the opportunity to secure a low interest rate for the initial years of their mortgage and then have the option to adjust the rate as market conditions change. This type of mortgage can be a great way to save money and reduce your monthly payments, but it’s important to understand the risks before you sign on the dotted line. In this article, we’ll dive into the specifics of adjustable-rate mortgages, explaining how they work, the pros and cons, and how to determine if an ARM is the right choice for you.

What Are the Basics of an Adjustable-Rate Mortgage (ARM)?

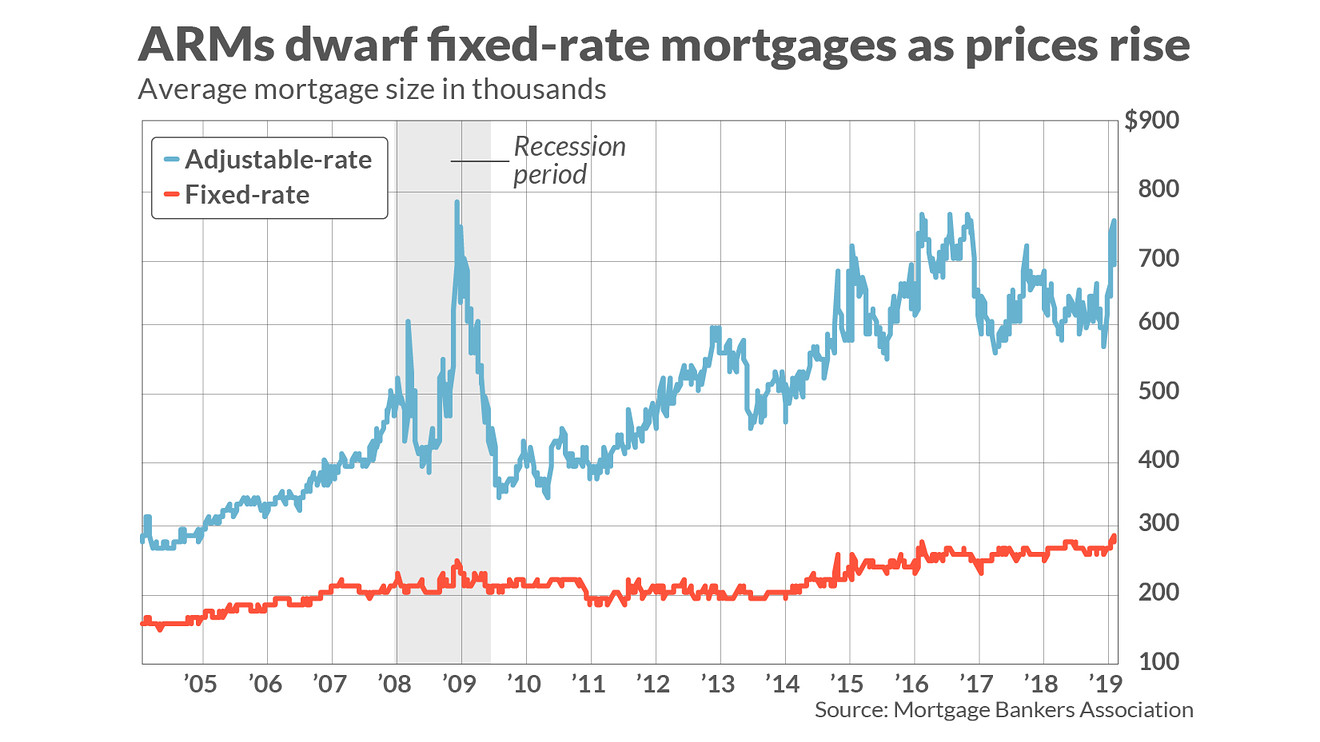

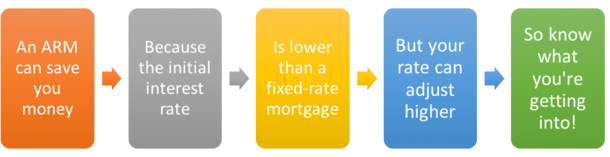

An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate changes over time. This type of loan is a great option for those who are looking to save money in the long run. With an ARM, the interest rate is lower at the beginning of the loan, but it can fluctuate over time depending on the market. This type of loan is perfect for those who expect their income to increase over time, as the rate can adjust based on the market. ARMs are a great option for those who are looking for a lower rate and the potential for savings in the long run.

What Are the Advantages and Disadvantages of an Adjustable-Rate Mortgage?

.Adjustable-Rate Mortgages (ARMs) offer a lot of flexibility and can be a great choice for those looking to save money on their mortgage. The main advantage of an ARM is that it offers the potential for lower interest rates in the short-term. This can be especially beneficial for those who plan on staying in their homes for a short period of time. On the flip side, the main disadvantage of an ARM is that interest rates are subject to change over time. This means that if interest rates rise, borrowers may find themselves paying more than they initially planned on. Additionally, ARMs may not be suitable for those looking to stay in their homes for the long-term, as the interest rate could rise beyond what they can afford. So, before making the decision to go with an ARM, it’s important to weigh the pros and cons to ensure it is the best option for your financial situation.

How Can I Determine if an Adjustable-Rate Mortgage Is Right for Me?

When it comes to determining if an adjustable-rate mortgage (ARM) is the right decision for you, it’s important to do your research and consider all of your options. Ask yourself the following questions: Do I plan on staying in my home for the long-term? Can I afford the potential increase in payment that could occur after the initial fixed-term? Am I comfortable with the risk of an ARM? Taking the time to think through these questions can help you decide if an ARM is the right fit for your current financial situation. After all, no one knows your situation better than you do, so it’s important to make sure you’re making the right decision for your future.

What Are the Different Types of Adjustable-Rate Mortgages?

When it comes to ARMs, there are several different types of adjustable-rate mortgages to choose from. Depending on your financial needs and goals, you’ll want to make sure you understand the different options and how they can fit into your plan. The most common types of ARMs are the 5/1, 7/1 and 10/1 ARMs. A 5/1 ARM has a fixed interest rate for five years and then adjusts every year after that. A 7/1 ARM has a fixed interest rate for seven years and then adjusts annually after that. A 10/1 ARM has a fixed interest rate for ten years and then adjusts annually after that. Depending on the length of the fixed-rate period, the interest rate on these mortgages can vary greatly. Understanding the different types of ARMs and how they work can help you make the best decision for your individual situation.

How Can I Secure the Best Possible Rate on an Adjustable-Rate Mortgage?

Securing the best possible rate on an adjustable-rate mortgage (ARM) is possible with a little research and planning. Shopping around for lenders and comparing rates and terms can help you find the best deal available. Additionally, it’s important to have a good credit score, as this will determine the interest rate you can get. It’s also a good idea to have a large down payment when applying for an ARM, since this will lower your principal balance and potentially reduce the interest rate. Finally, if you have a history of making on-time payments, this will help you secure a competitive rate. With a little bit of effort, you can find an ARM that meets your financial needs while helping you save money in the long run.