What is accounting method? It’s a system for recording and summarizing financial transactions. The two main types of accounting methods are accrual basis accounting and cash basis accounting.

-What is Accounting Method?

There are two types of accounting methods: cash and accrual. Cash accounting is the simplest method and records transactions only when money changes hands. This method does not provide a clear picture of your business’s financial health because it does not account for money that is owed to you (receivables) or money that you owe (payables). The accrual method is more complex, but provides a more accurate picture of your business’s financial health. This method records transactions when they occur, regardless of when the money changes hands. This means that receivables and payables are included in your financial records.

-Types of Accounting Methods

There are two types of accounting methods: accrual basis accounting and cash basis accounting.

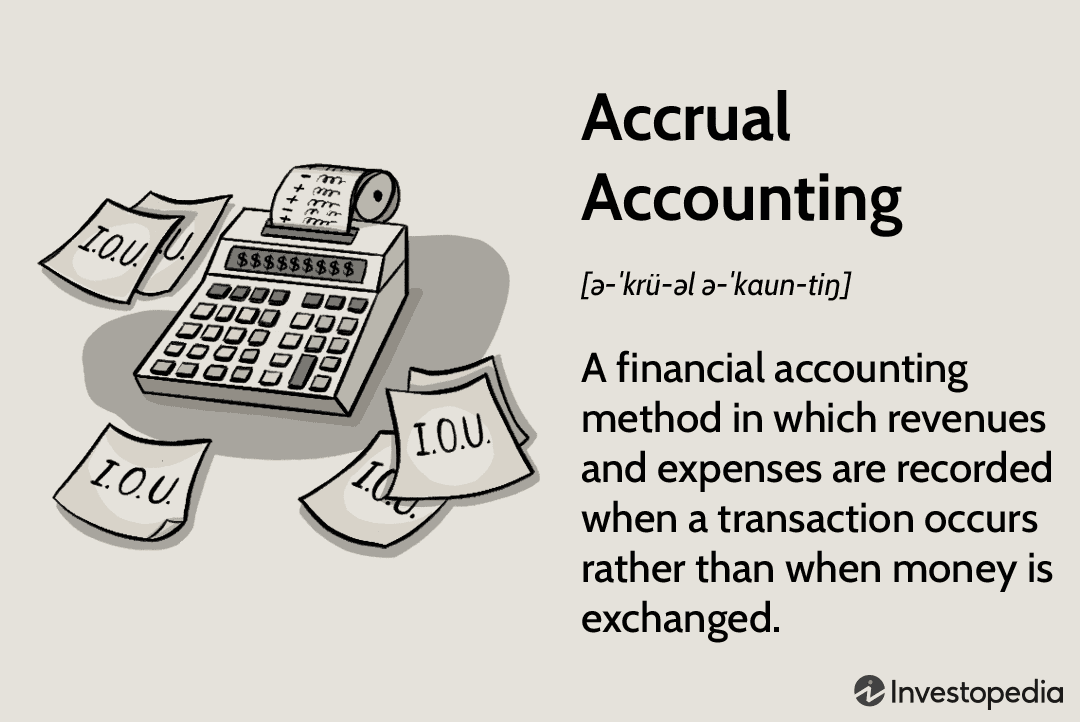

Accrual basis accounting is the most common type of accounting. It records transactions when they occur, regardless of when the money is actually paid. This provides a more accurate picture of a company’s financial position.

Cash basis accounting only records transactions when the money is actually paid. This can be misleading, because it doesn’t show the full picture of a company’s financial position.

-What are the Different Types of Accounting Methods?

There are two types of accounting methods: cash basis and accrual basis.

The cash basis of accounting recognizes revenue when cash is received and expenses when they are paid. This method is simple and easy to understand, but it can be misleading because it does not show the true picture of a company’s financial condition. For example, if a company has receivables (money that is owed to them), the cash basis method will not show this as income until the receivables are collected.

The accrual basis of accounting recognizes revenue when it is earned and expenses when they are incurred. This method gives a more accurate picture of a company’s financial condition because it includes all revenues and expenses, regardless of when the cash is actually received or paid. For example, if a company has receivables, the accrual basis method will show this as income when the sale is made, even if the cash is not received until later.

Which accounting method you use depends on your business and what information you need for your financial statements. The accrual basis method is generally used by businesses because it provides more information for decision-making. However, the cash basis method can be used in certain situations, such as when you arepreparing personal financial statements or tax returns.

