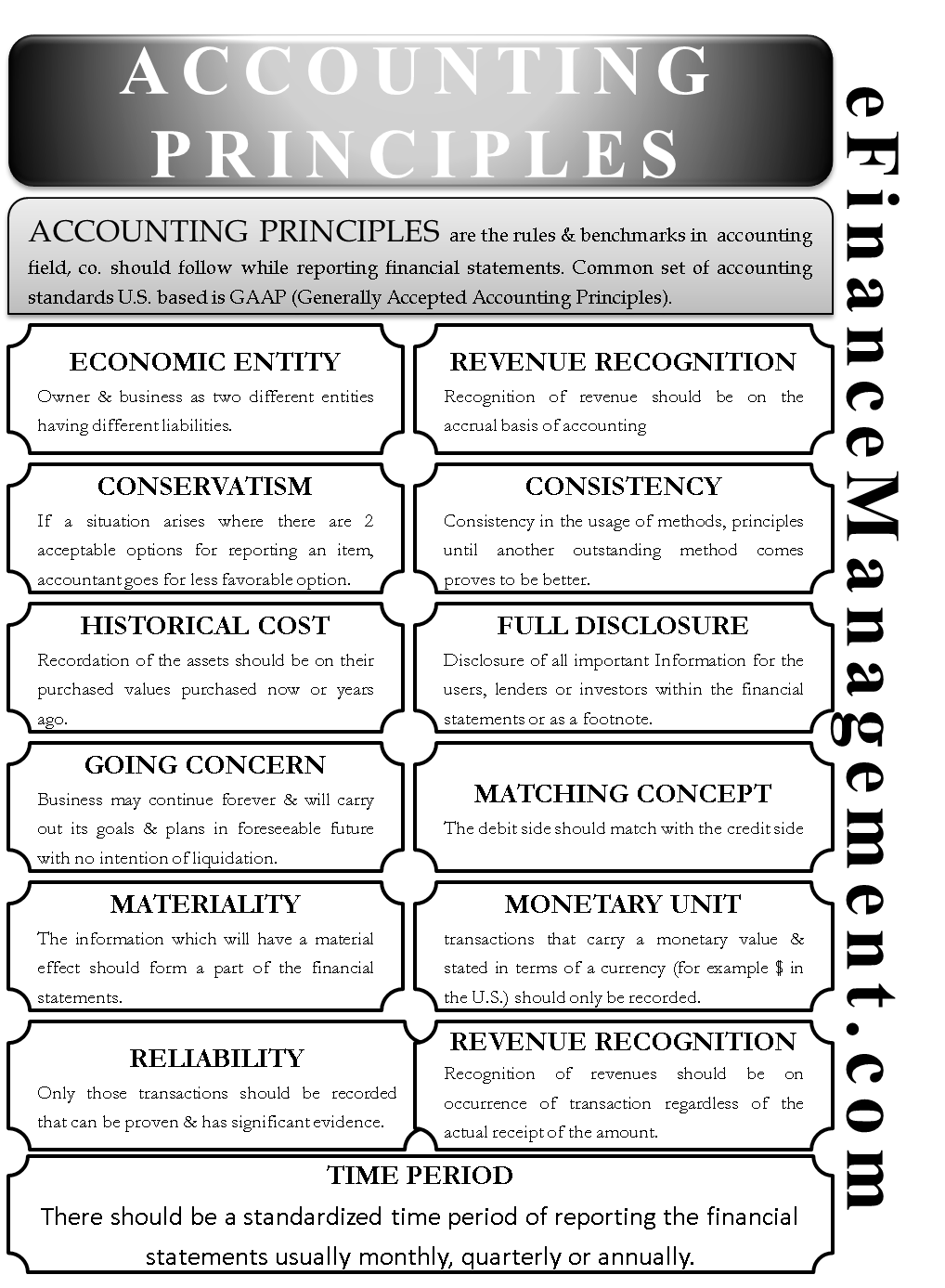

If you’re new to the world of accounting, you may be wondering, “What is accounting principles?” Accounting principles are the foundation upon which financial reporting is based. In other words, they provide guidance for how financial transactions should be recorded and reported.

