Accumulated Other Comprehensive Income, or AOCI, is an important concept when it comes to understanding financial statements and the overall health of a business. It is a measurement of gains and losses that are not included in the calculation of net income, but are instead accumulated and reported on a separate line of the balance sheet. AOCI can help investors and analysts gain insight into a company’s financial performance and identify potential investment opportunities. In this article, we’ll discuss what Accumulated Other Comprehensive Income is, how it is calculated and why it is important for investors to understand.

What is Accumulated Other Comprehensive Income (AOCI)?

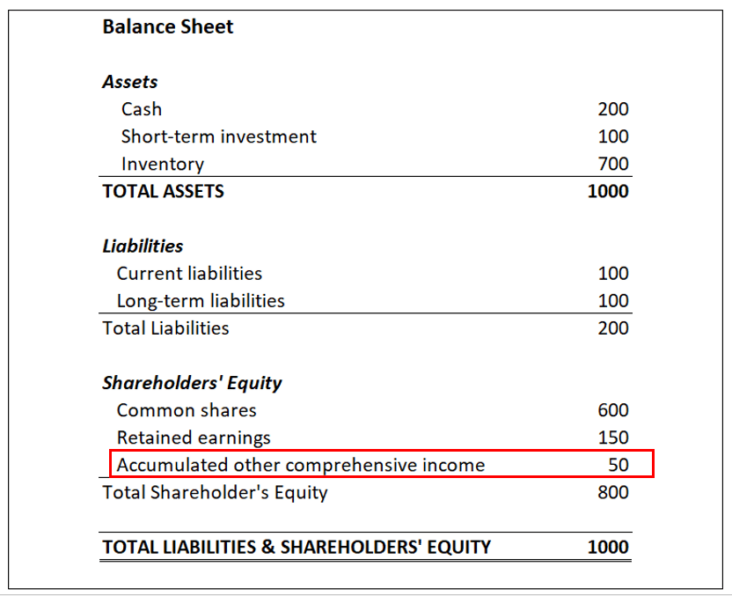

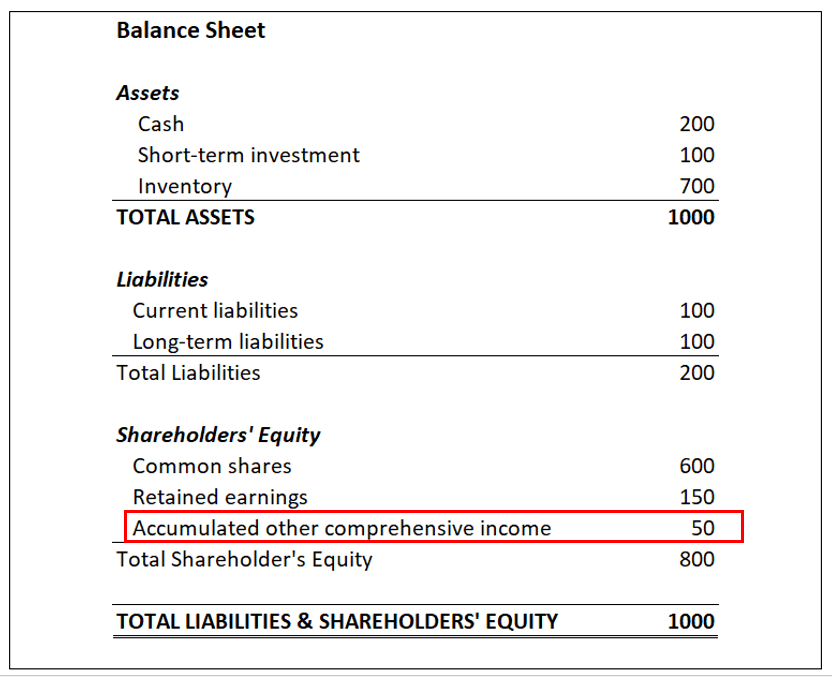

Accumulated Other Comprehensive Income (AOCI) is an accounting component that tracks income or losses that have been generated but not yet realized in a company’s income statement. This income or loss would be caused by events that are outside of the ordinary course of business. This type of income or loss is usually related to changes in the value of assets or liabilities. AOCI is typically reported as a separate component in the equity section of the balance sheet. AOCI can either be a positive or negative balance, depending on the company’s performance. A positive balance indicates that the company has realized gains in value that have yet to be reported, while a negative balance indicates that the company has realized losses in value that have yet to be reported. AOCI is an important component of a company’s financial health, as it allows investors and analysts to get a more accurate picture of the company’s total financial performance.

How Does Accumulated Other Comprehensive Income Affect Financial Statements?

