Adjustable life insurance is a type of permanent life insurance that allows the policyholder to adjust their death benefit and premium payments over time. It can be an excellent choice for people who want to protect their family in the long-term, while also having the flexibility to make changes as their life and financial needs evolve. With adjustable life insurance, policyholders can increase or decrease their coverage, adjust the premiums they pay, or even alter the investment component of their policy. This guide will explain what adjustable life insurance is and how it works, so you can make an informed decision about whether it’s the right life insurance policy for you.

What Are The Benefits of Adjustable Life Insurance?

Adjustable life insurance is an amazing product that offers you a lot of flexibility when it comes to your life insurance policy. It offers many benefits that you won’t find with other types of life insurance. One of the biggest benefits of adjustable life insurance is that it gives you the ability to adjust your death benefit as your needs and financial situation changes. This means that you can adjust the amount of coverage you have without having to purchase a new policy. It also allows you to adjust the premiums you pay, giving you more control over the cost of your coverage. Additionally, adjustable life insurance offers the opportunity to build cash value, which gives you access to more funds in the future. Finally, adjustable life insurance can also provide tax benefits, so it is worth considering for those looking for a flexible and cost-effective life insurance option.

What Types of Adjustable Life Insurance Are Available?

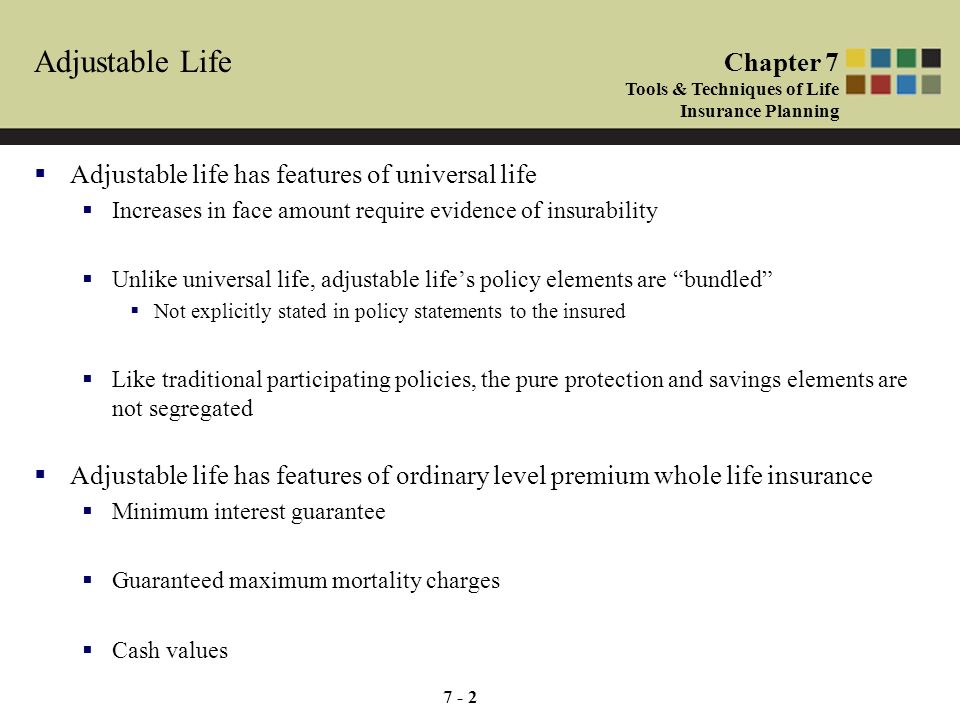

If you’re looking for an insurance policy that will provide you with the flexibility to adjust your coverage as your life changes, adjustable life insurance may be the right choice for you. This type of policy provides a number of options that can be tailored to fit your individual needs. There are two main types of adjustable life insurance available: Whole Life and Universal Life. Whole Life policies provide a permanent life insurance policy that can be adjusted to fit your changing needs. Universal Life policies provide adjustable death benefit amounts, premiums, and cash values that can be changed to fit your changing needs. Both types of policies provide a variety of benefits that can help you and your family stay secure in the event of unexpected life events.

How Can Adjustable Life Insurance Help You Achieve Financial Security?

Adjustable life insurance can provide you with the financial security you need in the future. It provides a death benefit to your beneficiaries if you pass away and can also provide a cash value component that can be used to help you achieve your financial goals. The cash value component can be adjusted to meet your needs over time and the death benefit can be changed as well. With adjustable life insurance, you have the flexibility to adjust the policy to fit your needs. This can help you protect your loved ones and can also help you achieve financial security in the future. With adjustable life insurance, you can rest assured that your family will be taken care of if something were to happen to you.

