When you think of accounting, you probably think of financial statements and debits and credits. But there’s more to it than that. Accounting ratio is a financial term that refers to a mathematical comparison of two financial statement items.

For example, you might compare a company’s sales to its expenses, or its assets to its liabilities. The resulting number is called a “ratio.” Ratios can be used to evaluate a company’s financial health and performance.

In this blog post, we will explore what accounting ratios are and why they are important. We will also provide some examples of common ratios used in accounting.

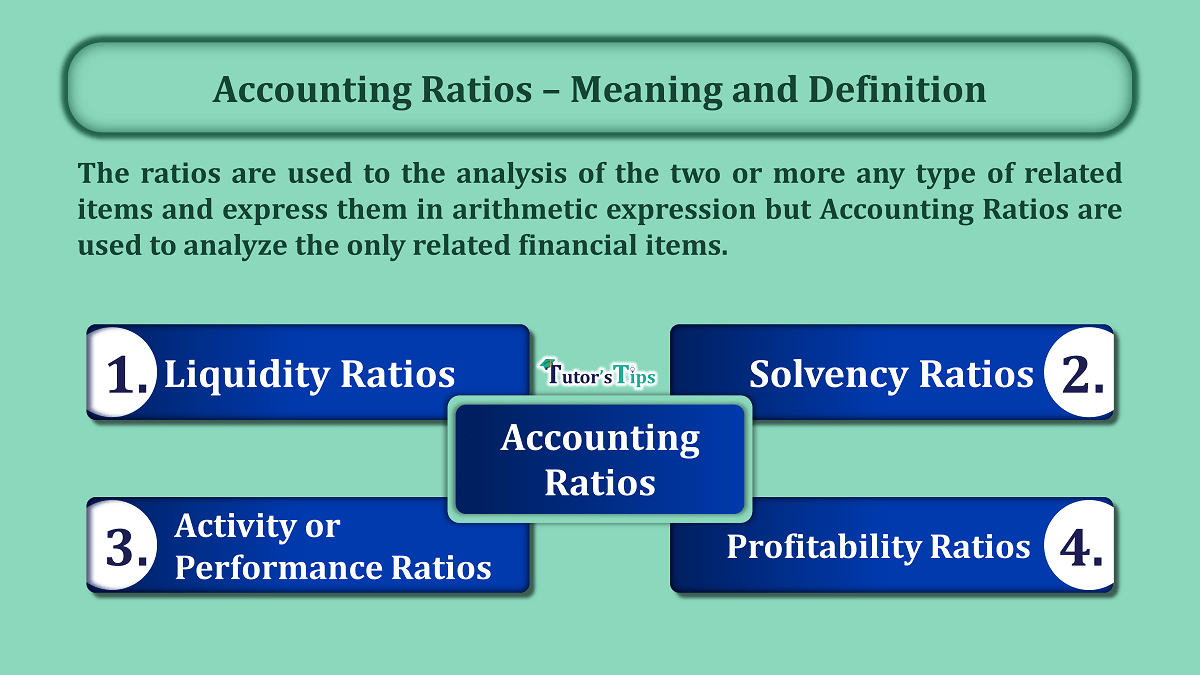

What Is Accounting Ratio?

An accounting ratio is a mathematical comparison of two financial statement items. The items are usually taken from the balance sheet, income statement, or statement of cash flows. The purpose of an accounting ratio is to measure various aspects of a company’s financial performance, such as its profitability, liquidity, or solvency.

