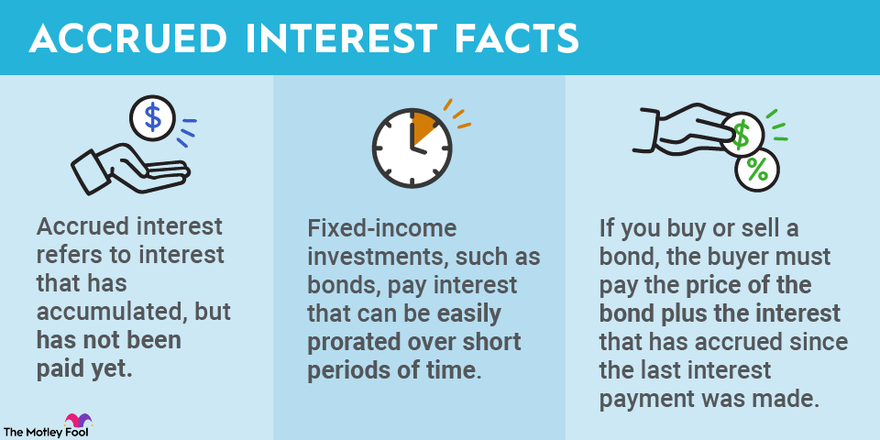

Accrued interest is a financial concept that is important for individuals and businesses to understand. Accrued interest is the interest that accumulates on a loan or bond between the time the interest was last paid and the current date. It is important to understand accrued interest because it can have a significant impact on the total amount of interest paid over the life of the loan or bond. Additionally, it can be a complex concept for those unfamiliar with financial terms, so it’s important to become familiar with the concepts of accrued interest and how to calculate it. This article will explain in detail what accrued interest is, how it is calculated, and how it affects total interest costs.

