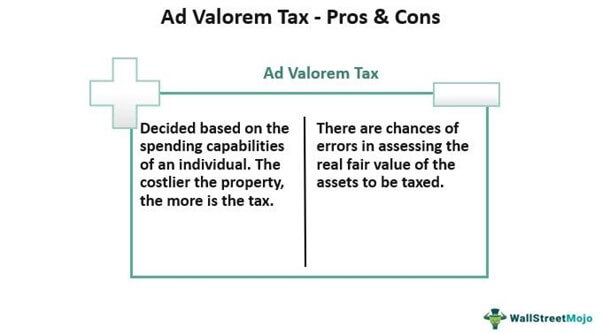

Ad Valorem Tax is a type of tax imposed on the value of an item. It is calculated as a percentage of the value of the item or property, and is usually used to fund public services. Ad Valorem Tax is an important source of revenue for many governments, used to fund vital public services such as schools, roads and public safety. It is also used by local governments to fund services like libraries, parks, and other public works. With an understanding of how Ad Valorem Tax works and how it affects you, you can make decisions that are financially beneficial for yourself and your community.

Understanding Ad Valorem Tax – Key Definitions and Concepts

Ad valorem tax is a type of tax assessed based on the value of a person’s property. It is usually applied to real estate and personal property, but can also be charged on other items such as vehicles. This type of tax is usually calculated as a percentage of the assessed value of the property and is often used as a way for local governments to collect revenue. Ad valorem tax is also known as a property tax, and is usually paid annually. It is important for property owners to understand how their property is assessed and the rate of ad valorem tax they are required to pay. It is also important to remember that the rate of ad valorem tax can change depending on where you live and the type of property that is being taxed. Understanding ad valorem tax can help you make informed decisions when it comes to managing your property and making sure that you are paying the right amount in taxes.