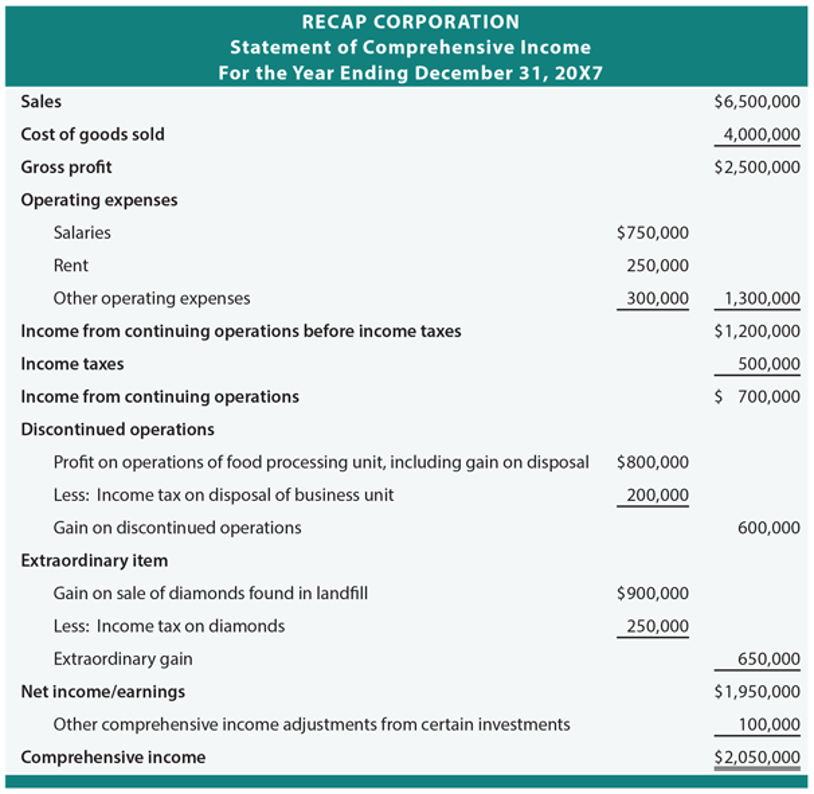

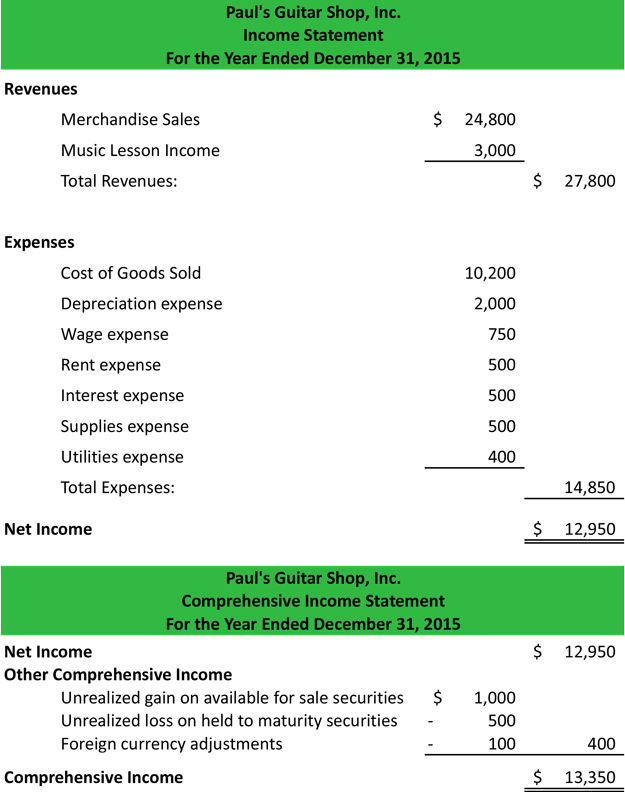

Accumulated other comprehensive income (AOCI) is an important factor when it comes to understanding financial statements. AOCI is a non-cash item that is reported in the equity section of the balance sheet. It includes items that are not included in net income, such as unrealized gains and losses on investments, foreign currency translation adjustments, and pension and postretirement benefit adjustments. AOCI is used to adjust the balance sheet and to report the changes in value of certain assets and liabilities. It can affect financial statements by increasing or decreasing the amount of equity reported, depending on the changes in value of the assets and liabilities included in the AOCI. Understanding how AOCI affects financial statements can help you get a better understanding of your company’s financial position.

What Are the Components of Accumulated Other Comprehensive Income?

