Accounting profit is the total revenue of a company minus the total expenses. The term is used to describe the financial success of a business. It is different from economic profit, which factors in opportunity cost.

Many businesses try to maximize their accounting profit because it is the easiest way to increase shareholder value. However, there are cases where companies might choose to forgo short-term accounting profits in order to make long-term investments that will result in greater economic profits down the road.

What is Accounting?

When most people think of accounting, they think of financial statements and bookkeeping. However, accounting is much more than this. Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions.

The purpose of accounting is to provide financial information that is useful in making business decisions. The users of accounting information include managers, investors, creditors, and government agencies. Financial information is used in making decisions such as whether to invest in a company, how to finance a business expansion, or whether to buy or lease equipment.

Accounting information can be divided into two types: financial accounting and managerial accounting. Financial accounting provides information about a company’s financial position, performance, and cash flow. Managerial accounting provides information that is useful in managing a company. It includes information on costs, revenues, and profits.

The three main types of financial statements are the balance sheet, income statement, and statement of cash flows. The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The income statement shows a company’s revenues and expenses over a period of time. The statement of cash flows shows a company’s cash inflows and outflows over a period of time.

Generally accepted accounting principles (GAAP) are the rules that govern financial reporting. GAAP are set by rule-making bodies such as the Securities and Exchange Commission (SEC) in the United States and the

What is Profit?

When most people think of profit, they think of accounting profit. Accounting profit is defined as the total revenue from sales minus the total costs of goods sold and operating expenses. It is important to note that accounting profit does not take into account the cost of capital, which is the cost of funds used to finance the business. For this reason, accounting profit is often referred to as net income or earnings before interest and taxes (EBIT).

The Difference Between Profit and Accounting Profit

Profit is the goal of any business, but what exactly is profit? And how does it differ from accounting profit?

Profit, also called net income, is the total revenue of a business minus the total expenses. Accounting profit, on the other hand, is the total revenue of a business minus the total expenses, minus any one-time items or non-operating expenses.

So why is accounting profit important? Because it’s a more accurate measure of a business’s true profitability. One-time items and non-operating expenses can distort profit margins, making it difficult to compare apples to apples. By excluding these items, accounting profit gives you a clearer picture of a business’s financial performance.

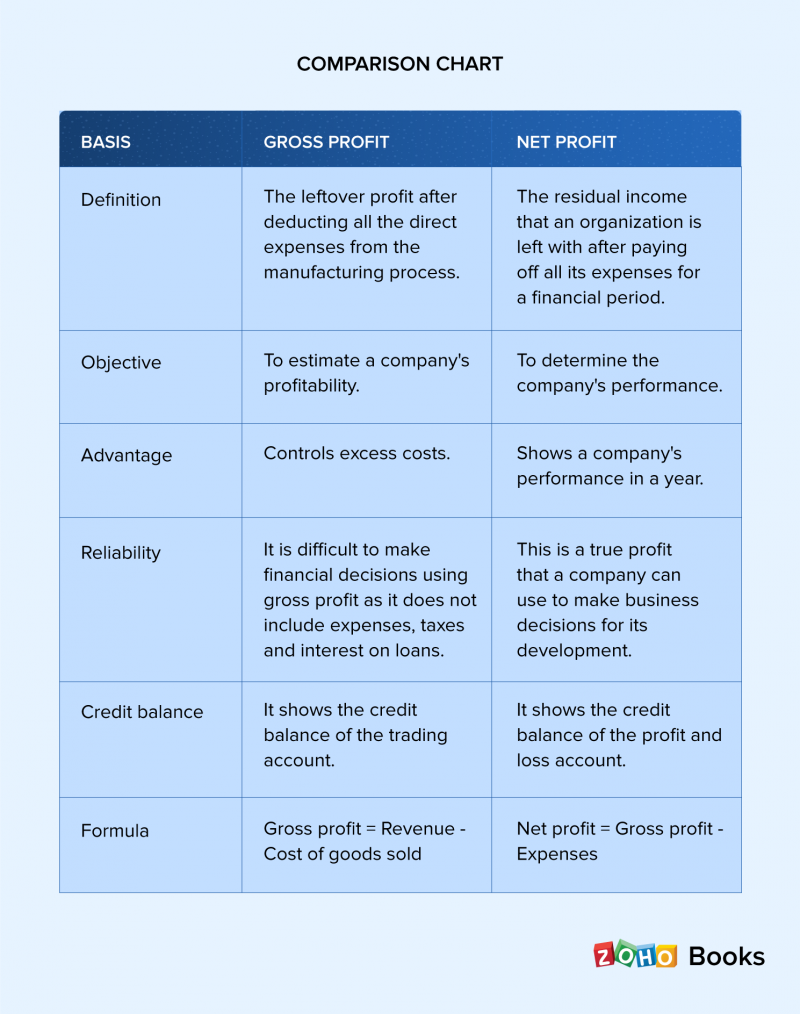

The Difference Between Gross Profit and Net Income

Gross profit is the total revenue less the cost of goods sold. Net income is the total revenue less the cost of goods sold and all expenses. The difference between gross profit and net income is that net income also includes all other expenses, such as operating expenses, interest, and taxes.

What Is Accounting Profit? – Accounting Profit Financial Definition

Accounting profit is the financial gain or loss that a company reports on its income statement. This profit or loss is calculated using Generally Accepted Accounting Principles (GAAP).

A company’s accounting profit may differ from its true economic profit. True economic profit takes into account all revenues and costs, including opportunity costs. For example, if a company could have earned a higher return by investing its resources in another project, but instead invested them in the project that generated the accounting profit, then its accounting profit would be less than its true economic profit.

Despite this potential difference, accounting profit is still an important metric for companies and investors to track. It provides valuable information about a company’s financial performance and can be used to compare different companies.