The Accumulation/Distribution Indicator (A/D) is a powerful tool that helps investors to identify potential buying and selling opportunities in the stock market. This leading technical indicator tracks the money flow in and out of stocks and helps investors to spot potential trends in the markets. By analyzing the net money flow, the A/D allows traders to identify the strength of a stock and its potential for growth or decline. With the help of this indicator, investors can make informed decisions and maximize their return on investments.

An Overview of the Accumulation/Distribution Indicator (A/D)

The Accumulation/Distribution Indicator (A/D) is a technical analysis tool used to measure the relative buying and selling pressure of a stock or other security over time. A/D is a momentum indicator that attempts to identify when a stock or other security is being accumulated (bought) or distributed (sold). This is done by analyzing the volume and price movements of the security to determine if the buying pressure is greater than the selling pressure or vice versa. The A/D indicator can be used to confirm potential trend reversals, identify potential breakouts, and gauge the strength of a stock’s current trend. With the A/D indicator, investors can better gauge the buying and selling pressure of a security and make better decisions in terms of when to enter and exit positions.

Understanding the Components of the Accumulation/Distribution Indicator (A/D)

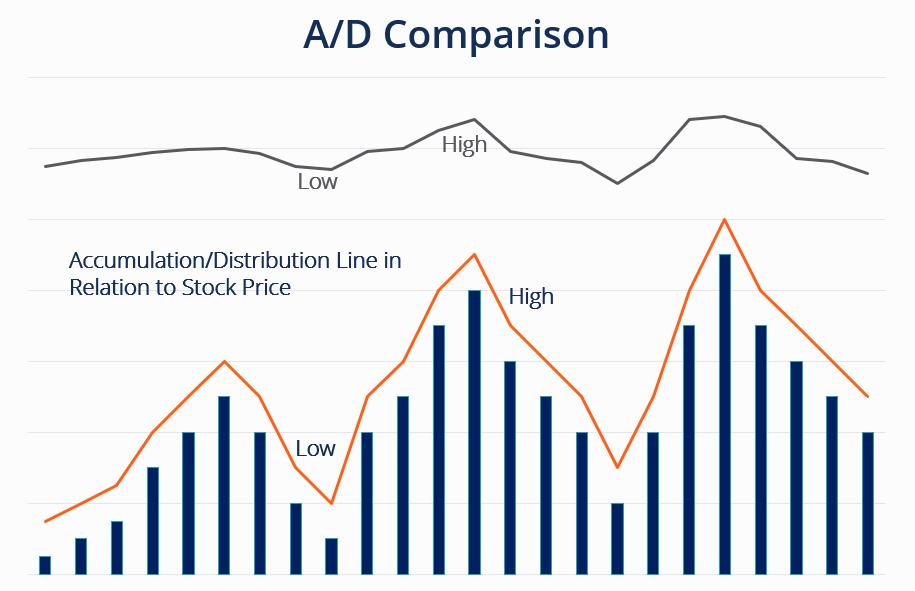

The Accumulation/Distribution Indicator (A/D) is a technical analysis tool that measures the flow of money into or out of a security. The A/D is based on the principle that the more money that flows into a security, the higher the price is likely to go, and vice versa. The A/D indicator is made up of two components: a positive flow, which measures the amount of money flowing into the security, and a negative flow, which measures the amount of money flowing out of the security. The two components are combined to create an overall A/D score, which gives investors an insight into whether money is flowing into or out of a security. A high A/D score indicates that money is flowing into the security, and a low score indicates that money is flowing out of the security. Knowing the A/D score can help investors identify the best times to buy or sell a security.