There are generally accepted accounting principles (GAAP) that all businesses must follow. These principles were established by the Financial Accounting Standards Board (FASB). In addition to GAAP, there are also International Financial Reporting Standards (IFRS), which are set by the International Accounting Standards Board (IASB).

While GAAP and IFRS may seem similar, there are some key differences between the two. For example, GAAP is focused on historical cost while IFRS is focused on fair value. As a result, financial statements prepared under GAAP can sometimes paint a different picture than those prepared under IFRS.

Despite these differences, both GAAP and IFRS provide valuable guidance for financial reporting. By understanding and following these principles, businesses can ensure that their financial statements are accurate and informative.

What is Accounting Principles?

Accounting principles are a set of rules and guidelines that companies use to record and report their financial activity. The most common accounting principles are generally accepted accounting principles (GAAP), which are a set of standards that have been developed by the Financial Accounting Standards Board (FASB).

There are four main types of financial statements that companies prepare:

Income statement: This statement shows a company’s revenue, expenses, and net income for a period of time.

Balance sheet: This statement shows a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

Statement of cash flows: This statement shows a company’s cash inflows and outflows for a period of time.

Statement of stockholders’ equity: This statement shows a company’s changes in equity for a period of time.

Accounting principles also dictate how companies should disclose information in their financial statements. For example, companies must disclose information about any material transactions or events that could have a significant impact on their financial position or performance.

Who Uses Accounting Principles?

Accounting principles are the rules and guidelines that companies use to record and report their financial information. These principles are designed to create financial statements that are accurate, reliable, and consistent.

There are many different types of businesses and organizations that use accounting principles. For-profit companies use accounting principles to produce financial statements that show how much money they have made or lost during a period of time. Non-profit organizations use accounting principles to produce financial statements that show how much money they have raised and spent during a period of time. Governments use accounting principles to produce financial statements that show how much money they have collected in taxes and other revenue, and how much money they have spent on expenses.

Individuals can also use accounting principles to manage their personal finances. By tracking their income and expenses using accounting principles, individuals can create a budget and make sure they are living within their means.

