Are you a parent looking for a way to get some extra money for your family? The Additional Child Tax Credit (ACTC) is a great way to help you get the financial relief you need. This credit is available to those with children who qualify, and can provide additional funds to help cover the costs of raising a family. In this article, we will explain what the Additional Child Tax Credit is, who qualifies, and how to apply for it. We will also discuss the various rules and restrictions that you should be aware of when considering applying for the credit. With this information, you can make an informed decision about whether the ACTC is right for you and your family.

Understanding the Details of Additional Child Tax Credit

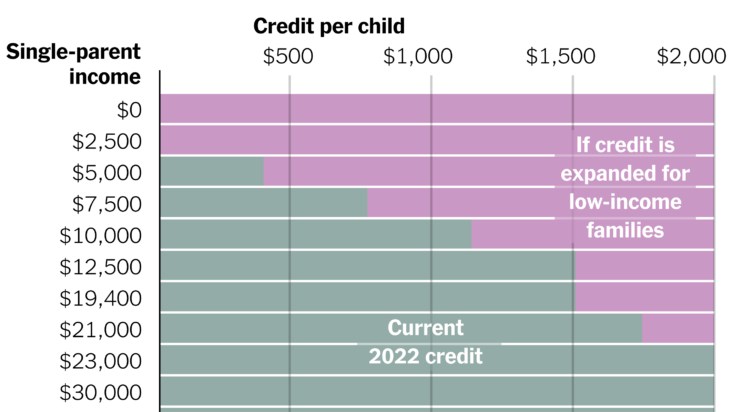

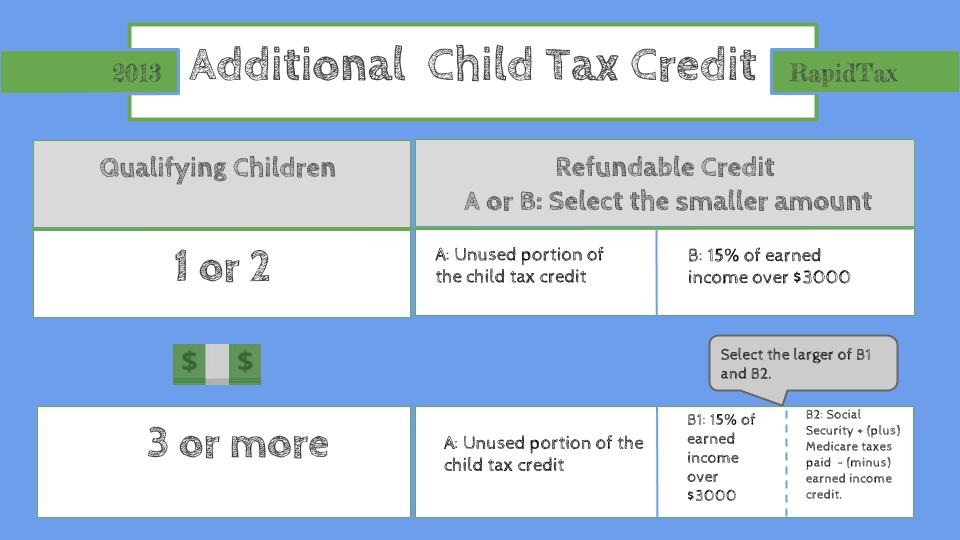

itThe Additional Child Tax Credit is a great way to get some extra money if you have children. It’s a refundable tax credit, which means even if you don’t owe any taxes, you can still get the money. To qualify, your adjusted gross income must be under a certain limit, and you must have dependents who are under the age of 17. You also must have at least $3,000 in earned income to qualify. The best part is that you can get up to $1,400 per qualifying child, which can really make a difference if you have multiple children. So if you’re looking to get some money back during tax season, make sure you check if you qualify for the Additional Child Tax Credit.

What You Need to Know About Eligibility Requirements

If you’re the parent or guardian of a dependent child, you may be eligible for the Additional Child Tax Credit (ACTC). This credit can help you get a refund if you’ve paid more in taxes than you owe, even if you don’t owe any taxes at all. To be eligible for the ACTC, you must meet certain requirements. You must be the parent or guardian of a dependent child under the age of 17, and you must have earned income during the tax year. Your total income must be less than the amount allowed for the credit, and you must have a valid Social Security Number for yourself and your dependents. You also need to have paid federal income taxes, either through withholding or estimated tax payments. If you meet all of these requirements, you may be eligible for the ACTC, which can help you get a refund for the taxes you’ve paid.

Maximizing Your Additional Child Tax Credit Benefits

Maximizing your Additional Child Tax Credit benefits can help you get the most out of your money. There are several ways to go about increasing your return. First, you need to make sure that you are eligible for the credit. You must have earned income and have a qualifying child to be eligible. Additionally, you need to make sure that your AGI is below the threshold. If your AGI is too high, you may be unable to claim the credit. Once you have established your eligibility, you can start exploring other options to maximize your return. A great way to do this is to take advantage of the Earned Income Tax Credit and the Child Tax Credit. Both credits offer a way to reduce your adjusted gross income and increase your refund. Additionally, you can look into other deductions such as medical expenses or charitable donations to get the most out of your credit. Lastly, make sure to file your taxes as early as possible to ensure your refund is processed faster. Taking advantage of all these options can help you get the most out of your Additional Child Tax Credit benefits.

What If Your Additional Child Tax Credit Is Rejected?

If your Additional Child Tax Credit gets rejected, don’t panic! It’s not the end of the world. The IRS will usually send you a CP-22A form explaining why your claim was rejected, as well as instructions on how to fix the issue. The most common reasons for rejections are filing status errors, incorrect Social Security numbers, and income discrepancies. To fix any of these issues, you’ll need to make sure that all of your information is accurate and up to date. You may also need to provide additional documentation to support your claim. Once the issue is resolved, the IRS will process your claim and you’ll get your credit in no time. So don’t worry if your Additional Child Tax Credit is rejected, just take the steps to fix the issue and you’ll be on your way to getting the credit you deserve!

How to Avoid Common Mistakes When Claiming Additional Child Tax Credit

When claiming the Additional Child Tax Credit, it’s important to be aware of some common mistakes that could cost you money. One important thing to remember is that the Additional Child Tax Credit is a refundable credit, so if you don’t have enough tax liability to receive the full refund, you may still qualify for a refund of a portion of the credit. It’s also important to make sure the information you provide is accurate and complete. Inaccurate or incomplete information can lead to delays in processing or even a denial of the credit. Lastly, it’s important to keep track of all documents related to your claim. Keeping records of your claim can help ensure you get the credit you deserve.