Accrued liabilities are a key concept in understanding financial statements. Accrued liabilities refer to a type of debt that a company has incurred but has not yet been recorded on its financial statements. This liability is a potential liability that will eventually become due, and it is important for businesses to understand how accrued liabilities work and how they can affect the financial health of their business. This article will provide an overview of accrued liability, its definition, and how it can affect a business.

Overview of Accrued Liability – What It Is and How It Impacts Financial Reports

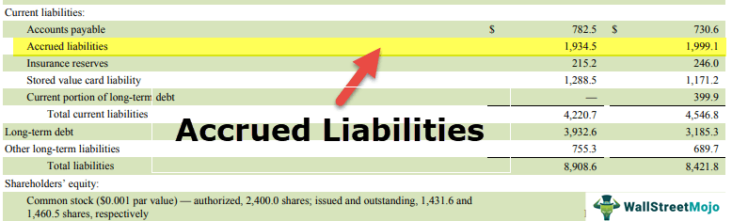

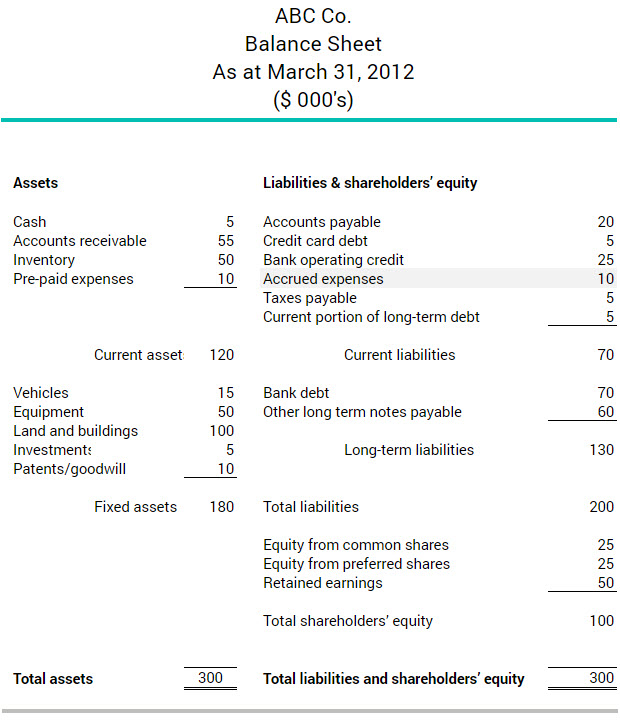

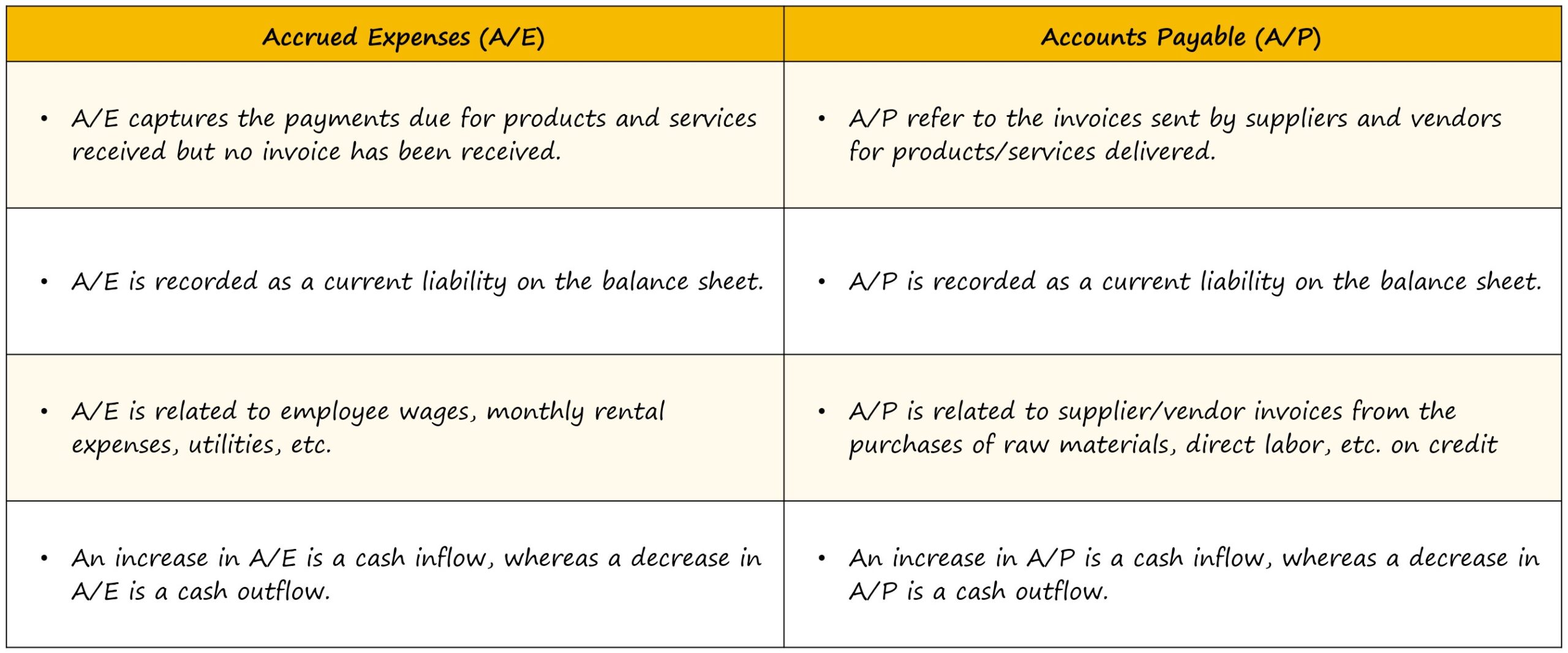

Accrued liabilities are a type of liability that companies must account for in their financial reports. They represent expenses that a company has incurred but not yet paid for. This means that the company is liable for the costs even though they have not yet been paid out. Accrued liabilities can include expenses such as payroll taxes, employee benefits, interest payments, rent, and other expenses that have not been paid at the time of the financial report. These accrued liabilities are important to keep track of as they can impact a company’s financial statements and overall financial health. It’s important to understand how these liabilities are reported and accounted for to ensure that a company is in compliance with accounting standards and regulations.