What is Accrued Interest and How It Works

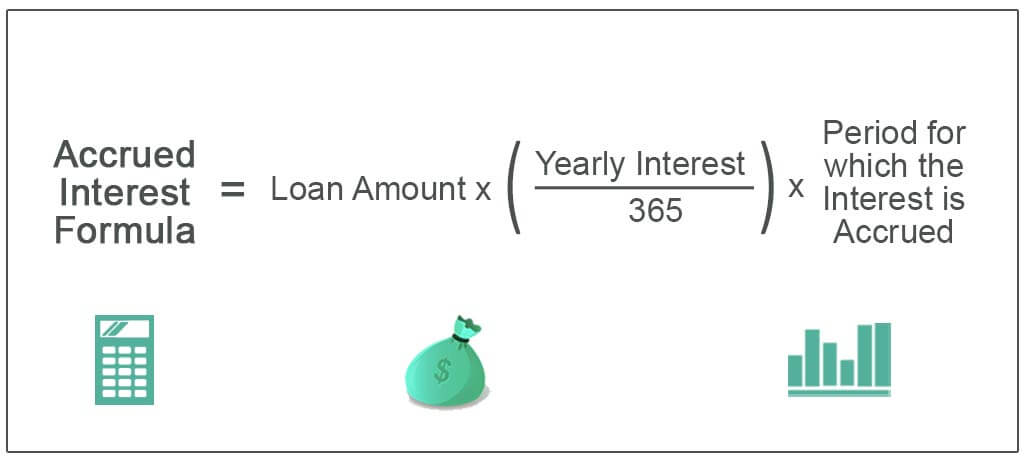

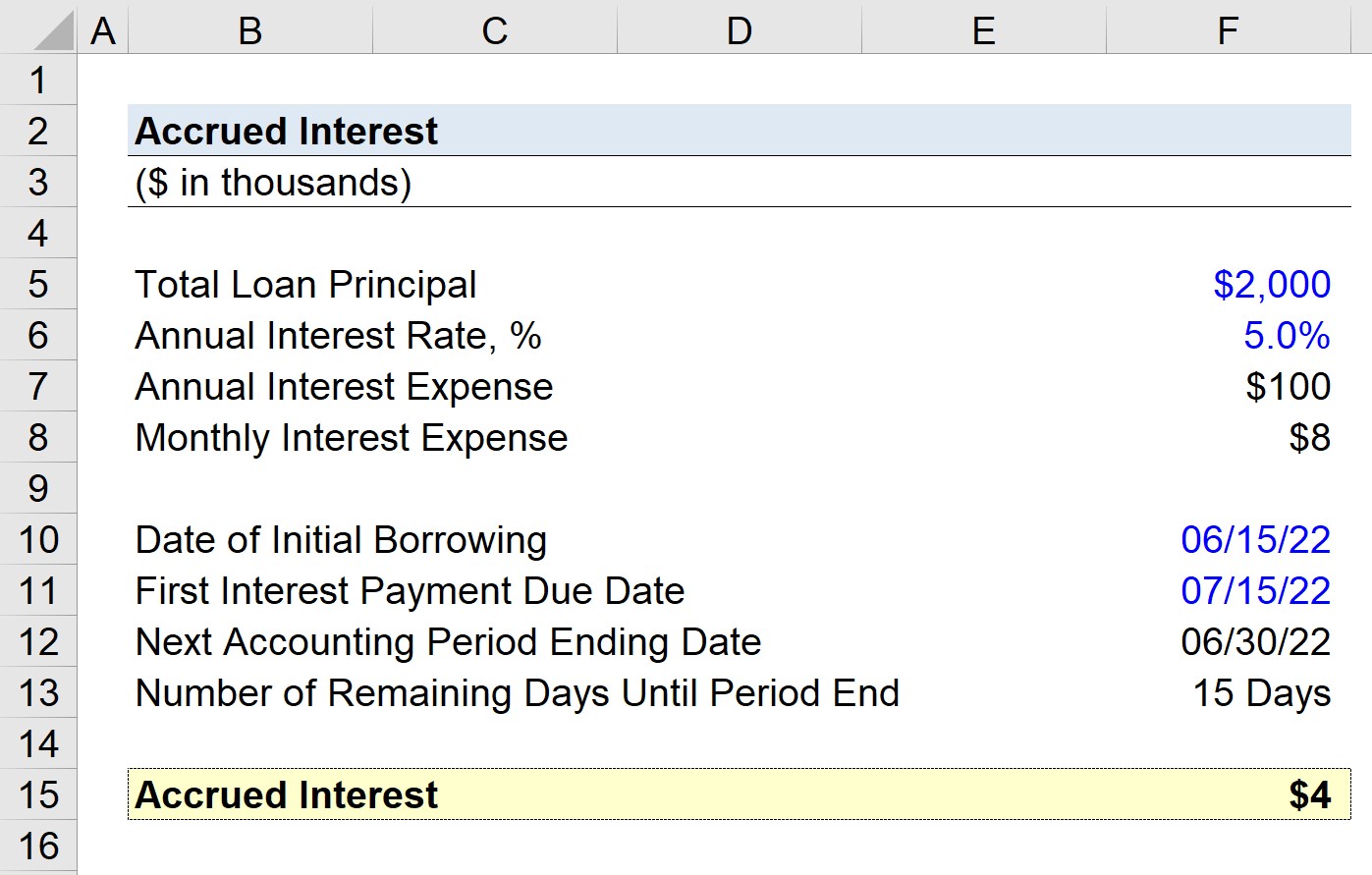

Accrued interest is the interest that accumulates on a loan or debt over a given period of time. It’s an important concept to understand if you’re taking out a loan or have an existing loan, as it can add to the amount you owe. Accrued interest works by adding the interest to the loan balance, meaning you’ll owe more in the end. This can be a tricky concept to wrap your head around, but it’s important to understand how it works so you can manage your finances more effectively. Accrued interest can be calculated in a few different ways, but the most common is to use the daily interest rate and the number of days since the last payment. It’s a good idea to keep an eye on this number, so you know exactly how much you owe.

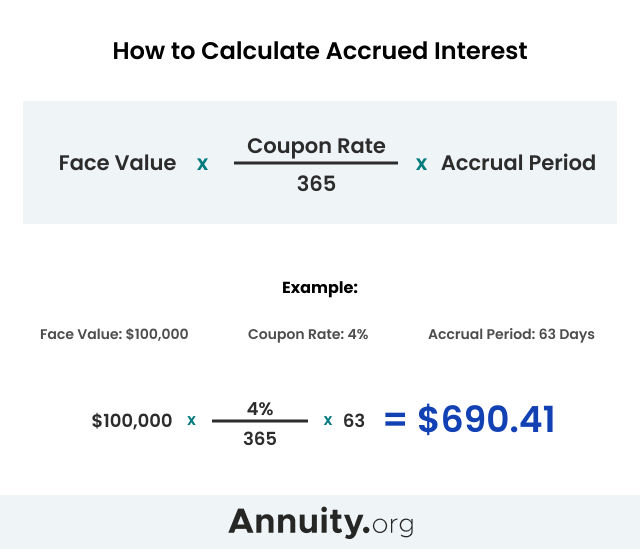

Understanding the Accrued Interest Calculation

Accrued interest is an important concept to understand when it comes to calculating interest on certain investments. Accrued interest is the interest that accumulates on an investment from the time of purchase to the time of payment. Understanding the accrued interest calculation is crucial for investors to ensure they are getting the best return on their investment. The calculation is based on the rate of interest, the amount of days the investment has been held, and the purchase price of the investment. Knowing how to calculate accrued interest can help investors maximize their returns and make more informed financial decisions. It is important to note that accrued interest is not paid out until the investment is sold or the bond matures, so investors must take this into consideration when making financial decisions.