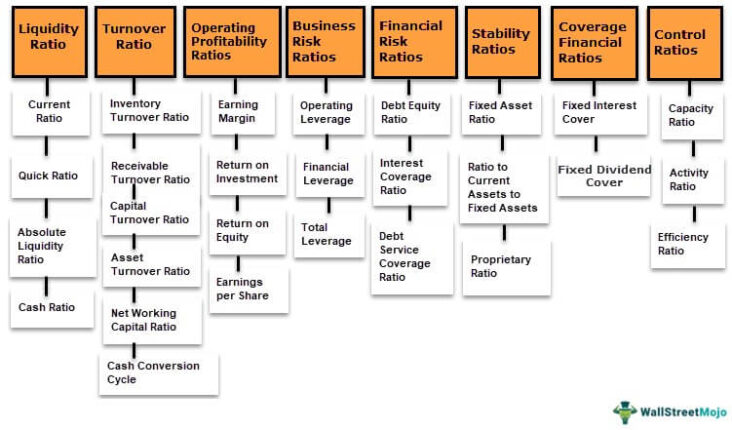

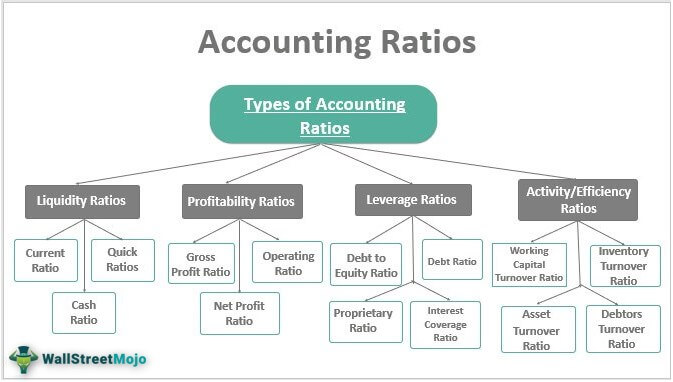

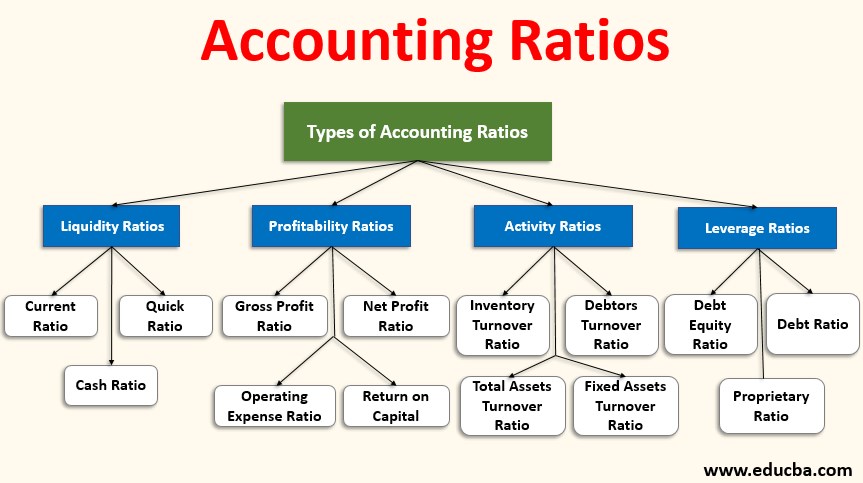

There are many different types of accounting ratios, each designed to measure a specific aspect of financial performance. Some common examples include the following:

-Gross margin ratio: This measures a company’s profitability by comparing its gross profit to its total revenue. A higher gross margin ratio indicates a more profitable company.

-Asset turnover ratio: This measures a company’s efficiency in using its assets to generate sales. A higher asset turnover ratio indicates a more efficient company.

-Debt-to-equity ratio: This measures a company’s financial risk by comparing its debt to its equity. A higher debt-to-equity ratio indicates a greater risk.

Role of Accounting Ratios

Accounting ratios are used to measure a company’s financial performance and health. Ratios can be used to compare a company’s financials to its industry peers or to its own historical results. They can also be used to predict a company’s future financial health.

There are many different types of accounting ratios, but some of the most important include:

-Gross margin: This ratio measures a company’s ability to generate profit from its sales. A higher gross margin indicates a more profitable business.

-Asset turnover: This ratio measures how efficiently a company is using its assets to generate sales. A higher asset turnover ratio indicates a more efficient use of assets.

-Debt-to-equity: This ratio measures a company’s financial leverage. A higher debt-to-equity ratio indicates a greater level of financial risk.

-Current ratio: This ratio measures a company’s ability to pay its short-term obligations with its current assets. A higher current ratio indicates a healthier business.

Financial Reporting

Financial reporting is the process of communicating financial information to shareholders, creditors, and other interested parties. Financial reports typically include income statements, balance sheets, and statements of cash flows.

The purpose of financial reporting is to provide information that is useful in making economic decisions. Financial reports can be used to evaluate a company’s financial health, assess its performance, and make decisions about investing and managing risks.

Financial reporting is governed by generally accepted accounting principles (GAAP), which provide guidance on how financial information should be presented. GAAP is issued by professional accounting associations, such as the International Accounting Standards Board (IASB).

There are two types of financial statements: audited and unaudited. Audited financial statements are prepared by independent accountants and are subject to an external audit. Unaudited financial statements are not subject to an external audit but may be reviewed by internal auditors.

When interpreting financial statements, it is important to consider the accounting methods used by the company. Different accounting methods can result in different numbers being reported on the financial statements. For example, companies can choose to use either accrual or cash basis accounting. Companies using accrual basis accounting report revenue when it is earned, regardless of when the cash is received. Companies using cash basis accounting report revenue when the cash is received, regardless of when the work was performed.

What Is Accounting Ratio? – Accounting Ratio Financial Definition

An accounting ratio is a financial ratio that measures one aspect of a company’s financial condition. There are many different types of accounting ratios, each measuring a different aspect of the company’s finances.

Some common accounting ratios include:

– The debt to equity ratio, which measures a company’s financial leverage.

– The current ratio, which measures a company’s ability to pay its short-term debts.

– The inventory turnover ratio, which measures how efficiently a company is using its inventory.

– The profit margin ratio, which measures a company’s profitability.