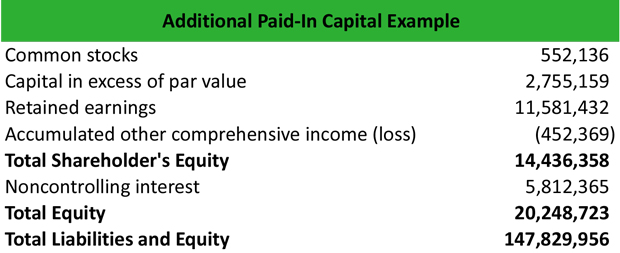

Additional Paid-In Capital is a type of equity capital that is raised by a company through the issuance of stock. It is the difference between the par value of the shares issued and the proceeds received from the sale of those shares. This type of capital is an important part of a company’s balance sheet and helps to show the true value of a company. Understanding Additional Paid-In Capital and its implications can help businesses make informed decisions and maximize their potential. In this article, we will explore what Additional Paid-In Capital is, how it works and why it is important.

What is Additional Paid-In Capital and How Does it Impact Your Business?

Additional paid-in capital is an important financial concept that any business should be aware of. It’s the amount of money that a company raises from issuing stock above its par value. In other words, it’s the difference between the price of a company’s stock and its actual value. This extra money is known as additional paid-in capital and can significantly impact a company’s financial standing. It can help a company gain access to additional capital and can be used to finance operations and investments. Additionally, it can be used to pay dividends to shareholders or to purchase additional shares of the company’s stock. By understanding the concept of additional paid-in capital, businesses can make better decisions about how to raise money and how to use it to their advantage.

