Acquisition Accounting is an important accounting practice used to record the purchase of another company or business. Through the use of this accounting method, businesses are able to accurately record and assess the financial implications of an acquisition, allowing them to make informed decisions on the value of such transactions. This article will explain the concepts behind Acquisition Accounting, how it works, and its importance in the financial world.

Overview of Acquisition Accounting Principles

Acquisition accounting is a process used to account for the purchase of one company by another. It is used to account for the assets and liabilities of the acquired company and to fairly reflect the financial results of the transaction. Acquisition accounting is a complex process that requires the application of certain principles and guidelines to ensure accurate reporting. The most important principle is that of fair value, which requires that the purchase price for the acquired company be based on the fair value of its assets and liabilities. Other principles include recognition of the acquisition of assets and liabilities, recognition of the gain or loss from the transaction, and allocation of the purchase price between the assets and liabilities of the acquired company. Understanding the principles and guidelines of acquisition accounting is essential for anyone involved in the purchase or sale of businesses.

What Are the Benefits of Acquisition Accounting?

Acquisition accounting is a great way to make sure your financial transactions are accurately tracked and recorded. It’s also a great way to make sure you get the most out of any purchases you make. When you use acquisition accounting, you can ensure that the costs associated with buying a business or asset are properly identified and accounted for. This can help you save money in the long run, as well as give you a better understanding of where your money is going and how it is being used. Plus, you’ll be able to make better decisions about investments, as well as be able to track your expenses more accurately. With acquisition accounting, you’ll be able to get the most out of your purchases and make sure you’re making the most informed decisions.

Different Types of Acquisition Accounting Treatments

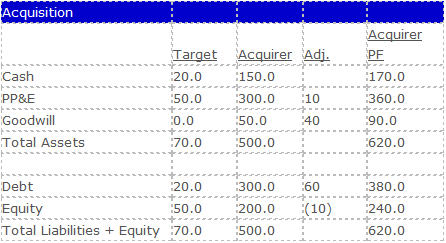

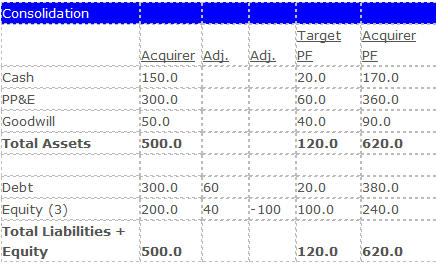

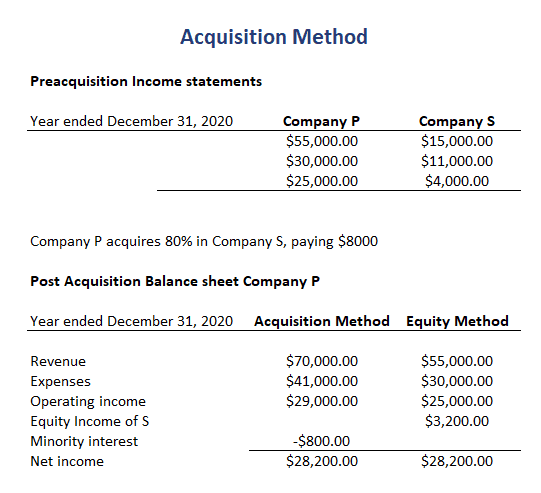

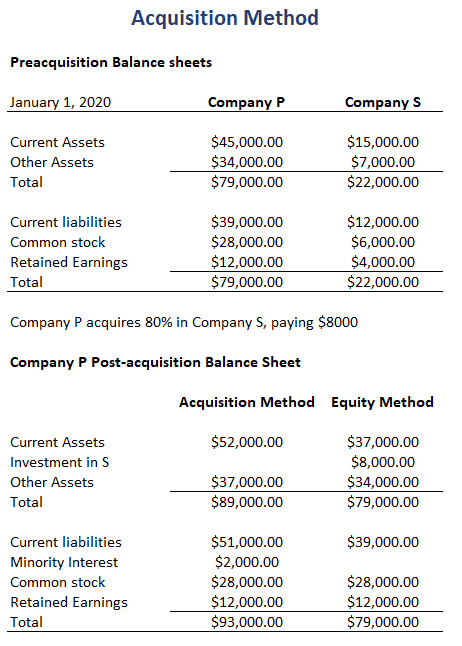

If you’re in the finance world, you’ve probably heard of acquisition accounting. Acquisition accounting is the process of recording and reporting the details of an acquisition in financial statements. Basically, it’s an accounting process that allows companies to accurately record the cost of purchasing another business. There are three main types of acquisition accounting treatments: purchase accounting, pooling of interests, and equity accounting. Purchase accounting is the most common method of acquisition accounting, which involves recording the assets and liabilities of the acquired company at fair market value. Pooling of interests is a method of combining the assets and liabilities of two entities without revaluing them. Equity accounting is the process of recording the equity of the acquired company at its book value. Each of these acquisition accounting treatments has its own set of rules and regulations. It’s important to make sure you understand each of these methods before you attempt to record and report an acquisition.

Challenges in Applying Acquisition Accounting

Acquisition accounting can be a tricky process to master, especially if you’re unfamiliar with the different rules and regulations that come along with it. There are several key challenges to keep in mind when trying to apply acquisition accounting correctly, such as acquiring assets that have a different value than what was originally recorded, determining the fair value of certain assets, and making sure all of the required information is accurately recorded. Additionally, it’s important to understand the tax implications associated with the acquisition and the impact of any cash flows or non-cash items. It’s essential to have a thorough understanding of acquisition accounting to ensure the process is done correctly and efficiently. With the help of an experienced accountant, you can be sure that your business is properly accounting for an acquisition and all of its associated costs.

Best Practices for Acquisition Accounting Processes

Acquisition accounting is a complex process that requires best practices to ensure accuracy and compliance. When it comes to acquisition accounting, it is important to be aware of the different procedures and regulations that need to be followed. It is essential to ensure that all accounting transactions related to the acquisition are correctly recorded in the company’s books. This includes any payment made, any liabilities incurred, and any assets acquired. Furthermore, it is important to properly document all the details of the acquisition, such as the terms and conditions of the agreement, the date of the agreement, and all other relevant information. Additionally, it is important to ensure that all accounting entries are made in accordance with the Generally Accepted Accounting Principles (GAAP) and relevant tax laws. Additionally, periodic reviews of the acquisition accounting process should be conducted to ensure accuracy and compliance. This will help to ensure that the company is in compliance with all relevant regulations and laws and that all accounting entries are accurately recorded.