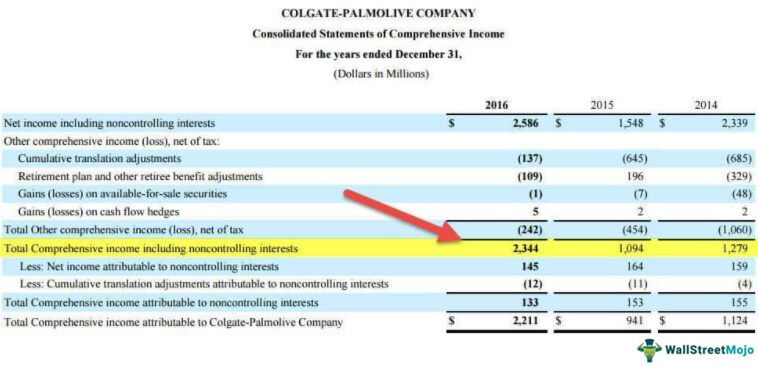

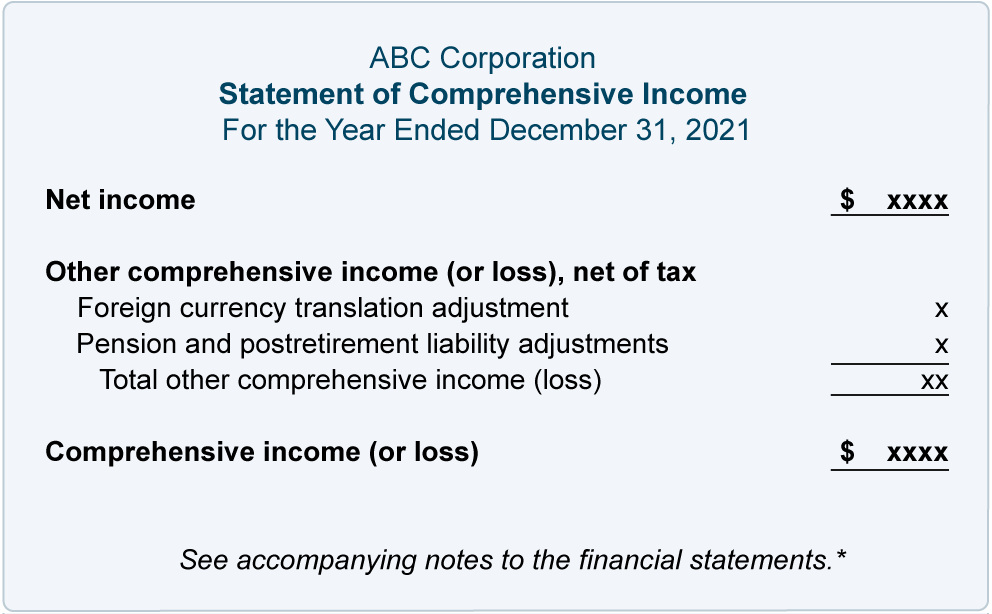

Accumulated other comprehensive income (AOCI) is an important concept to understand when it comes to financial statements. AOCI is a component of stockholders’ equity that holds unrealized gains or losses on certain items that are not part of the company’s net income. The components of AOCI include any foreign currency translation adjustments, gains or losses on hedging instruments, unrealized gains or losses on investments classified as available for sale, and changes in the fair value of certain pension plans. It is important to understand these components of AOCI in order to make informed decisions about a company’s financial health. AOCI can be found on the bottom of the equity section of the balance sheet and usually is reported in the statement of comprehensive income. It is important to keep track of AOCI in order to make sure that the company’s financial statements are accurate and up to date.

How Can Accumulated Other Comprehensive Income Impact Taxation?

Accumulated Other Comprehensive Income (AOCI) can have a major impact on your taxes. AOCI is a non-cash item on your financial statements that represents unrealized gains and losses on investments. These investments may be securities, foreign currency, or derivatives. AOCI is reported on the balance sheet as part of shareholders’ equity, rather than on the income statement. This means that it does not directly affect your taxable income. However, AOCI can still have an indirect impact on your taxes. For example, if you sell investments and have a gain, the amount of the gain must be reported as income for tax purposes. If you have losses in AOCI, it can offset the gains, reducing the amount of taxable income. Additionally, some tax credits or deductions may be impacted by the amount of AOCI. Therefore, AOCI should be taken into consideration when filing your taxes.

What Are the Advantages and Disadvantages of Accumulated Other Comprehensive Income?

Accumulated other comprehensive income can be a great tool for businesses, as it allows them to track and record changes in equity that don’t have to be reported on the income statement. On the plus side, it allows companies to keep track of changes in equity that are not related to the income statement, such as foreign currency translations, unrealized gains and losses, and more. This helps businesses stay on top of how their equity is changing and allows them to better manage their finances. On the downside, accumulated other comprehensive income can be difficult to calculate, as it requires a lot of complex calculations and can be time consuming. Additionally, if a company’s equity is changing rapidly, it can be hard to keep up with all of the changes and make sure that they are being accurately reported. All in all, accumulated other comprehensive income can be a great tool for businesses that want to keep track of their equity, but it can be time consuming and require a lot of calculations.