Understanding Additional Paid-In Capital: A Closer Look

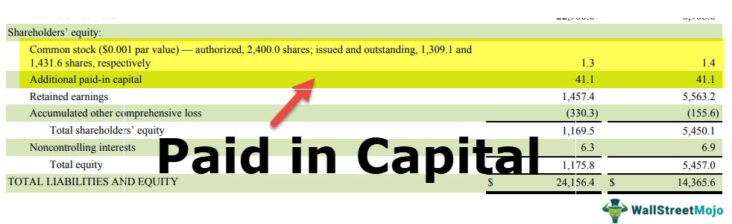

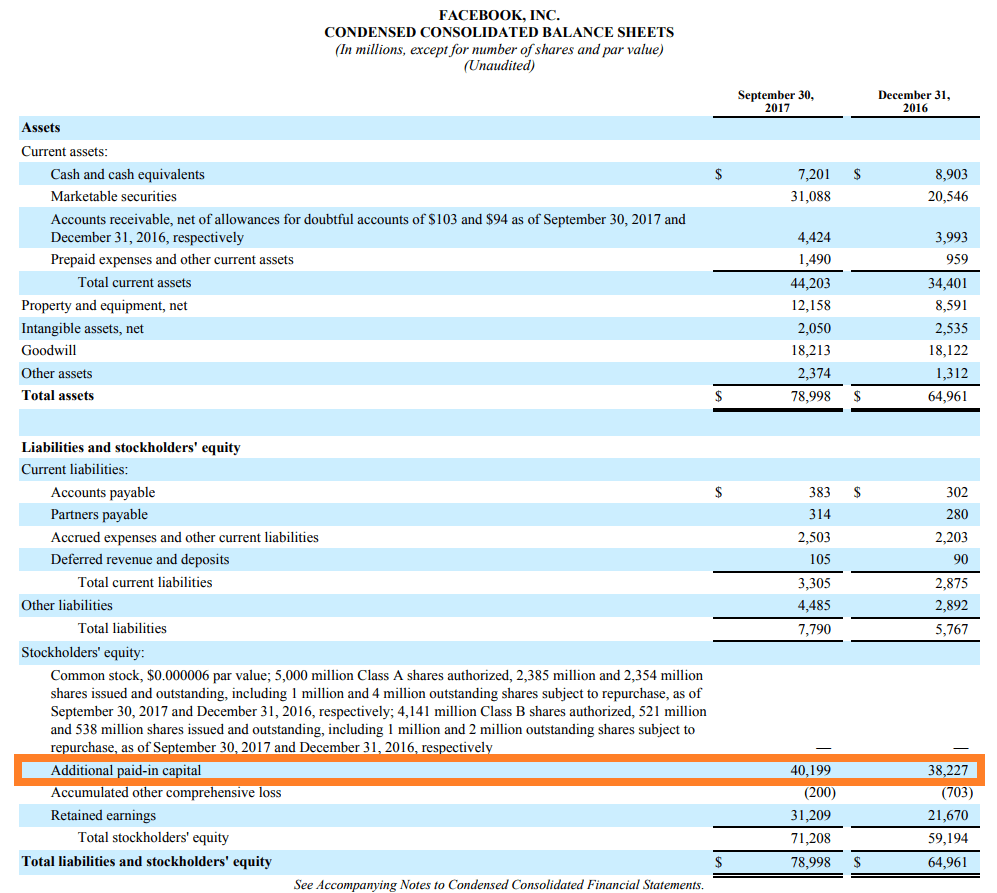

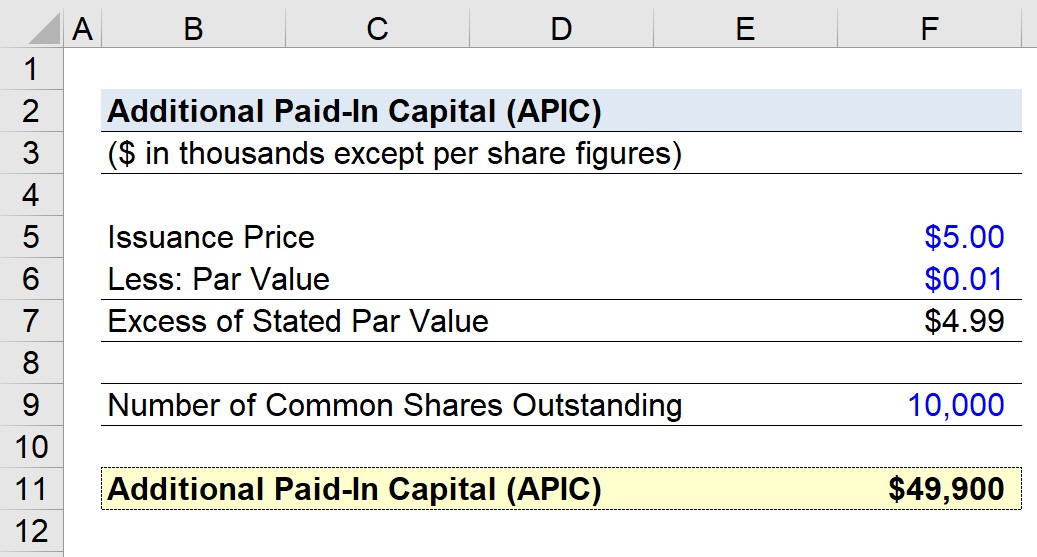

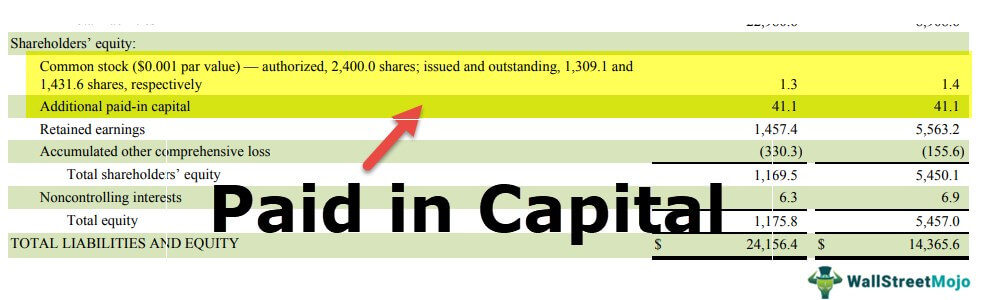

Additional Paid-In Capital (APIC) is a financial term that refers to the amount of money investors pay for stock in a company that is above the par value of the stock. This excess capital is then recorded in the company’s books as additional paid-in capital. APIC helps to measure the difference between the actual price of a stock and its par value. A company’s APIC is found on its balance sheet and is a useful tool for investors to gauge the financial health of a company. APIC is made up of money from shareholders, such as capital raised through stock sales, and any additional capital that is paid in, such as from acquired companies. Understanding APIC and its implications can help investors make more informed decisions about investing in a company. APIC can also be used to measure the company’s profitability since it shows the amount of money that was paid for stock, as well as any other capital that was injected into the company. By taking a closer look at a company’s APIC, investors can get a better understanding of the company’s finances, allowing them to make more informed decisions about their investments.

Exploring Additional Paid-In Capital: What You Need to Know

Exploring Additional Paid-In Capital is an important part of understanding your finances. It can be a great tool for helping you make financial decisions, whether it’s investing in stocks or taking out a loan. Additional Paid-In Capital (APIC) is a term used to describe the amount of money that is invested in a company beyond the amount of money initially invested. This can include investments from shareholders, debt financing, or other investments. It is typically found in the equity portion of a company’s balance sheet and is an important source of capital for a company. APIC is also a great way to measure a company’s financial health, as it shows how much additional capital has been infused into the company. If a company has a high APIC, it can be seen as a sign of financial strength, while a low APIC may be a sign of financial difficulty. Knowing the ins and outs of APIC can be a great way to help you make the right decisions when it comes to your finances.

What Are the Benefits of Additional Paid-In Capital?

Additional paid-in capital (APIC) is an important part of a company’s capital structure and can provide a number of benefits. One of the main advantages of APIC is that it can provide a cushion of protection, in that it can absorb losses if a company’s earnings and profits decline. This can be especially beneficial in times of economic downturns and other challenging market conditions. Additionally, APIC can provide a company with a source of funds for investments and other strategic initiatives. This can help a company to stay competitive and to take advantage of opportunities when they arise. Finally, APIC can be used to pay dividends to shareholders, which can provide them with a return on their investments. All in all, APIC can be an important asset for businesses of all sizes and can provide a number of benefits to the company, its shareholders, and its overall capital structure.

Additional Paid-In Capital: Tips to Maximize Your Investment

Maximizing your additional paid-in capital investment can be a great way to increase your profits. By understanding the different ways to use this form of capital, you can take advantage of the tax benefits and higher returns that it offers. Here are a few tips to help you maximize your additional paid-in capital: Research the different types of additional paid-in capital available, from common stock and preferred stock to convertible bonds and warrants. Make sure you understand the different tax implications and benefits associated with each option. Utilize stock buybacks to use your additional paid-in capital to its fullest potential. This can help to reduce the amount of outstanding shares, which can lead to a higher stock price. Consider issuing dividends to shareholders to reward them for their investment. This can help to attract more investors and create a positive reputation for your company. Finally, look into raising more capital through additional paid-in capital offerings. This can help to expand your business and provide more liquidity.