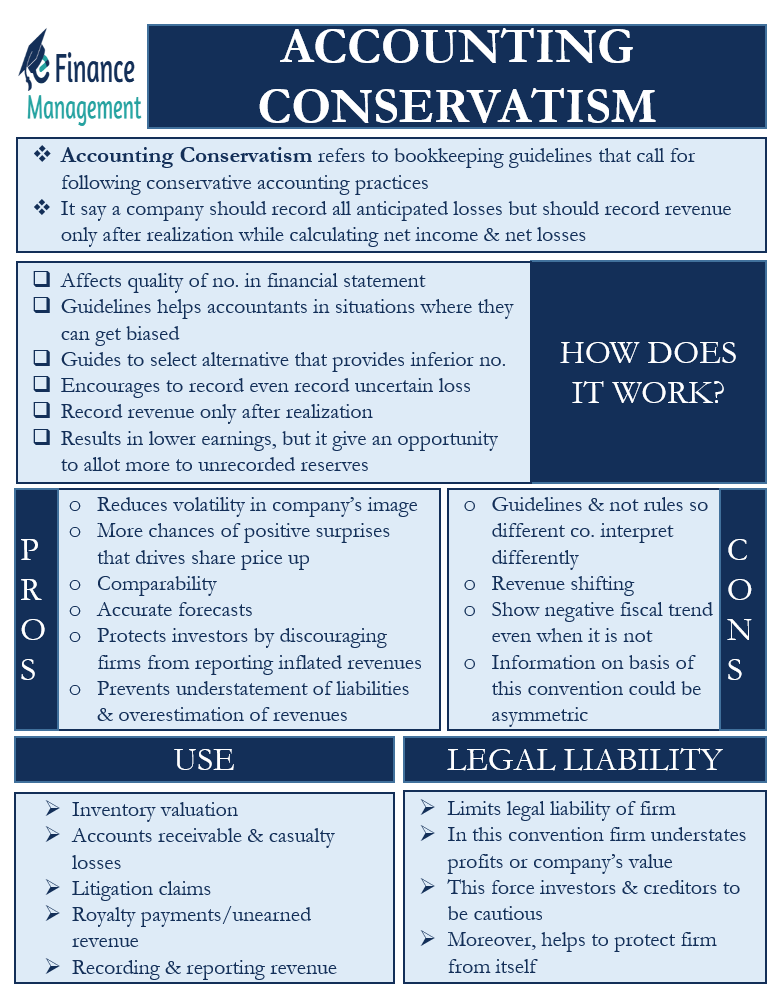

Accounting conservatism is an accounting principle that requires companies to record losses, but not gains, in their financial statements. The goal of this principle is to provide a more accurate picture of a company’s financial health.

This principle is based on the idea that it is better to be safe than sorry. Companies should err on the side of caution when it comes to recording their financial information. This means that they should only record losses when they are absolutely sure that they have incurred them.

The concept of accounting conservatism has come under fire in recent years. Critics argue that it can lead to companies understating their profits and overstating their losses. As a result, they say, accounting conservatism can give investors a false impression of a company’s financial health.

Despite the criticism, accounting conservatism remains a widely used accounting principle. Many companies continue to follow it because they believe it provides a more accurate portrayal of their financial situation.

What is accounting conservatism?

Accounting conservatism is an important concept in financial accounting. It refers to the practice of recording expenses and losses in the period when they occur, rather than deferring them to future periods. This approach ensures that the financial statements reflect the true financial position of the company, and provide a clear picture of its recent performance.

There are several reasons why accounting conservatism is important. First, it provides a more accurate picture of the company’s financial position. By recording expenses and losses in the period when they occur, the balance sheet will more accurately reflect the company’s assets and liabilities. Second, it ensures that the income statement reflects the company’s true profitability. If losses and expenses are deferred to future periods, they will not be reflected in the current period’s income statement. As a result, the current period’s profitability will be overstated.

Third, accounting conservatism protects against earnings manipulation. If companies were allowed to defer losses and expenses to future periods, they could artificially boost their reported earnings in any given period. This would make it difficult for investors to compare apples to apples when evaluating different companies’ financial performance. Finally, accounting conservatism provides a measure of protection against fraud. If losses and expenses are notrecorded in the period when they occur, it may be more difficult to detect fraudulent activity.

Overall, accounting conservatism is a good thing. It provides a more accurate picture of a company’s financial position and performance, and protects against earnings manipulation and fraud.