How to Use the Accumulation/Distribution Indicator (A/D)

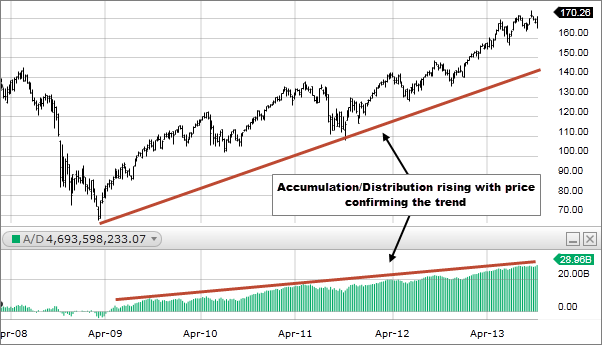

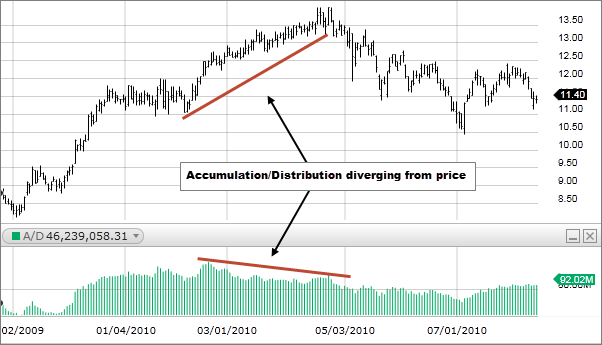

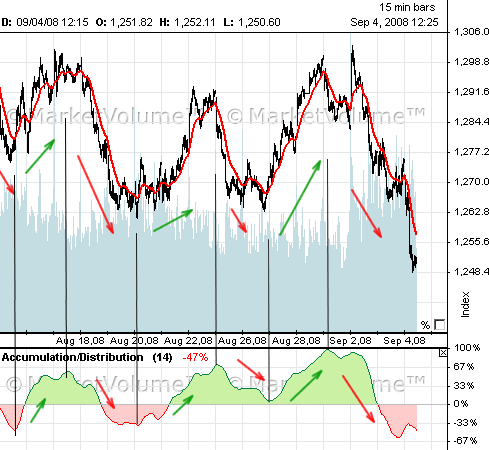

The Accumulation/Distribution Indicator (A/D) is an important tool for traders who want to gain insight into the current state of the stock market. The A/D indicator is a technical analysis tool that tracks the buying and selling pressure of a given security. This indicator can be used to identify potential turning points in the market, and can help traders identify when to enter or exit a position. To use the Accumulation/Distribution Indicator, traders will look for divergences between the price of a security and the indicator line. When the price is moving up while the indicator line is moving down, it indicates increased selling pressure and could signal a potential change in the trend. On the other hand, if the price is moving down while the indicator line is moving up, it indicates increased buying pressure and could signal a potential change in the trend. By paying attention to these divergences, traders can gain insight into the current market sentiment and make more informed trading decisions.

Common Mistakes to Avoid When Implementing the Accumulation/Distribution Indicator (A/D)

When it comes to the Accumulation/Distribution Indicator (A/D), it’s important to not make any rookie mistakes when implementing it. One of the most common mistakes traders make when using the A/D is setting the indicator with the wrong parameters. It’s important to note that the A/D is a momentum oscillator, so setting it too low or too high can lead to false signals. Another mistake to watch out for is assuming the A/D will accurately predict future price movements. While this indicator can be a great tool for identifying trends, it should not be relied upon to predict future price movements. Finally, it’s important to make sure that the A/D is correctly calibrated with other indicators to ensure that the signals are accurate and reliable. By avoiding these common mistakes, traders can make the most out of the Accumulation/Distribution Indicator (A/D) and use it to gain an edge in the markets.

Examples of the Accumulation/Distribution Indicator (A/D) in Action

The Accumulation/Distribution Indicator (A/D) is a technical indicator used in stock market analysis to measure the level of buying or selling pressure in a stock. It is calculated by taking the daily closing price and subtracting the cumulative total of all prior days’ closing prices from it. The result is then divided by the total number of days in the period being observed. The resulting figure is known as the Accumulation/Distribution Indicator, or A/D.The A/D indicator is a great tool for investors to use to help gauge the strength of a stock’s trend. It can be used to identify potential entry and exit points in a security, as well as to help identify potential reversals in a stock’s trend. When the A/D indicator is rising, it is usually a sign that the stock is in an uptrend and is likely to continue rising. Conversely, when the A/D indicator is falling, it usually indicates that the stock is in a downtrend and is likely to continue falling. By comparing the A/D indicator with the price of a stock, investors can determine the strength of the trend and decide whether or not it is a good time to buy or sell.Examples of