Accounting Principles Definition

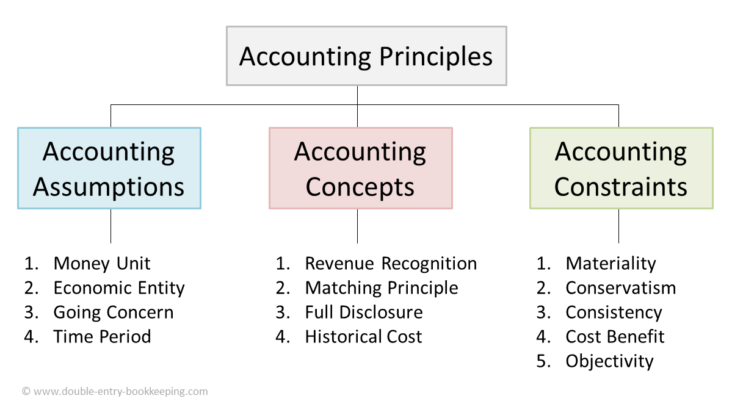

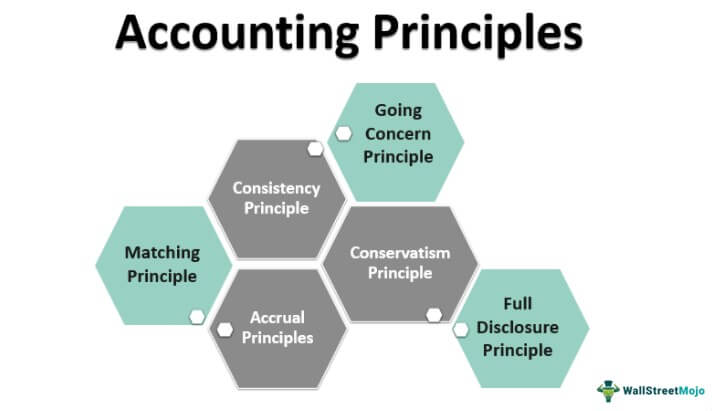

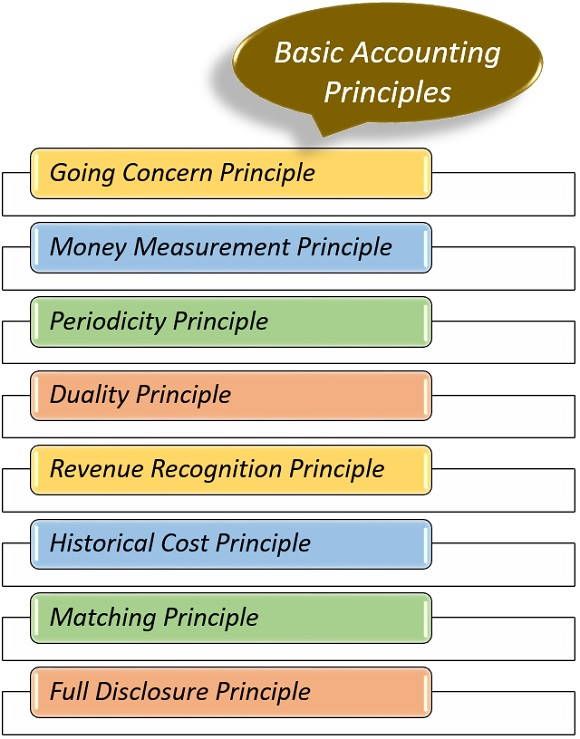

Accounting principles are the building blocks for GAAP. Without them, financial reporting would be a mess. The key accounting principles include:

-Revenue recognition: Revenue should be recognized when it is earned, not when it is collected. This principle is important because it ensures that companies don’t artificially inflate their revenue.

-Matching: Expenses should be matched with the revenue they helped generate. This principle is important because it ensures that companies don’t artificially inflate their profits.

-Full disclosure: All material information should be disclosed in financial statements. This principle is important because it helps investors make informed decisions.

-Consistency: Companies should use the same accounting methods from one period to the next. This principle is important because it helps investors compare apples to apples when comparing financial statements.

How Do You Understand Accounting Principles?

There are generally accepted accounting principles (GAAP) that provide guidance on how transactions should be recorded and presented in financial statements. The goal is to maintain consistency and fairness in financial reporting.

While each business is different and may use different methods to track and report their finances, there are still some core accounting principles that all businesses should follow. These include:

1. Recognition: This principle dictates that businesses should only record transactions when they occur, not before or after. This ensures that the financial statements accurately reflect the company’s current financial position.

2. Valuation: This principle ensures that all assets and liabilities are reported at their fair market value. This allows for more accurate comparisons between companies and over time.

3. Matching: This principle states that businesses should match revenue and expenses in the same period. This provides a clear picture of the company’s profitability for a specific period of time.

4. Disclosure: This principle requires businesses to disclose all relevant information about their financial position, performance, and risk factors. This allows investors and other interested parties to make informed decisions about the company.

Where Can I Learn About Accounting Principles?

There are several ways you can learn about accounting principles. One way is to attend a college or university that offers accounting courses. Many colleges and universities offer accounting programs that teach the basic concepts of accounting principles.

Another way to learn about accounting principles is to read books or articles on the subject. There are many books and articles available that explain the basics of accounting principles. You can also find information on accounting principles online. There are many websites that offer information on accounting principles.

You can also talk to an accountant or financial advisor to get more information on accounting principles. Accountants and financial advisors are familiar with the basic concepts of accounting and can provide you with helpful information.

What Is Accounting Principles? – Accounting Principles Financial Definition

“Accounting principles” refers to the basic guidelines and standards that govern financial accounting. The primary goal of accounting is to provide information that is useful in making business decisions. Financial accounting focuses on the reporting of an organization’s financial information to external users, such as shareholders and creditors.

The main objective of accounting principles is to ensure that financial statements accurately reflect the transactions and events that have occurred during the reporting period. In order to achieve this, accountants must follow certain rules and guidelines when recording, classifying, and summarizing financial information.

There are generally accepted accounting principles (GAAP) that must be followed in the United States. These GAAP are issued by professional organizations, such as the Financial Accounting Standards Board (FASB). International Financial Reporting Standards (IFRS) are issued by the International Accounting Standards Board (IASB) and are used in many countries outside the United States.

While GAAP and IFRS are different, they both share common objectives, such as providing transparent and consistent financial information. This allows investors and creditors to make informed decisions about investing in or lending to a company.