Advantages and Disadvantages of Accrued Interest

Accrued interest is an important concept in finance, but there are both advantages and disadvantages to consider when deciding whether or not to use it. On the plus side, accrued interest can help you stay on top of payments and ensure that you’re not missing out on any interest that may be due. It also makes it easier to track when and how much interest is owed. On the downside, it can lead to confusion and mistakes when it comes to calculating interest, which can result in you paying too much or not enough. Ultimately, it’s important to understand the implications of accrued interest to make sure you’re making the best decision for your finances.

Tax Implications of Accrued Interest

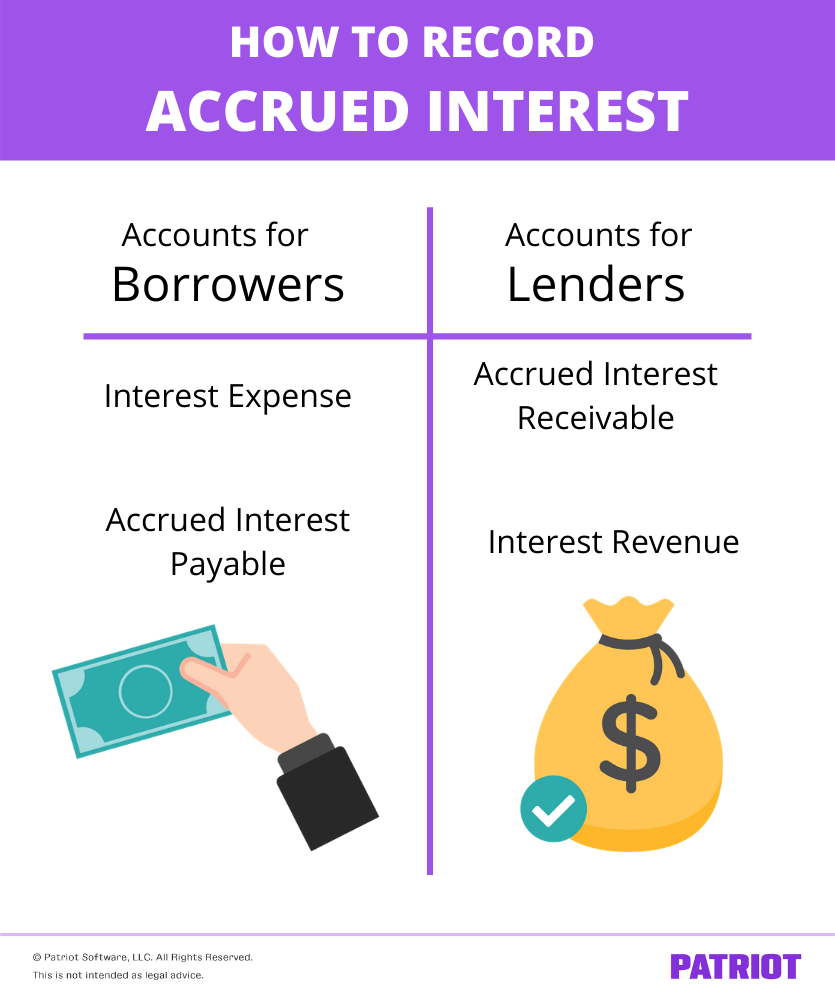

Accrued interest can have some serious tax implications for both lenders and borrowers. For lenders, accrued interest is generally considered taxable income, meaning that you may be required to pay taxes on any interest that has been accrued over the course of a loan’s life. On the other hand, borrowers may be able to deduct accrued interest on their tax returns as a way to minimize the amount of taxes they owe. Depending on the nature of the loan and the borrower’s individual situation, the deduction may or may not be allowed. It’s important to speak to a tax professional and get an accurate understanding of how accrued interest will affect your taxes.

Tips to Manage and Avoid Accrued Interest

If you want to avoid accumulating interest on your debts, the best way to do it is to make sure you pay off your bills on time. This is especially important when it comes to credit cards and other forms of revolving credit. Not only will you avoid paying interest on the existing balance, but you’ll also avoid any interest that might be added to the balance if you don’t make the payment. Additionally, it’s important to keep track of any additional fees or interest that might be added to your balance. If you’re not sure how much the interest rate is on your account, call up your credit card issuer and ask. Lastly, be mindful of how much you’re charging to your credit card. Paying your balance off in full each month can help you avoid any interest or other fees.