Accounting conservatism financial definition

Accounting conservatism is an accounting principle that requires accountants to record liabilities and expenses when they occur, rather than when they are paid. This principle is intended to provide a more accurate picture of a company’s financial position.

However, some critics argue that accounting conservatism can lead to understated earnings and overstated liabilities, which can give investors a false sense of security.

Accounting conservatism and depreciation

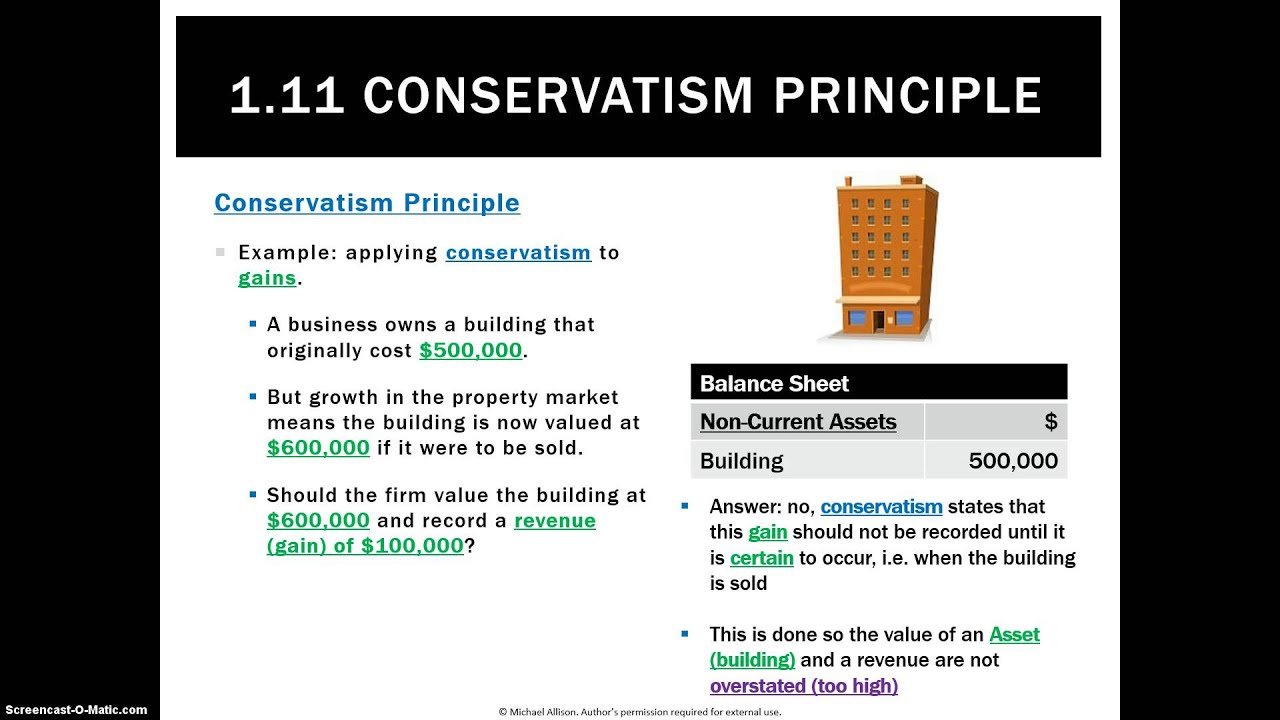

Accounting conservatism is the recognition of losses in a timely manner and the deferral of gains until they are realized. The goal is to reflect the true economic position of the company.

There are two main types of accounting conservatism: recognition and measurement.

Recognition conservatism refers to the timely recognition of losses. This means that when there is uncertainty about whether a loss has been incurred, the accountant will err on the side of caution and recognize the loss.

Measurement conservatism refers to the deferral of gains until they are realized. This means that when there is uncertainty about whether a gain will be realized, the accountant will defer recognition of the gain until it is certain that it will be realized.

Accounting conservatism is important because it ensures that financial statements provide a true and fair view of a company’s financial position. It also helps to protect against fraud and errors by requiring that losses be recognized in a timely manner and gains be deferred until they are certain to be realized.

How accounting conservatism affects financial statements

Accounting conservatism is an accounting principle that requires accountants to record liabilities and expenses as soon as they are incurred, even if the payments are not due until a later date. This principle is intended to provide a more accurate picture of a company’s financial position.

While accounting conservatism can make financial statements more accurate, it can also have some negative effects. For example, if a company incurs a large expense that will not be paid until next year, the expense will be recorded on this year’s financial statements, which could make the company’s financial position look worse than it actually is. In addition, accounting conservatism can make it difficult to compare financial statements from different companies, because each company may be using different methods to account for their expenses.