How to Calculate Accrued Liability – Understanding the Components

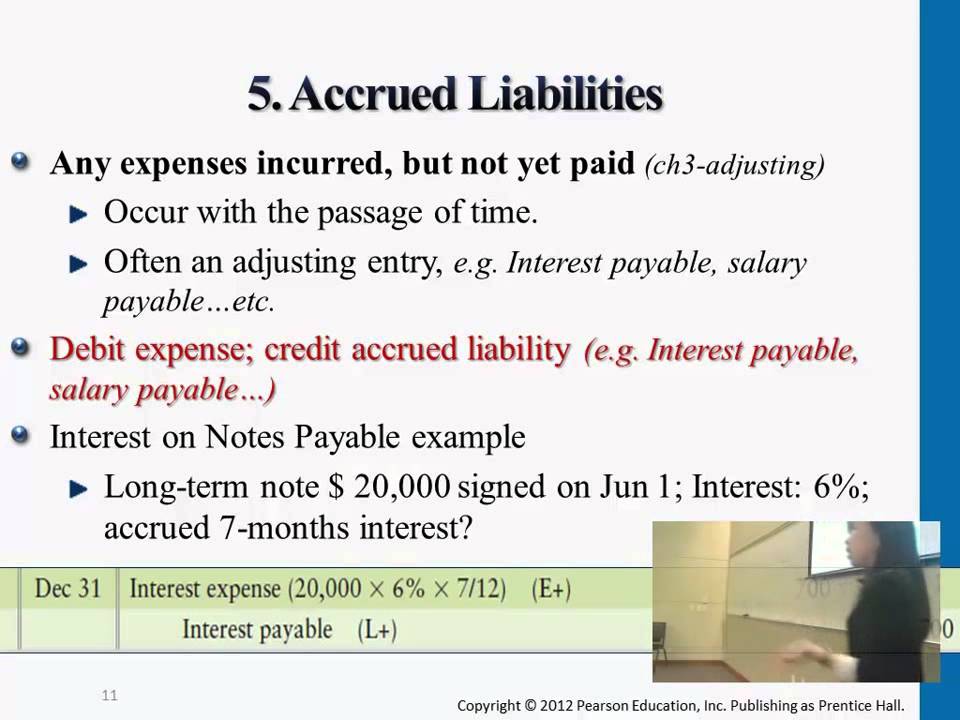

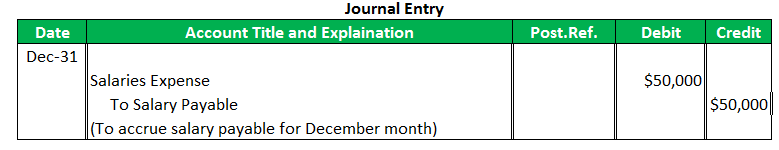

Calculating an accrued liability can be a tricky process, but understanding the components involved makes it easier. Accrued liabilities are debts that a company owes, but has not yet paid. The components needed to calculate an accrued liability include the amount owed, the length of time it was owed, and the interest rate if applicable. To determine the value of the accrued liability, multiply the amount owed by the length of time it was owed. If interest is applicable, the accumulated interest must also be included in the calculation. By understanding the components of an accrued liability, you can easily calculate the amount owed.

Types of Accrued Liabilities – Common Examples and Potential Implications

Accrued liabilities are liabilities that have been earned or incurred but have not yet been paid. They are also known as accrued expenses. Examples of accrued liabilities include items such as unpaid wages, interest, taxes, and rent. These liabilities represent money that the company owes and must pay in the near future. Understanding accrued liabilities is important to ensure that a company is accurately reporting its financial position at any given time. Potential implications of accrued liabilities include changes to the company’s cash flow, potential cash shortages, and the need to increase borrowing or other financing. It’s important for businesses to monitor their accrued liabilities closely, as they can have a significant impact on the company’s financial health.

The Impact of Accrued Liability on Corporate Financial Reporting and Taxation

Accrued liabilities can have a major impact on how a company reports its financials and how much it pays in taxes. When a company incurs an accrued liability, it must be reported on the balance sheet as a current liability. This increases the company’s liabilities, which decreases its net worth. Accrued liabilities can also impact the company’s reported income, as the company must pay out its accrued liabilities before it can record them as an expense. This can lead to the company reporting higher profits than it actually has. Additionally, companies must pay taxes on their accrued liabilities, which can add up to a significant amount. As such, it’s important for businesses to keep track of their accrued liabilities and manage them properly in order to ensure accurate financial reporting and to minimize their tax burden.

Strategies for Managing Accrued Liability – Tips for Minimizing Risk and Impact

Accrued liability is an important part of managing your finances and minimizing risk. Taking proactive steps to manage your accrued liabilities will help you keep them in check and ensure that you can stay on top of payments. Here are some tips for minimizing risk and impact associated with accrued liability: Be sure to keep track of all your income and expenses. This will give you an accurate picture of your financial situation. Monitor your accounts regularly, and keep an eye out for any unexpected expenses that may increase your accrued liability. Make sure you pay bills on time and avoid late fees. If you can’t pay your bills in full, consider negotiating with creditors to set up a payment plan that works for you. Keeping your financial records updated and accurate will help you stay on top of your accrued liability and minimize your risk. Finally, it’s important to review your credit report regularly to identify any errors or discrepancies that may be contributing to an increase in your accrued liability.