In accounting, the rate of return (ROR) is a measure of the profitability of an investment. It is computed by dividing the net income from the investment by the cost of the investment. The ROR is usually expressed as a percentage.

The accounting rate of return (ARR) is a measure of profitability that takes into account the time value of money. It is computed by dividing the average annual net income from the investment by the average invested capital. The ARR is usually expressed as a percentage.

The advantage of using the accounting rate of return over the simple rate of return is that it takes into account the time value of money. This makes it a more accurate measure of profitability.

Accounting rate of return can be used to compare different investments and to choose between them. It can also be used to evaluate the performance of an existing investment.

What is Accounting Rate of Return (ARR)?

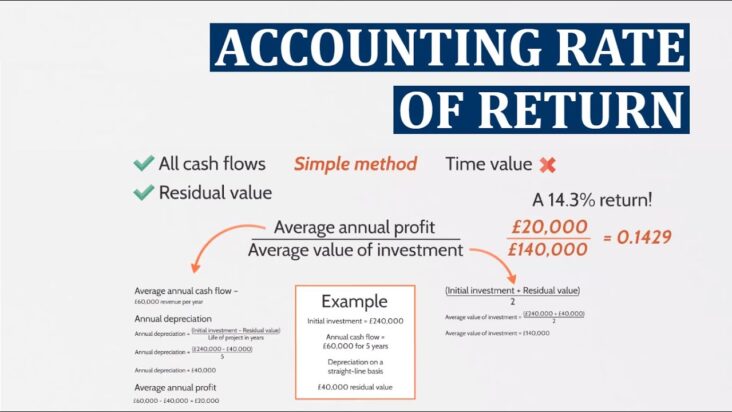

Accounting rate of return (ARR) is the percentage of average accounting profit earned on an investment over a particular period of time. The accounting profit is calculated by subtracting the interest expense from the total revenue. ARR is used as a tool to evaluate potential investments.

The higher the accounting rate of return, the better as it indicates that the investment is generating more profit. For example, if an investment has an accounting rate of return of 10%, it means that for every dollar invested, the company earns 10 cents in profit.

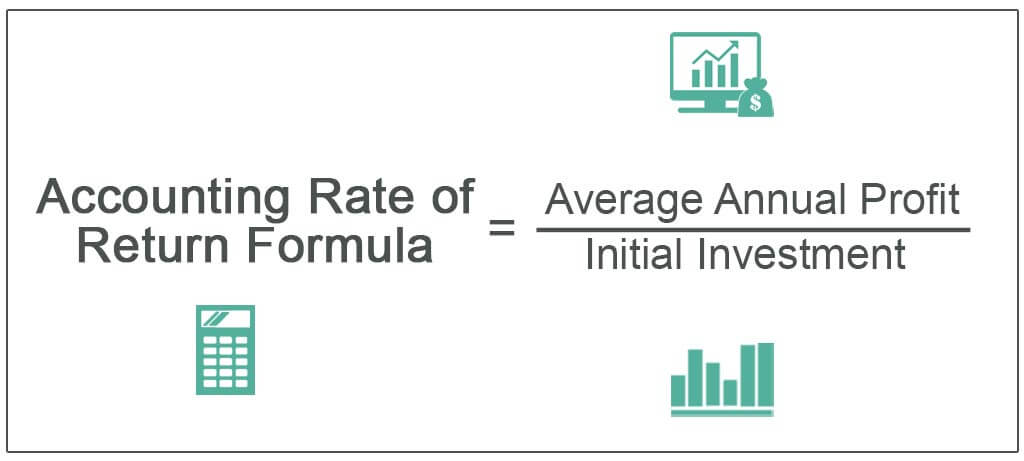

To calculate the accounting rate of return, divide the average accounting profit by the initial investment amount:

ARR = Average Accounting Profit / Initial Investment Amount

For example, let’s say Company XYZ is considering investing in a new factory. The initial investment required for the factory is $1 million. The company estimates that over a five-year period, the factory will generate annual profits of $200,000. To calculate the accounting rate of return, we would divide $200,000 by $1 million to get 0.2 or 20%.

It’s important to note that ARR only looks at profitability and doesn’t take into account other factors such as risk. As a result, ARR should not be used as the sole criteria for making investment decisions.

Accounting Rate of Return (ARR) Financial Definition

The accounting rate of return (ARR) is a financial ratio used to measure the profitability of an investment. The ratio is calculated by dividing the net present value (NPV) of an investment by its initial cost. The result is expressed as a percentage.

The accounting rate of return is a popular metric because it is relatively easy to calculate. However, the ratio has several limitations. For example, it does not consider the time value of money or the riskiness of an investment. As a result, the ARR may overstate or understate the true profitability of an investment.

How to Calculate the Accounting Rate of Return (ARR)?

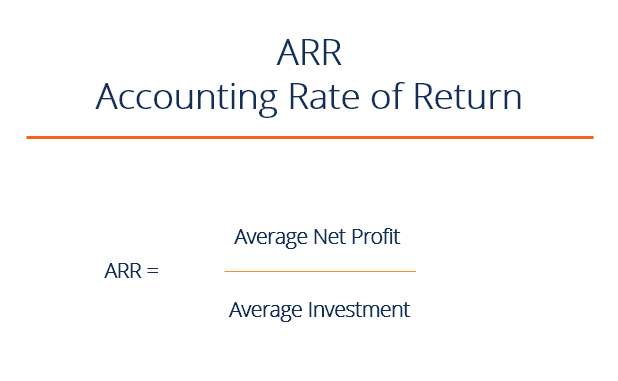

To calculate the accounting rate of return, divide the average net income by the average investment. The result is the accounting rate of return.

For example, say a company has an average net income of $100,000 and an average investment of $1 million. The accounting rate of return would be 10 percent (($100,000/$1 million) x 100).

What Is Accounting Rate of Return (ARR)? – Accounting Rate of Return (ARR) Financial Definition

Accounting rate of return (ARR) is defined as the average net income earned on an investment over its holding period divided by the average capital invested. The holding period is typically one year, but can be any length of time.

The ARR is a simple measure of profitability that is easy to calculate and understand. However, it has several limitations. First, it does not consider the time value of money. Second, it does not consider the riskiness of the investment. Third, it can be manipulated by changing the length of the holding period.

Despite its limitations, the ARR is still widely used by businesses and investors to evaluate potential investments.