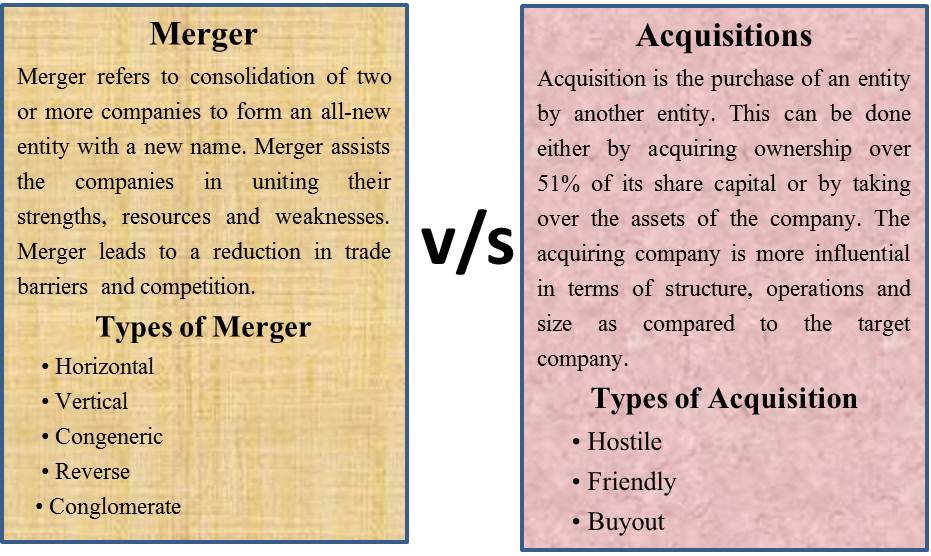

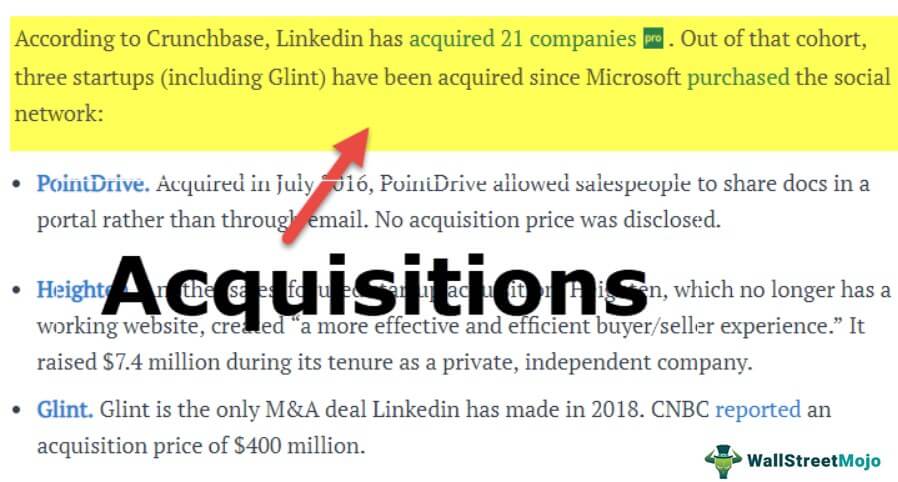

Acquisition is an important concept in financial and business management, as it helps businesses of all sizes grow and expand. Mergers and acquisitions (M&A) are the primary ways that companies acquire other businesses, products, services, or resources. Understanding what acquisition is, the different types of acquisitions, and the benefits of acquisition can help businesses make informed decisions that result in successful growth.

Definition of Acquisition: A Comprehensive Overview

Acquisition is an important part of the business world and can be used to grow and expand your business. It is a process that involves the purchase of one company by another. The purchased company is then absorbed into the purchasing company, which can result in a range of benefits for the acquiring company. Acquisition can help to bring new talent, technologies, and markets to the acquiring company, as well as access to additional resources and capital. It can also help the acquiring company to expand their market share and increase their competitive advantage. Acquisition is a complex and often costly process, but if done properly, it can be an effective and rewarding way to grow and diversify your business.

The Benefits of Acquisition: What Can Companies Gain?

Acquiring another company can be a great way for companies to expand their business and gain a competitive advantage. Not only does acquisition provide the opportunity to gain access to new markets, technologies, and customers, but it can also help to increase the overall size and scope of the business. Additionally, acquiring another company can help to diversify a company’s portfolio and reduce risk, as well as provide access to valuable resources such as talent, intellectual property, and capital. Furthermore, an acquisition can also be used to reduce costs and increase efficiency by consolidating operations, streamlining processes, and increasing economies of scale. With the right acquisition strategy and good planning, companies can reap the many benefits of acquisition and grow their business.

Different Types of Acquisition Strategies

Acquisition is a term used in the world of business and finance to refer to the process of buying, merging, or taking over another company. There are several different types of acquisition strategies that businesses can use in order to grow and expand their operations. These strategies include horizontal integration, vertical integration, consolidated acquisition, and strategic alliance. Horizontal integration is the process of acquiring a company in the same industry as the acquiring company. Vertical integration is when a company acquires another company in the same supply chain, such as a supplier or distributor. Consolidated acquisition is when a company acquires multiple companies to form one large company. Lastly, a strategic alliance is when two or more companies join forces to create a joint venture. Each of these acquisition strategies has its own pros and cons, and businesses should carefully consider their options before making a decision.

How to Evaluate the Success of an Acquisition

If you’re wondering how to evaluate the success of an acquisition, you need to look at more than just the financials. You should also consider the strategic implications, the customer response, and the overall impact on the business. You’ll want to measure the impact on profits, revenue, market share, customer satisfaction, and employee morale. It’s important to remember that while financials are important, they don’t paint the full picture. Evaluating the success of an acquisition requires looking at the whole picture, so you can make sure you’re getting the most out of your investment.

Risks Associated With Acquisition: What Companies Should Be Aware Of

When looking into acquiring a company, it is important to be aware of the risks involved. Companies should evaluate the potential risks of any acquisition before making a commitment. These risks include legal and regulatory issues, potential financial losses, potential decrease in market share and customer loyalty, and potential difficulties with integration of the new entity into the existing organization. Companies should also consider the potential risks associated with the target company’s products, services, and customers. By taking the time to thoroughly evaluate potential risks and manage them appropriately, companies can minimize potential losses and increase the likelihood of a successful acquisition.