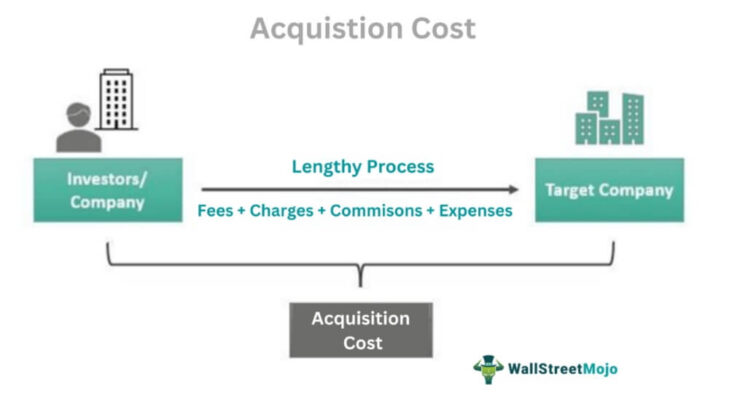

Acquisition cost is an important financial term that every business should understand. It refers to the total price of goods or services that a company purchases to use in its operations. It includes both the purchase price and the costs associated with the purchase, such as taxes, shipping, and installation. Knowing how to calculate acquisition cost is essential for businesses to manage their finances and make informed decisions about their investments. In this article, we will discuss what acquisition cost is, how it is calculated, and the potential benefits of knowing and understanding it.

Breaking Down the Components of Acquisition Cost

Acquisition cost is an important factor to consider when making business decisions. It’s the cost of acquiring an asset, such as a product, service, or property. It’s the total cost incurred when buying or acquiring something, and it includes direct costs like the purchase price, taxes, and other fees, plus indirect costs like the cost of research, installation, or training. Breaking down the components of acquisition cost is key to understanding the full cost of an asset or purchase. Components include the purchase price, any taxes or fees associated with the purchase, research and development costs, installation costs, and training costs. It’s important to take all these costs into account when calculating the total acquisition cost of an asset or purchase. Understanding these components can help businesses make informed decisions and better manage their acquisition costs.