-Businesses that use each accounting method

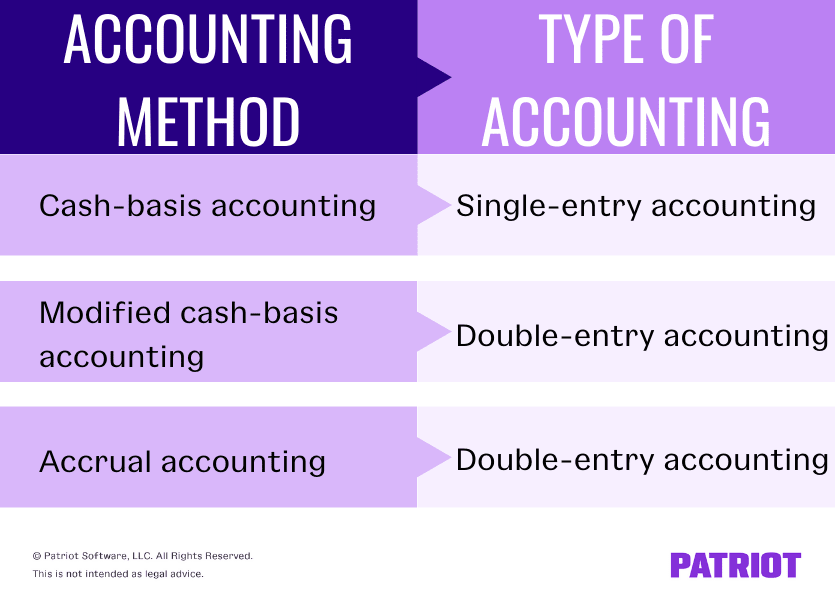

If you’re a business owner, you have several accounting methods to choose from when keeping track of your finances. The most common accounting methods used by businesses are the cash basis, accrual basis, and hybrid method.

The cash basis accounting method is the most straightforward and easiest to understand. With this method, you only record transactions when cash changes hands. This means that revenue is only recognized when it’s received, and expenses are only recognized when they’re paid. This method is best for businesses with simple financial transactions.

The accrual basis accounting method is more complex than the cash basis method, but it provides a more accurate picture of your finances. With this method, you record transactions when they occur, regardless of when the money changes hands. This means that revenue is recognized when it’s earned, and expenses are recognized when they’re incurred. This method is best for businesses with complex financial transactions.

The hybrid accounting method is a combination of the cash basis and accrual basis methods. With this method, you can choose to either record transactions when they occur or when the money changes hands. This flexibility can be helpful if you have some complex financial transactions but want to keep things simple for your accountant or bookkeeper.

-Accounting Methods Examples

There are two types of accounting methods: cash basis accounting and accrual basis accounting.

With cash basis accounting, revenues and expenses are only recognized when cash is exchanged. This method is typically used by small businesses because it is simpler than accrual basis accounting.

With accrual basis accounting, revenues and expenses are recognized when they are incurred, regardless of when cash is exchanged. This method is used by most large businesses because it provides a more accurate picture of a company’s financial position.

What Is Accounting Method? – Accounting Method Financial Definition

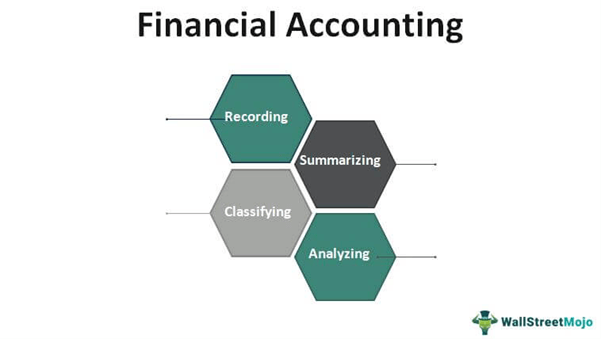

Accounting method is the process of recording and classifying financial transactions to provide information that is useful in making business decisions. The three most common types of accounting methods are cash basis, accrual basis, and hybrid basis.

Cash basis accounting records only transactions when cash is exchanged. This method is simple to use and is often used by small businesses. However, it can be difficult to track expenses and income, which can lead to inaccurate financial reports.

Accrual basis accounting records transactions when they occur, regardless of when cash is exchanged. This method provides a more accurate picture of a business’s financial position, but it can be more complex to use.

Hybrid basis accounting combines elements of both cash basis and accrual basis accounting. This method can provide a more accurate picture of a business’s financial position than either cash basis or accrual basis accounting alone.