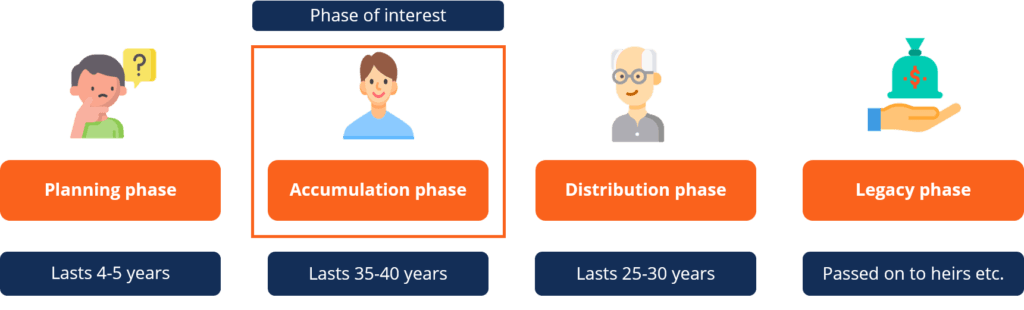

Are you ready to take your finances to the next level? Accumulation Phase is an important concept in investing, and understanding how it works can help you reach your financial goals faster and with fewer risks. Accumulation Phase is a stage in an investor’s life cycle that focuses on building wealth through investments. During this period, investors focus on building long-term wealth and reducing their risk by diversifying their portfolios. In this article, we’ll discuss the definition of Accumulation Phase, how it works, and the benefits it can offer to investors.

What Is Accumulation Phase Investing?

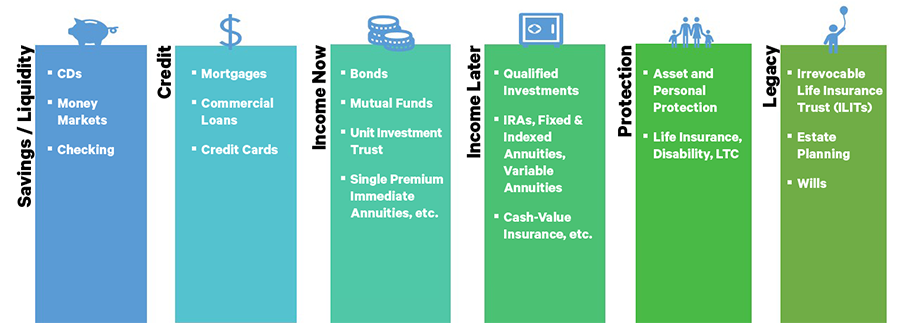

Accumulation phase investing is a strategy used by investors to build up their portfolio over time. This type of investing involves investing in a mix of stocks, commodities, bonds and other financial instruments in order to gradually accumulate wealth. The idea is to gradually increase the value of your portfolio over the long term and reduce risk by diversifying your investments. This can be done through a mix of strategies such as buying and holding, dollar cost averaging, and value investing. It is important to consider your risk tolerance and investment goals when deciding on an accumulation phase investing strategy. This type of investing is a great way to build wealth over time and can be used by investors of all ages and levels of experience.

What Are the Benefits of Accumulation Phase Investing?

Accumulation phase investing provides a number of great benefits. For starters, it allows you to start building your wealth early on so that you can make the most of your money. This phase also allows you to take advantage of compounding returns, which means that the returns you earn will generate returns that you can reinvest. Accumulation phase investing also allows you to spread out your investments over a larger period of time, which can reduce your risk and increase your chances of earning a higher return. Finally, the cash flows from your investments can be reinvested, which further increases the value of your investments and allows you to benefit from compounding returns. All of these advantages make accumulation phase investing a great option for anyone who wants to start building their wealth.

How to Manage Your Money During Accumulation Phase

Managing your money during the accumulation phase is key to reaching your financial goals. It’s important to stay disciplined and have a plan in place to ensure that you are making the most of your money and setting yourself up for success. Start by identifying your goals, then figure out how much money you need to save to meet those goals. Also consider what kind of investments you need to make to reach your goals. Make sure to track your expenses and set up a budget to ensure that you are staying on track with your financial goals. Finally, consider hiring a financial planner to help you stay on top of your finances and make sure you are taking the right steps for a secure financial future.

What Are the Risks of Accumulation Phase Investing?

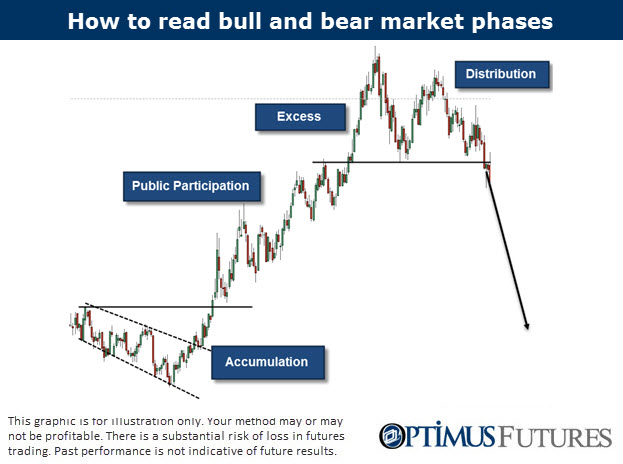

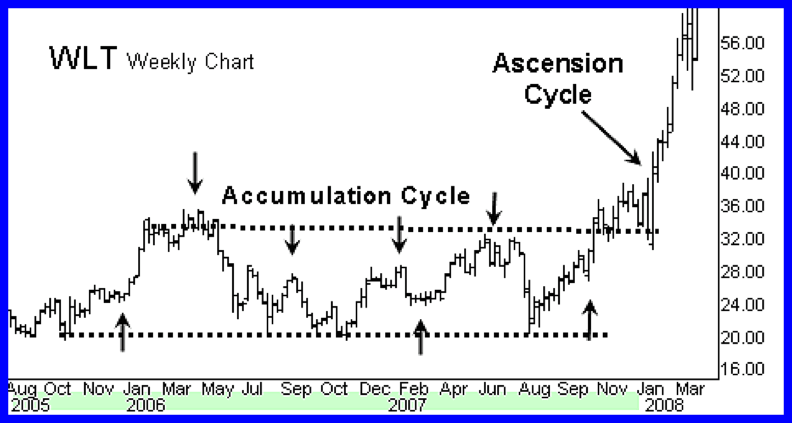

Investing during the accumulation phase of your financial plan can be a great way to save for retirement, but it can also come with certain risks. One of the most significant risks of investing during the accumulation phase is market volatility. When the stock market is volatile, investments can become unpredictable, and the value of your portfolio can fluctuate significantly. Additionally, if you have a large concentration of investments in a certain sector, you could be exposed to sector-specific risks. Finally, you could be exposed to liquidity risks if your portfolio is heavily concentrated in illiquid investments. All of these risks can potentially lead to big losses, so it is important to understand the risks involved before investing during the accumulation phase.

How to Make the Most of Your Accumulation Phase Investment Plan

Making the most of your accumulation phase investment plan is key to ensuring that you are on the right track towards achieving your financial goals. Having a plan in place will help you stay organized and focused on what matters. To get the most out of your plan, start by setting realistic financial goals that are tailored to your situation. Make sure to track your progress and adjust your plan as necessary. You should also look into automating your savings and investments so you don’t have to worry about missing payments each month. Finally, be sure to review your portfolio regularly to make sure that your investments are performing as expected. With the right planning and dedication, you can make the most of your accumulation phase investment plan and reach your financial goals.