What Is Accounting Conservatism? – Accounting Conservatism Financial Definition

Accounting conservatism is an accounting principle that requires accountants to use caution when recognizing revenue and to be conservative when estimating the value of assets. This principle is also known as the prudence principle.

The goal of accounting conservatism is to provide accurate financial statements that reflect a company’s true financial position. This means that accountants must be careful not to overstate revenue or understate expenses.

Accounting conservatism is important because it helps investors and creditors make informed decisions about whether or not to invest in a company. If a company’s financial statements are not accurate, it can lead to bad investment decisions.

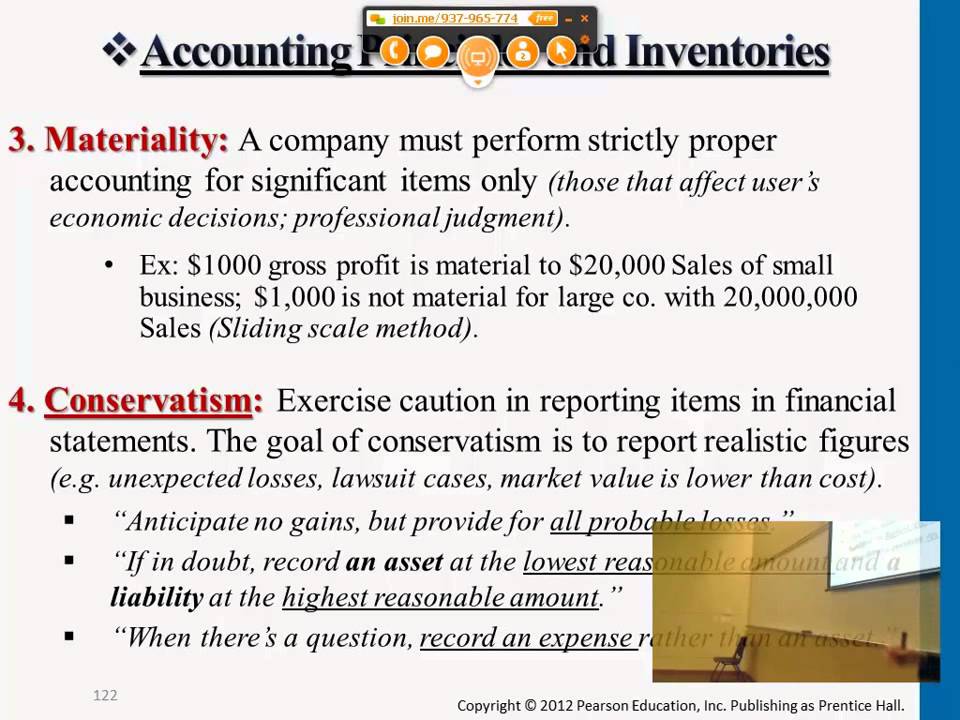

There are a few different ways that accountants can be conservative:

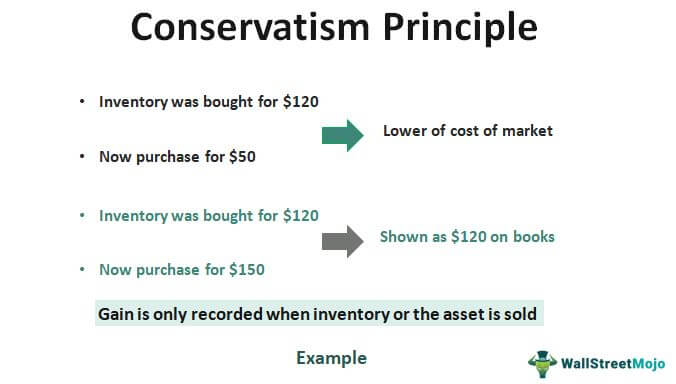

1) Recognizing revenue only when it is earned: This means that revenue should not be recognized until it is actually received. For example, if a company sells a product on credit, the sale should not be recorded as revenue until the product is actually delivered and the customer pays for it.

2) Recognizing expenses when they are incurred: This means that expenses should be recorded as soon as they are incurred, even if they will not be paid until later. For example, if a company incurs costs for raw materials, these costs should be recorded as expenses even if the materials have not yet been used in production.

3) Estimating the value of assets cautiously: This means that assets should be valued at their current market value, rather than at their original purchase price.