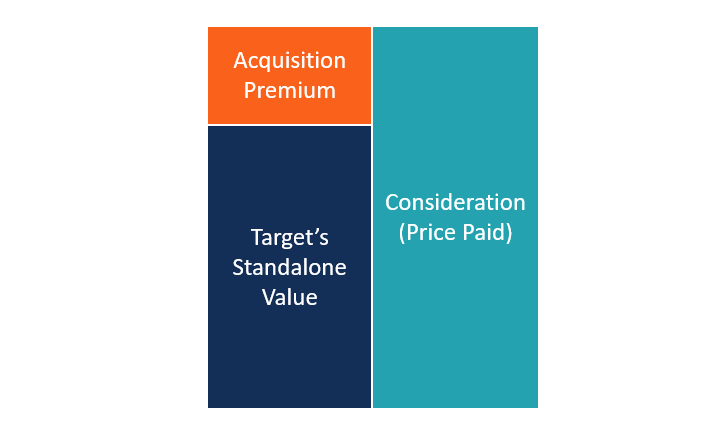

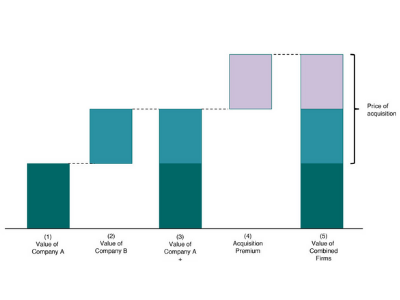

Acquisition premium is an important concept in the world of finance and investments. It refers to the difference between the price paid by an acquirer for a target company and the target company’s market value. This article will explain the concept of acquisition premium in more detail, including what it is, how it is calculated and the implications of paying a premium when making an acquisition. We will also discuss the potential risks and benefits of doing so. By the end of the article, you will understand the importance of acquisition premium and why it should be considered when making mergers and acquisitions.

What is the Definition of Acquisition Premium?

An acquisition premium is the amount of money one company pays to acquire another. It’s essentially a premium paid on top of the market value of the target company. The amount of the premium is based on the perceived value of the target company and the amount of money the buyer is willing to pay for it. The premium is typically paid in cash, but can also include stock or other assets. The premium is usually paid when the acquisition is completed, but can also be paid in installments over a period of time. Acquiring companies usually pay an acquisition premium to make sure that the target company is properly incentivized to sell. The premium is an attractive way for the buyers to acquire the target company, as it allows them to purchase the target company at a price that is higher than its market value.

How Does Acquisition Premium Impact Financial Statements?

When it comes to understanding the impact of acquisition premium on financial statements, it’s important to know that acquisition premium can have a significant effect on both the balance sheet and the income statement. The acquisition premium is the amount paid in excess of the fair market value of the acquired company, and this amount is recorded as an asset on the balance sheet. On the income statement, the premium is spread over the life of the acquired company, which means that it will have an impact on the company’s earnings for a number of years. It’s important to remember that acquisition premium can be a major factor in terms of the financial health of a company, and it should be taken into consideration when making any decisions related to mergers and acquisitions.

What are the Advantages and Disadvantages of Acquisition Premium?

Acquisition premium is a financial term used to describe the difference between the purchase price of a company and its market value. This premium can be seen as an indication of the confidence investors have in the company and the future potential it has. While acquisition premium can be a great way to increase the value of a company, it is important to be aware of the advantages and disadvantages associated with it. The main advantage is that it can generate a significant return on investment for those who have the confidence to invest in a company. On the other hand, it also carries a risk of overpaying for the company, which can lead to losses for the investors if the company does not perform as expected. Therefore, it is important to do thorough research on the target company before making any investment decision involving an acquisition premium.

What are the Different Types of Acquisition Premiums?

When it comes to acquisition premiums, there are several different types to consider. A “cold premium” is when the target company’s stock price is lower than the acquirer’s. This indicates that the acquirer is obtaining a bargain. A “control premium” is when the acquirer pays a higher price for the target company’s stock, in order to gain control of the company. Finally, a “synergy premium” is when the acquirer pays an even higher price for the target company’s stock, in order to realize a strategic advantage from the combination of the two companies. Each type of acquisition premium presents a unique opportunity for investors, and understanding the different types is essential for making the most of any acquisition.

How Can Companies Utilize Acquisition Premiums Effectively?

When it comes to utilizing acquisition premiums effectively, companies should be strategic in their approach. Companies can use acquisition premiums to purchase another company’s assets, or to acquire a company’s equity. This can provide a company with valuable resources and technology that they may not have access to otherwise. Additionally, acquisition premiums can be used to acquire high-value assets that may not be easily accessible, such as intellectual property. Companies should also consider the financial ramifications of the acquisition premium and the long-term benefits it can provide. Utilizing acquisition premiums effectively can help a company increase its competitive position, gain access to new markets, and grow its revenue. With careful consideration and strategic planning, acquisition premiums can be a powerful tool for companies to expand their business.