Accumulated depreciation is an important concept to understand when it comes to accounting and financial planning. It is an accounting method used to calculate the loss in value of an asset over time due to wear and tear, obsolescence, or other factors. This depreciation can then be used to reduce taxable income and create a more accurate financial statement. In this article, we will explain what accumulated depreciation is, how it is calculated, and its potential benefits.

Overview of Accumulated Depreciation: A Definition

Accumulated depreciation is an accounting term used to describe the total amount of depreciation expense that has been taken on an asset over its lifetime. It’s an important concept to understand if you’re managing a business, as it can help you determine how much of an asset’s value remains. Accumulated depreciation is a non-cash expense, meaning it doesn’t require money to be paid out, but it does reduce the value of the asset on the balance sheet. This can be useful in understanding the true cost of an asset, and the total cost of maintaining it over its lifetime. Accumulated depreciation is an important concept to understand when making financial decisions for your business, as it can help you decide which assets are worth keeping and which should be replaced.

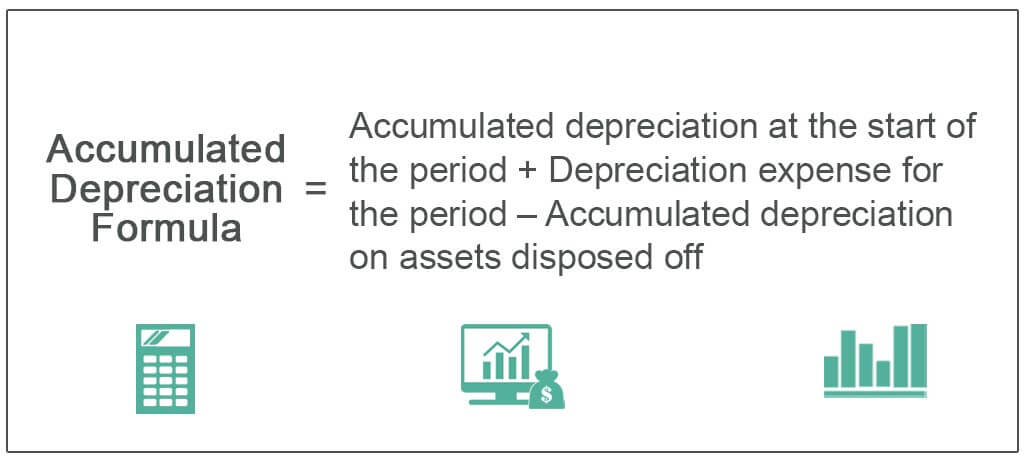

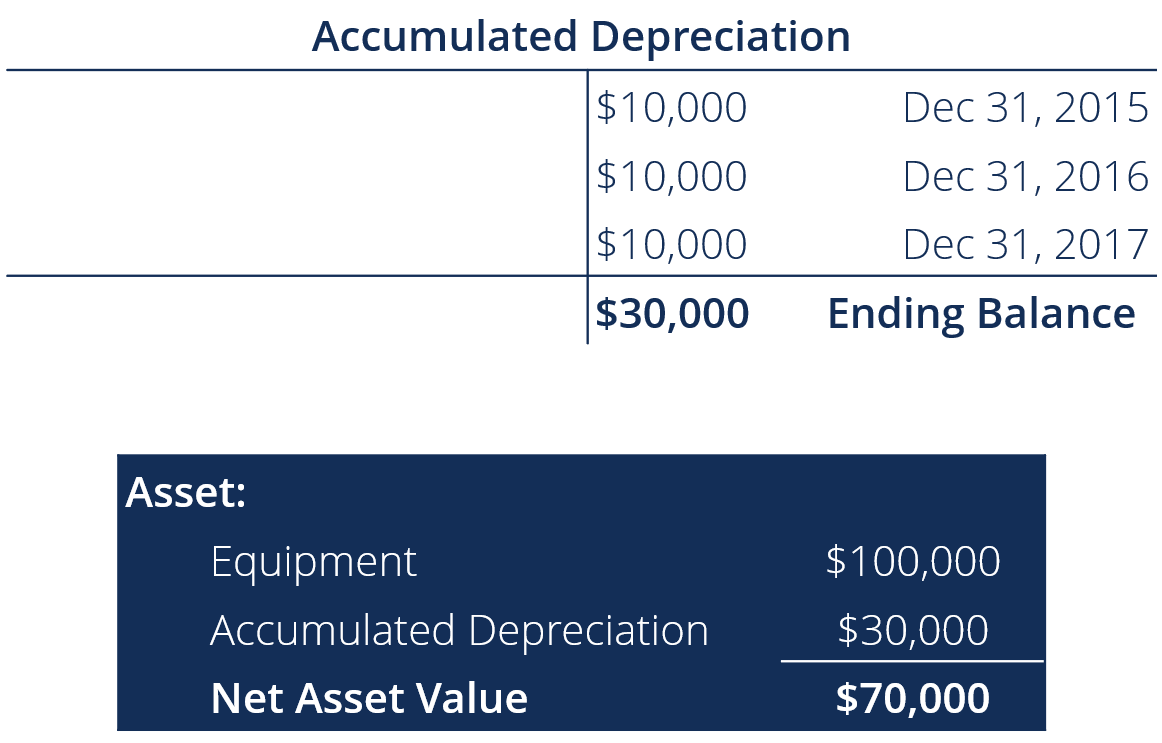

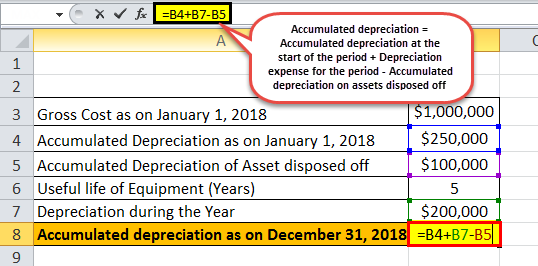

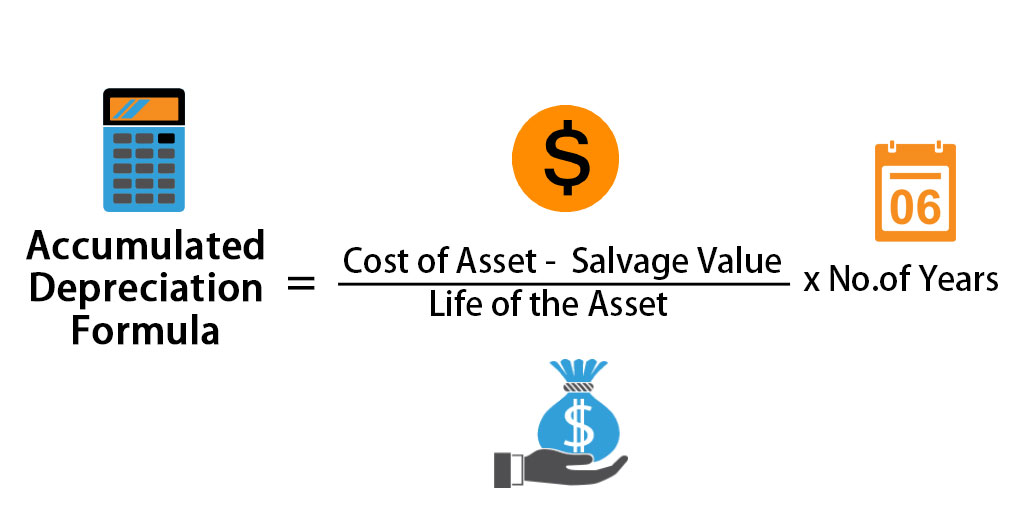

How Accumulated Depreciation is Calculated

Accumulated depreciation is an important concept to understand when it comes to keeping your books in order. It is the total amount of depreciation that has been recorded on an asset over its useful life. The calculation process for accumulated depreciation is relatively straightforward and can be broken down into a few simple steps. First, you need to determine the cost of the asset. Next, you need to decide on its useful life. Once this is established, you can then calculate its depreciation amount over that useful life. Finally, you just need to add up the total amount of depreciation taken on the asset over its useful life to figure out the accumulated depreciation. All of this helps to accurately track the asset’s value and make sure your books are kept up to date.