Are There Any Risks Involved With Adjustable Life Insurance?

When it comes to adjustable life insurance, there are some risks involved. The policyholder has to be aware of the risks associated with investing in a variable life insurance policy. The biggest risk is that the policyholder could lose money if their investments perform poorly. Additionally, the policyholder needs to be aware of any fees and expenses associated with the policy, including the cost of insurance and any surrender fees. Finally, the policyholder needs to be aware of any tax implications associated with the policy. It is important to understand all the risks before investing in adjustable life insurance.

What Should You Consider Before Choosing Adjustable Life Insurance?

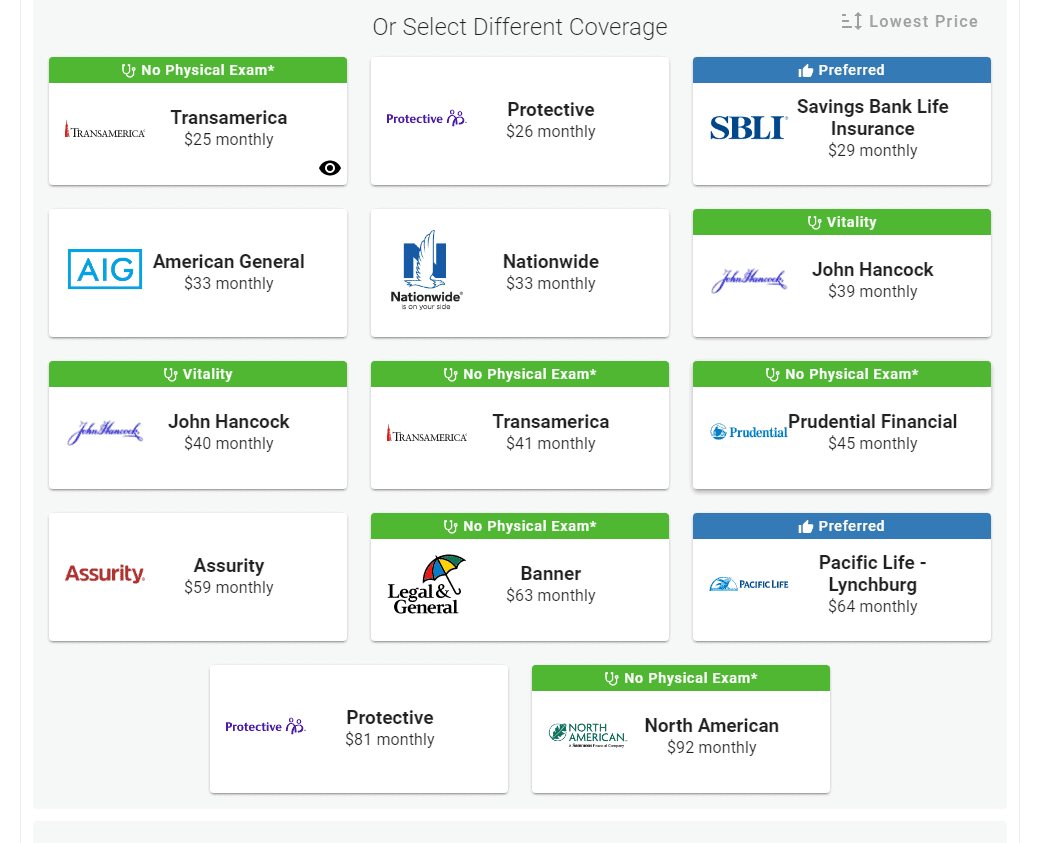

If you’re looking for a life insurance policy with more flexibility, adjustable life insurance might be right for you. Before you decide to go with this kind of policy, there are a few things you should consider. Firstly, adjustable life insurance is more expensive than a regular policy. This is because you have the option to change the death benefit and the length of the policy. Secondly, you should make sure you understand the risks associated with adjustable life insurance. If you don’t pay close attention to the terms of your policy, you could end up owing more money than you expected. Lastly, you should make sure you have the financial resources to cover your policy. Adjustable life insurance requires a higher premium than regular life insurance, and if you don’t have the funds to cover it, you may not be able to keep your policy. If you’re looking for a life insurance policy with more flexibility and want to make sure you get the most out of it, considering adjustable life insurance may be worth your while.