The Adjusted Closing Price is a key metric used to measure the performance of stocks and other investments. It is calculated by taking the closing price on a given day and adjusting it for any corporate actions, such as dividends, stock splits, and rights issues, that have occurred since the previous closing price. This metric is important for investors to understand and track, as it provides a more accurate representation of the stock’s performance than the unadjusted closing price. In this article, we will explain what the Adjusted Closing Price is and how it is used.

What is an Adjusted Closing Price?

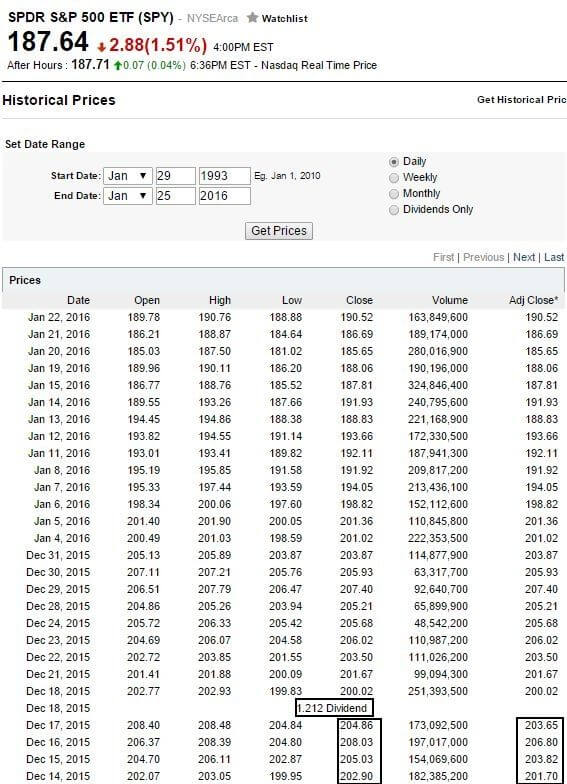

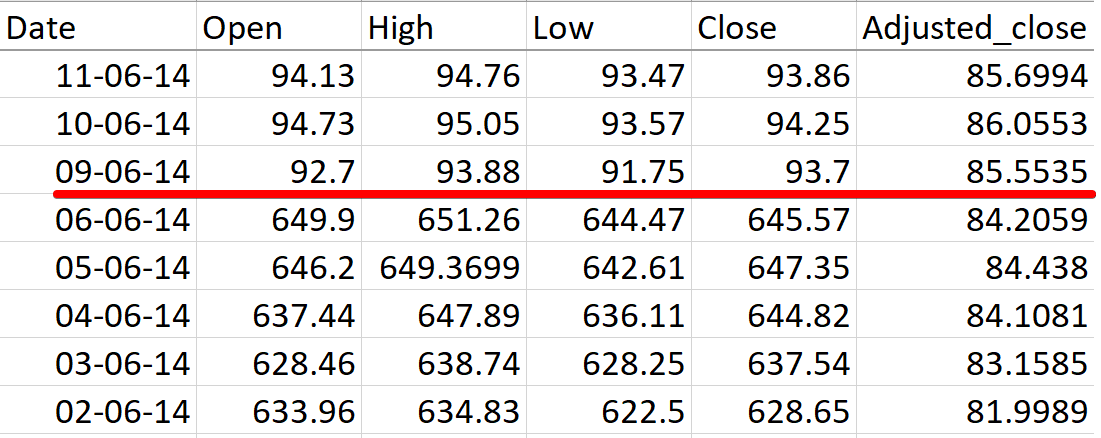

An adjusted closing price is a stock’s closing price that has been modified to account for corporate events that occurred after the market closed, such as splits and dividends. This price is important for investors who want an accurate picture of the stock’s price history for performance tracking or comparison between stocks. An adjusted closing price can be calculated by taking the stock’s closing price at the end of the trading day and then adjusting it for any corporate events that occurred after the market closed. This adjustment can be made by adding the value of any splits or dividends to the original closing price. This provides investors with an adjusted closing price that accurately reflects the stock’s price history and performance. By using an adjusted closing price, investors can make sound decisions and accurately compare stocks and their performance.