The Benefits of Accumulated Depreciation

Accumulated depreciation is a great way for businesses to maximize their profits and minimize their taxes. By calculating the depreciation of an asset over time, businesses can take advantage of the deductions associated with the asset, which can lead to significant savings. This can be especially beneficial for businesses that own large equipment or vehicles, as the depreciation of those items can be quite large. By taking advantage of accumulated depreciation, businesses can reduce the amount of taxes they owe on these items and boost their bottom line. It’s a great way to get the most out of your assets and make sure your business is running as efficiently as possible.

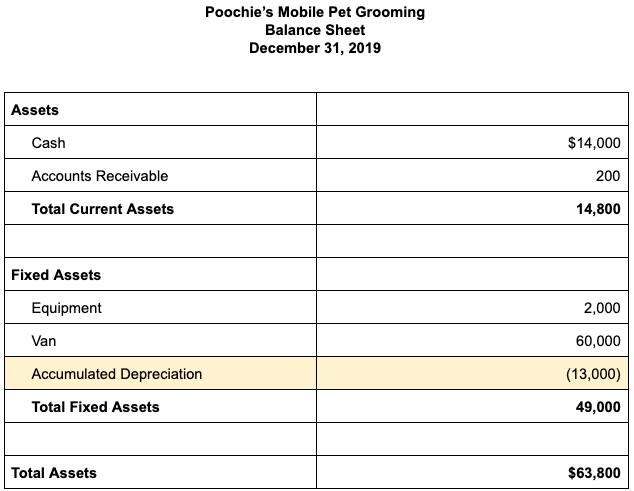

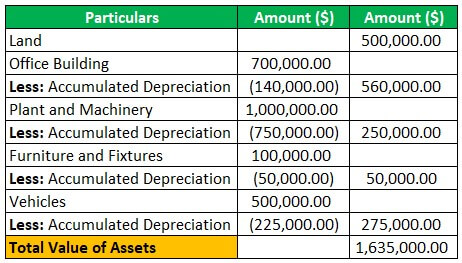

The Impact of Accumulated Depreciation on Financial Statements

Accumulated depreciation is an important concept to understand when it comes to financial statements. It can have a huge impact on the financials of a business, as it affects the value of assets, the profitability of a company, and the overall financial health of the business. Accumulated depreciation is the total amount of depreciation that has been recorded on an asset over time, and it can have a major effect on the bottom line of a business. When an asset has been fully depreciated, it can no longer be used to generate income for the business, and this can have a huge impact on the company’s financials. Additionally, accumulated depreciation can also affect the value of assets, as it reduces the book value of an asset. This can be significant for businesses that rely heavily on their assets for profit. Ultimately, understanding how accumulated depreciation can affect a business is essential for any business owner.

How to Avoid Plagiarism When Writing About Accumulated Depreciation

Accumulated depreciation is an important financial concept to understand when managing your business. It’s important to know how to accurately calculate it and how it affects your balance sheet and taxes. When writing about accumulated depreciation, it’s essential to do your own research and avoid plagiarism. The best way to do this is to read extensively about the topic, take detailed notes, and then craft your own unique piece of writing. If you need additional help, you can always reach out to a professional writer to make sure you don’t fall into the plagiarism trap. Don’t be afraid to use your own words and express your thoughts, opinions, and ideas. This will help you create the most accurate and engaging content about accumulated depreciation.