Are you looking for a way to make the most of your investments? Add-on interest is an effective financial strategy that can help you maximize returns while minimizing risk. Add-on interest is a relatively simple concept that has been used by savvy investors for decades to increase their portfolios. In this article, we’ll discuss what add-on interest is, how it works, and how it can help you build a stronger financial future.

What Is Add-On Interest and How Does It Work?

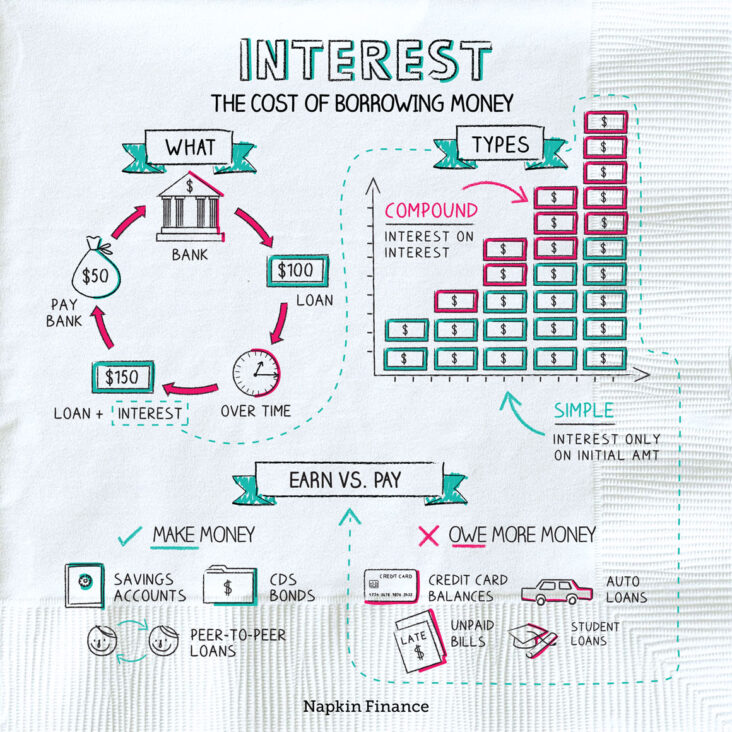

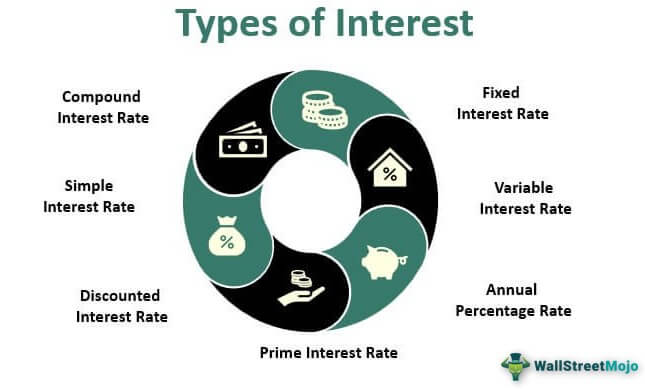

Add-On Interest is an interest rate that is added onto the principal amount of a loan and calculated as part of the total loan repayment amount. This type of interest rate is often used for short-term loans, such as payday loans. How does it work? When you borrow money with an add-on interest loan, the interest rate is added to the principal amount of the loan and the total loan repayment amount is then calculated with this added cost. This means that you will be paying more than the original principal amount of the loan. For example, if you borrow $1000 with an add-on interest rate of 5%, your total loan repayment amount would be $1050. The extra $50 is the add-on interest rate that has been added onto the principal amount. This type of interest rate can be beneficial for borrowers, as it allows for faster repayment of the loan with a lower amount of interest due.

Understanding Add-On Interest Calculations

.Understanding add-on interest calculations can seem like a daunting task, but it doesn’t have to be! Add-on interest is a type of loan interest calculation where the interest accrues on the original loan amount, plus any unpaid interest that has previously accrued. It’s important to understand how this works in order to accurately calculate your total loan costs. To do this, you’ll need to know the interest rate, how often the interest rate is applied, and the number of payments you’ll be making. With this information, you can determine the amount of interest that will be added on to the total loan amount. Add-on interest can be especially beneficial in situations where your loan will be paid off early, as it allows you to pay the interest that has accumulated so far instead of the entire loan amount. Knowing how add-on interest works and how to calculate it can help you make better informed decisions when it comes to taking out a loan.

Risks Associated With Add-On Interest

Add-on interest can be a useful financial tool if used responsibly, but it also has its risks. It’s important to be aware of the potential downside before committing to an add-on interest loan. One risk is that while it may enable you to pay off your loan faster, if you don’t make the minimum monthly payments, you could end up paying more in interest over the life of the loan. Additionally, you may have to pay a fee to have the add-on interest added to your loan, which could increase your overall cost. Lastly, the add-on interest rate is often higher than the standard rate, so if you don’t pay off the loan within the predetermined period, you may end up paying more than you originally anticipated. If you’re considering taking out an add-on interest loan, it’s important to evaluate the risks and ensure that it is the right financial decision for you.

Advantages and Disadvantages of Add-On Interest

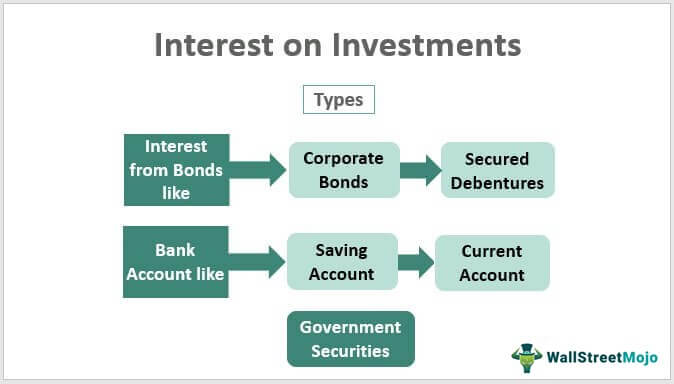

Add-on interest is a method of calculating interest charges on a loan or other type of credit. With this method, the interest charges are added to the total loan balance, and the borrower pays interest on the entire loan balance during the life of the loan. This method of interest calculation can be advantageous for the borrower in certain circumstances. For instance, if the borrower has a large loan balance, the interest rate may be lower than if interest is calculated separately on each payment. This can help the borrower reduce their overall interest costs. Additionally, add-on interest can be beneficial for lenders as it allows them to collect a larger amount of interest over the life of the loan.However, there are also some drawbacks to using add-on interest. One of the main drawbacks is that the borrower is paying interest on the original loan balance as well as the interest charges, resulting in a higher overall interest cost. Additionally, the borrower may not be able to pay off the loan sooner, even with additional payments, as the loan balance remains the same. For these reasons, add-on interest is not always the best choice for borrowers.

How to Avoid Plagiarism When Writing About Add-On Interest

If you’re writing about add-on interest, it’s important to keep plagiarism out of the equation. Plagiarism is a serious offense and can lead to serious consequences. To avoid it when writing about add-on interest, make sure that you always cite where you got your information from and quote anything that you didn’t write yourself. If you’re in doubt, it’s always best to err on the side of caution and cite the source. Additionally, consider paraphrasing the material you’re discussing. This way, you can keep the same message without using the same words. Writing about add-on interest doesn’t have to be a difficult task. By making sure you avoid plagiarism and properly cite your sources, you can stay on the right side of the law.