How to Calculate Adjusted Closing Price

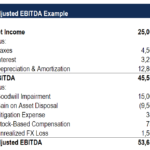

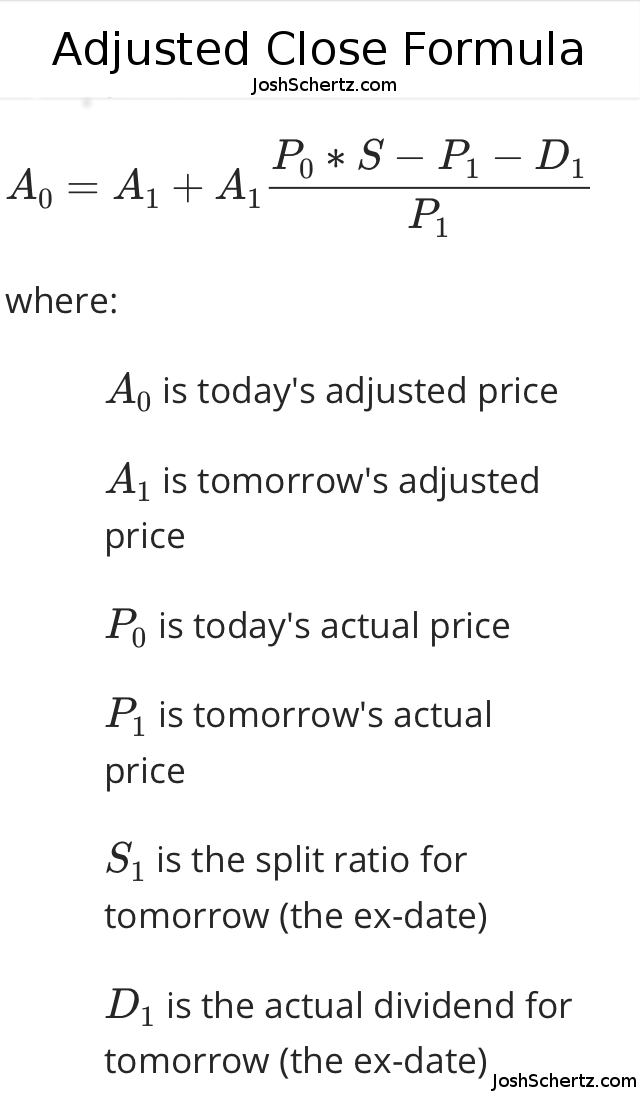

Calculating adjusted closing price is a great way to get an accurate idea of how a company’s stock is performing. By taking into account factors like stock splits, dividends, and other corporate actions, investors can get a more realistic idea of how their stock is performing. To calculate adjusted closing price, start by taking the closing price of the stock on the day of the action. Then, divide the closing price by the number of shares affected by the action. This calculation will give you the adjusted closing price. Once you have this number, you can compare it to the closing price of the stock before the action to get a better understanding of how the stock is performing. With this information, investors can make more informed decisions about investing in a company’s stock.

Benefits of Using Adjusted Closing Price

Using adjusted closing price is a great way to accurately compare prices of stocks over time. By taking into account stock splits, dividends, new equity issues, and other factors, adjusted closing prices make it possible to accurately evaluate the performance of stocks over a certain period of time. This can be incredibly useful for investors who want to gain a better understanding of their investments and determine their strategy for the future. Additionally, adjusted closing prices can be used to compare the performance of different stocks to each other, allowing investors to make more informed decisions when selecting which stocks to invest in. All in all, adjusted closing prices are an incredibly useful tool for investors who want to maximize their returns and make more informed decisions.

Risks Associated with Adjusted Closing Price

When it comes to investing, understanding the risks associated with adjusted closing price (ACP) is essential. ACP is a stock’s closing price that has been adjusted for factors such as dividend payments, splits, and other corporate actions. While ACP may be helpful for tracking a stock’s performance, it also carries some risks. For example, ACP doesn’t take into account the value of the stock from the moment it opens to the moment it closes, so investors may miss out on potential gains or losses in between. Additionally, ACP may not accurately reflect the stock’s actual value as prices may be artificially inflated or deflated due to certain corporate actions. As such, it’s important to understand the risks associated with ACP and to use other indicators when evaluating a stock’s performance.

Strategies for Maximizing Returns with Adjusted Closing Price

Maximizing returns on investments can be tricky, but using an adjusted closing price can help. By taking into account splits, dividends, and other corporate actions, an adjusted closing price gives investors a more accurate view of stock performance. This can help investors make more informed decisions about when to buy and sell. By understanding the concept of an adjusted closing price, investors can better analyze stock performance, which can lead to bigger returns. Utilizing an adjusted closing price can be a great way to boost returns on investments, so it’s important to have a sound understanding of the concept. With practice and research, investors can become better at recognizing the signals that indicate when to buy or sell their stocks. Doing so can result in better returns on their investments and help them reach their financial goals.