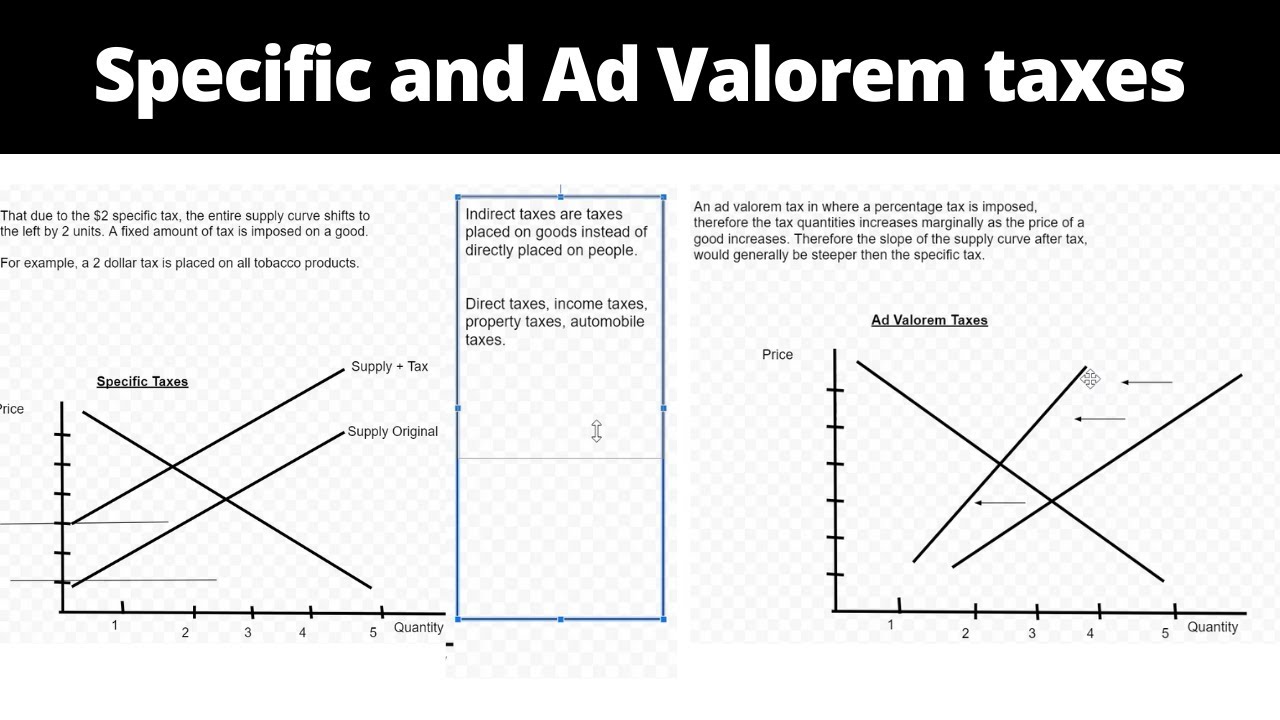

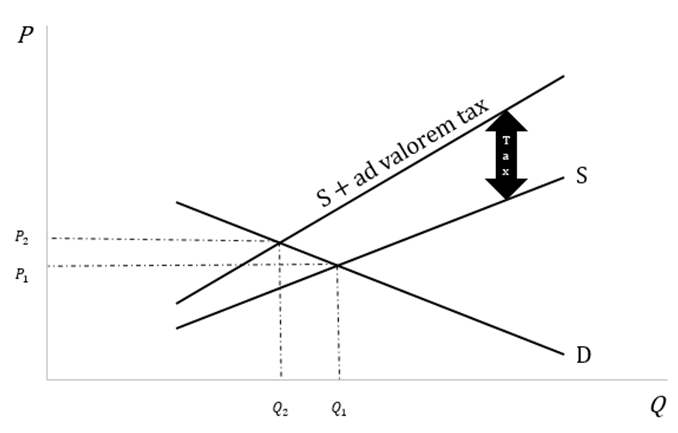

How Does Ad Valorem Tax Work? – Explaining the Basics

Ad valorem tax is a type of tax based on the value of a property or purchase. It’s usually a tax that’s charged on items that are bought or sold and can be used to fund local services or public works. When you make a purchase, the ad valorem tax is added to the price and then paid to the local government. This type of tax is an important part of many governments’ revenue and helps fund important public services like roads, education, and health care. Ad valorem taxes can also be used to fund special projects like parks and stadiums. Ad valorem taxes are a great way for governments to raise money and fund projects that benefit their citizens. They’re also a great way to help ensure that the cost of living is kept in check.

Determining Ad Valorem Tax Rates

Ad valorem tax rates can vary widely between different jurisdictions, but they are typically determined by assessing the value of a property or item and then taxing it at a certain percentage. In most cases, the rate is determined by the local government, but it can also be set by the state or federal government. In some cases, the rate may be based on the type of property being taxed, such as real estate or personal property. To determine the exact rate of an ad valorem tax, you’ll need to contact your local government or assessor’s office. They will be able to provide you with the current rate, as well as any applicable exemptions or deductions.

Impact of Ad Valorem Tax on Businesses

Ad Valorem tax can have a significant impact on businesses, especially small and medium-sized businesses. It affects the cost of goods and services, making it more expensive for businesses to stay competitive. Ad Valorem tax can also cause businesses to pass on the costs to the consumer, increasing prices and reducing the amount of money consumers have to spend. This can have a negative effect on businesses, as fewer people are likely to purchase their goods and services. Additionally, businesses are forced to pay a percentage of their profits to the government, resulting in reduced profits and less money to reinvest in the business. Ultimately, Ad Valorem tax can impact businesses in a variety of ways, making it important for businesses to carefully consider the impact it may have on their operations.

Strategies for Minimizing Ad Valorem Tax Liability

If you’re looking to minimize your ad valorem tax liability, there are a few strategies you can use. One of the best ways to minimize your ad valorem tax is to take advantage of any tax exemptions that you are eligible for, such as property tax exemptions for seniors, veterans, and disabled people. Additionally, you should make sure to keep all of your receipts for any property tax payments that you make. This will come in handy if you ever get audited and need to prove that you paid your taxes. You should also stay up-to-date on any changes in the local property tax laws, so you can take advantage of any new exemptions or deductions that may have been implemented. Finally, consider appealing your ad valorem tax assessment if you feel the amount you are being asked to pay is too high.