Accrued revenue is a key financial concept that many businesses must understand in order to remain profitable. Accrued revenue is when a business has earned money but has yet to be paid for it. This type of revenue is important to consider when calculating a business’s financial health and overall worth. Accrued revenue can be tricky to calculate and understand, which is why this article will provide you with a comprehensive overview of what it is, how to calculate it, and its importance in the financial world.

What Is Accrued Revenue?

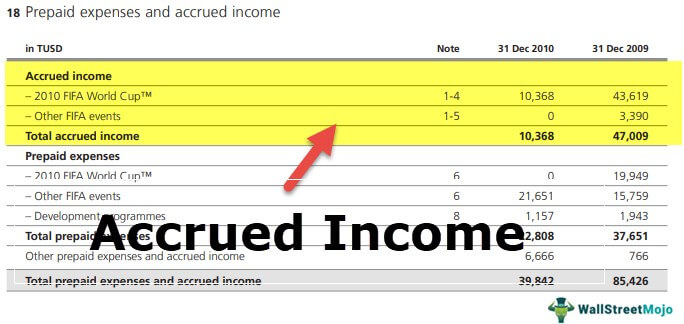

Accrued revenue, also known as unbilled revenue, refers to income that a company has earned but has not yet invoiced or received payment for. It’s important to recognize this type of income, as it represents money that the company has earned but has not yet officially recorded in the books. To properly track this revenue, companies use an accrual accounting system that records the earned revenue when it occurs, rather than when the company receives payment. This is beneficial for a company as it allows them to record revenue they have earned to show their financial health, even if they haven’t yet received payment. Accrued revenue is a vital part of any company’s accounting process, and helps to ensure that they are accurately representing their income.

The Difference Between Accrued Revenue and Recognized Revenue

If you’re trying to keep your books in order, it’s important to understand the difference between accrued revenue and recognized revenue. Accrued revenue is money that has been earned but not received by a business. This can happen when a customer orders goods or services but hasn’t yet paid for them. Recognized revenue, on the other hand, is money that has been earned and received by the business. This usually happens when the customer has paid for the goods or services. Both of these types of revenue need to be accounted for when preparing financial statements, but it’s important to understand the difference between the two. Knowing the distinction between accrued and recognized revenue is key to understanding your company’s financials and keeping your books in order.

The Accounting Principles of Accrued Revenue

Accrued revenue is a type of income that is earned but not yet received. It is an important accounting concept that must be taken into consideration when preparing financial statements. The accounting principles of accrued revenue dictate that when income is earned but not yet received, it should be recorded in the accounting records as accrued revenue. This will ensure that the financial statements are accurate and up-to-date. The accounting principles of accrued revenue also require that the amount of accrued revenue be reported on the balance sheet as a current asset. This is to ensure that the financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP). Accrued revenue is an important concept for businesses to understand, as it can have a significant impact on their financial statements. By understanding and properly recording accrued revenue, businesses can ensure that their financial statements are accurate and up-to-date.

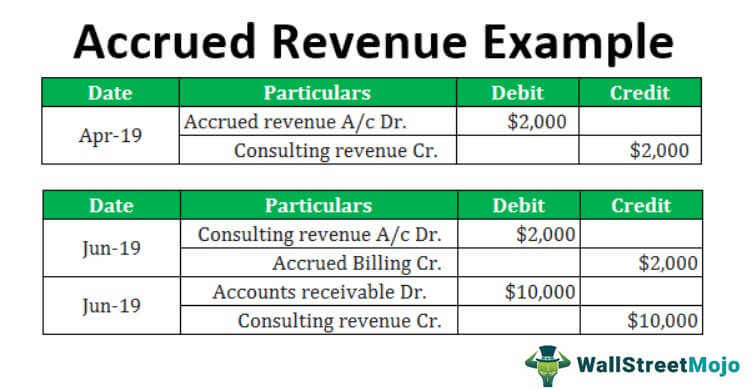

How to Calculate Accrued Revenue

Calculating accrued revenue is actually pretty simple! All you need to do is add the amount of revenue your company has earned over the period of time you are measuring to the amount of revenue that has yet to be billed. This will give you an accurate picture of your total income earned, even if it hasn’t yet been billed to a customer. To make sure you’re getting the most accurate figure possible, you’ll want to make sure you factor in any taxes or fees associated with the transactions. Once you have the total amount of your earned revenue, you can subtract any unpaid expenses from it to get your total accrued revenue. Keeping track of your company’s accrued revenue is important for ensuring your business is running smoothly and efficiently.

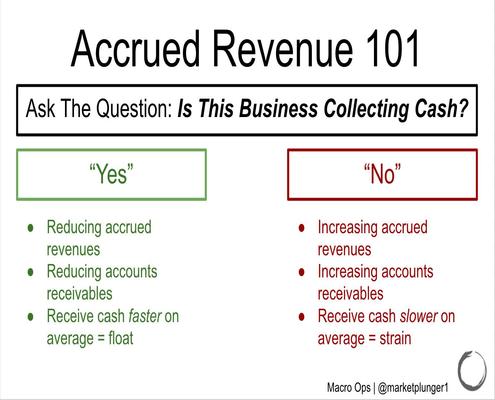

The Benefits of Accrual Accounting for Accrued Revenue

Accrual accounting is a great way to keep track of your business’s accrued revenue. With accrual accounting, you can easily track and recognize revenue that has been earned but not yet received. This allows you to ensure that your business’s financial statements accurately reflect the amount of income you have been able to generate. By tracking your accrued revenue, you can also identify any discrepancies and make sure your books are up to date. By taking advantage of the benefits of accrual accounting for accrued revenue, you can make sure your business is running smoothly and efficiently.