Understanding the Impact of Acquisition Cost on Your Bottom Line

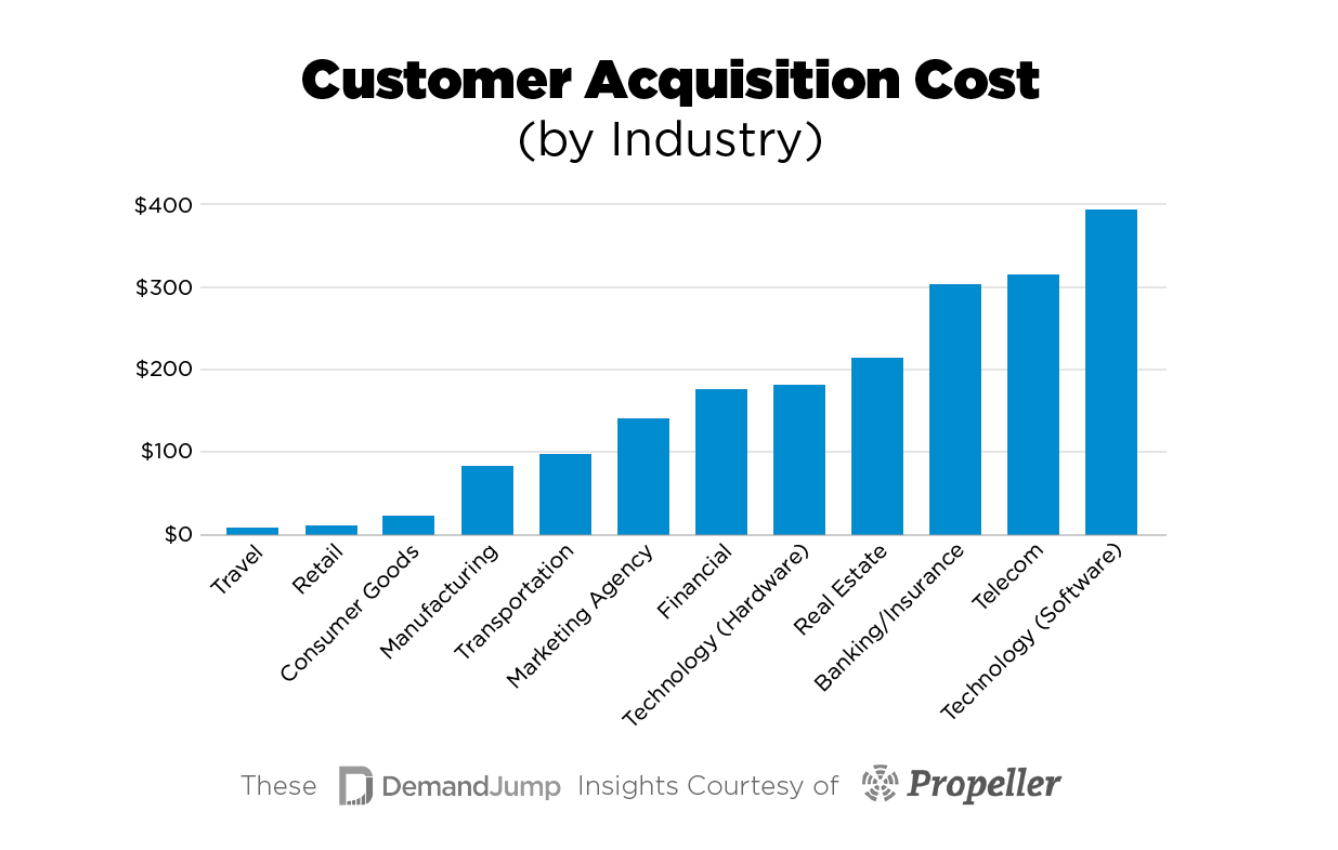

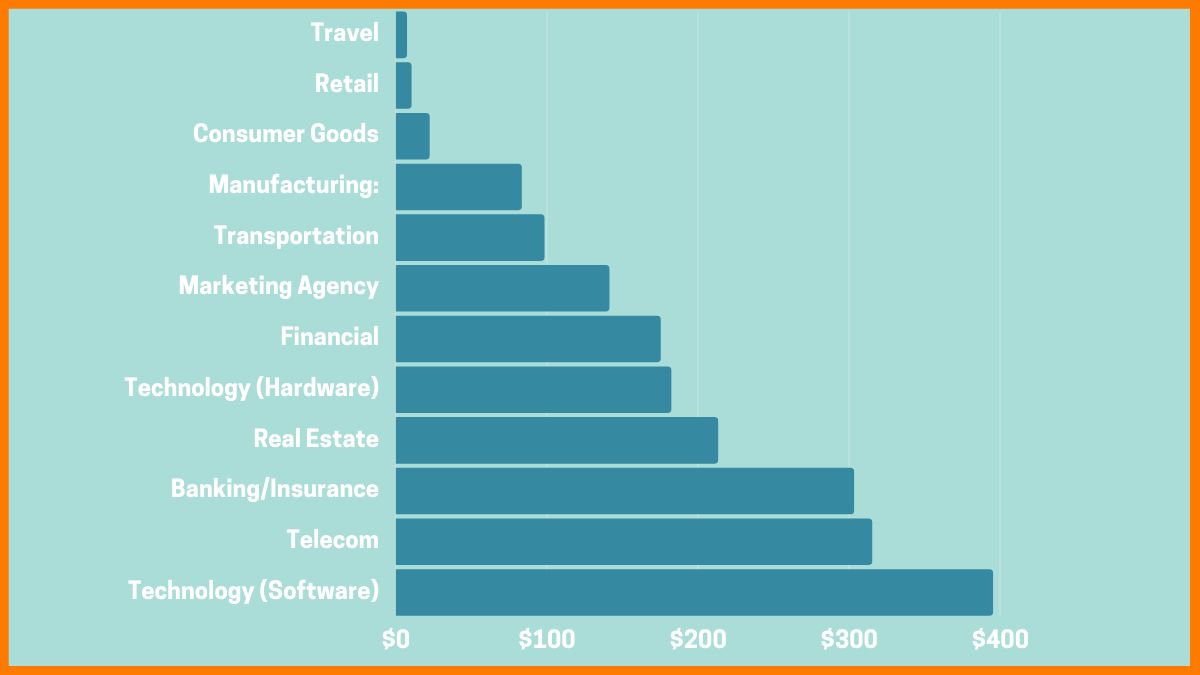

Acquisition cost is an important factor in determining the overall success of a business. It can have a significant impact on your bottom line, as it affects how much money you need to spend to acquire new customers or products. If the acquisition cost is too high, it can lead to reduced profits and could even put your business at a disadvantage compared to competitors. On the other hand, if it is too low, it could mean leaving money on the table and not maximizing your potential. Being aware of the acquisition cost and having strategies in place to reduce it can help any business stay ahead of the competition and keep their profits high.

Calculating Acquisition Cost to Make Better Business Decisions

Calculating acquisition cost is a key part of making smart business decisions. Knowing how much it costs to acquire customers, whether through digital marketing, physical advertising, or other methods, is essential for determining how much you can afford to spend to gain new customers. By understanding the cost of acquiring customers, businesses can also more accurately measure the return on their marketing and advertising investments. In order to calculate acquisition cost, businesses must first identify the channels they use to acquire customers and the associated costs. This could include anything from the cost of paid digital advertising to the cost of printing physical ads. Once all of the costs associated with acquiring customers in each channel have been identified, the next step is to divide the total cost by the number of customers acquired, resulting in the acquisition cost for each channel. Knowing these costs allows businesses to make more informed decisions about where to allocate their marketing and advertising budgets.

How to Minimize Acquisition Cost in Your Business

If you’re looking to minimize acquisition cost in your business, there are a few things you can do. First and foremost, make sure you’re taking advantage of any discounts or promotions you can find. This could be from suppliers, or from any other resources you use. You should also look into ways to streamline your processes, as this can help reduce costs. Additionally, consider utilizing online resources when possible. This could be for advertising, or simply for ordering materials. Finally, make sure to keep up with the latest trends in your industry, as this can help you stay competitive and keep costs to a minimum. By taking these steps, you can help ensure that your acquisition costs are kept to a minimum.

Strategies for Optimizing Acquisition Cost in Your Company

Strategies for optimizing acquisition cost in your company are essential for any business looking to maximize their profits. One of the best ways to do this is to focus on the customer journey and find ways to reduce the cost of each step. This can include implementing automation tools to streamline processes, reducing the number of manual steps involved in the process, and leveraging data to identify areas where cost savings can be made. Additionally, developing an effective content marketing strategy can help to drive more qualified leads and reduce the amount of money spent acquiring them. Finally, investing in analytics tools to track acquisition cost and performance metrics can help to identify areas where improvements can be made and help you to adjust your strategy accordingly.