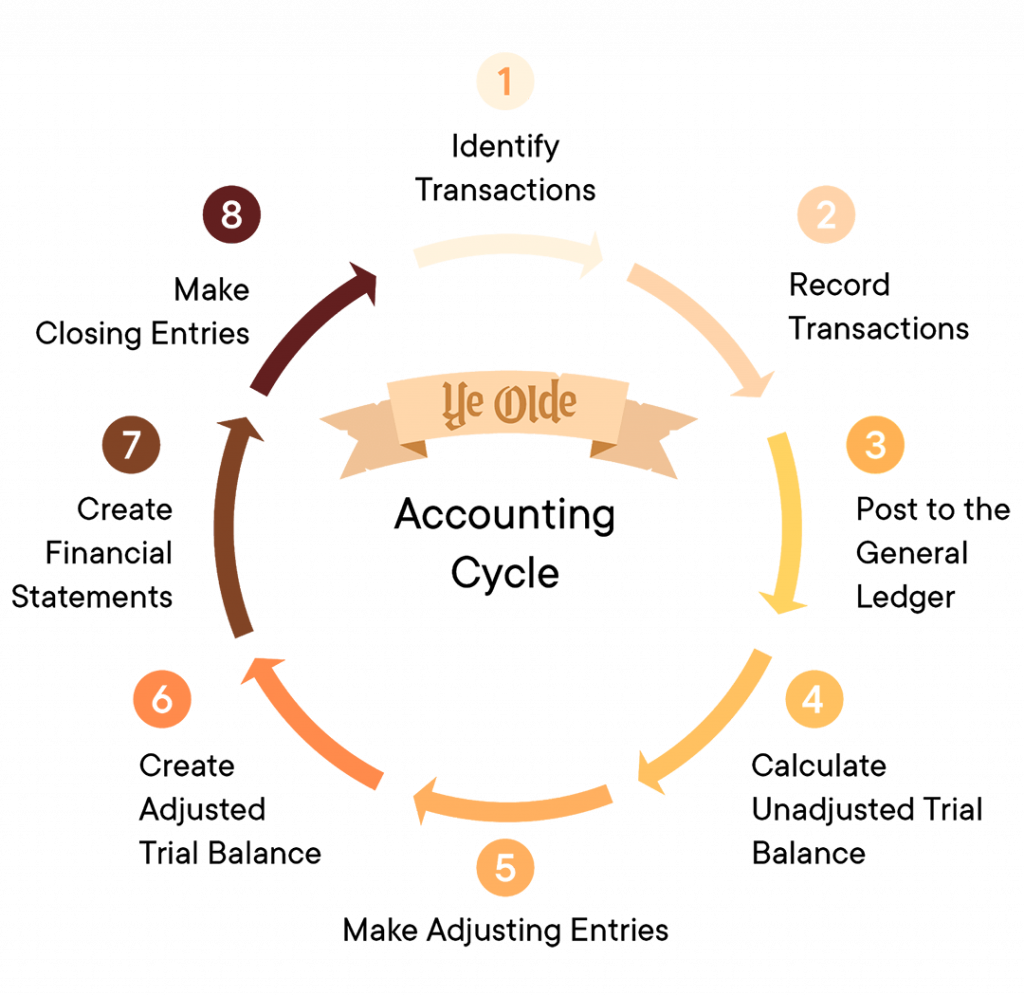

The accounting cycle is the process that companies use to record and report their financial activities. The cycle begins when a transaction occurs and ends when the financial statements are prepared.

There are four main steps in the accounting cycle: recording, classifying, summarizing, and presenting the financial data. Each step is important in order to produce accurate financial statements.

What is the accounting cycle?

The accounting cycle is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. The accounting cycle begins when a transaction occurs and ends with the preparation of financial statements.

There are four main steps in the accounting cycle:

1. Recording – This step involves journalizing the transactions and posting them to the ledger.

2. Classifying – This step involves sorting the transactions into categories so that they can be properly analyzed.

3. Summarizing – This step involves creating financial statements that provide information about the company’s financial position, performance, and cash flow.

4.Analyzing – This step involves interpretation of the financial statements in order to make sound business decisions.

Financial Definition of accounting cycle

The accounting cycle is the process that companies use to record and report their financial transactions. The cycle begins when a transaction occurs and ends when the financial statements are published.

There are four main steps in the accounting cycle:

1. Recording transactions in journals

2. Posting journal entries to ledger accounts

3. Preparing financial statements

4. Closing the books

The first step in the accounting cycle is recording transactions in journals. This involves documenting the date, amount, and type of each transaction in a journal entry.

The second step is posting journal entries to ledger accounts. Ledger accounts are used to track specific types of transactions, such as cash, inventory, or Accounts Receivable.

The third step is preparing financial statements. Financial statements show a company’s financial position, performance, and cash flow. They are used by shareholders, creditors, and other interested parties to make decisions about investing in or lending to a company.

The fourth and final step in the accounting cycle is closing the books. This involves resetting all of the temporary ledger account balances to zero so that they can be used again in the next reporting period.

How to use the accounting cycle

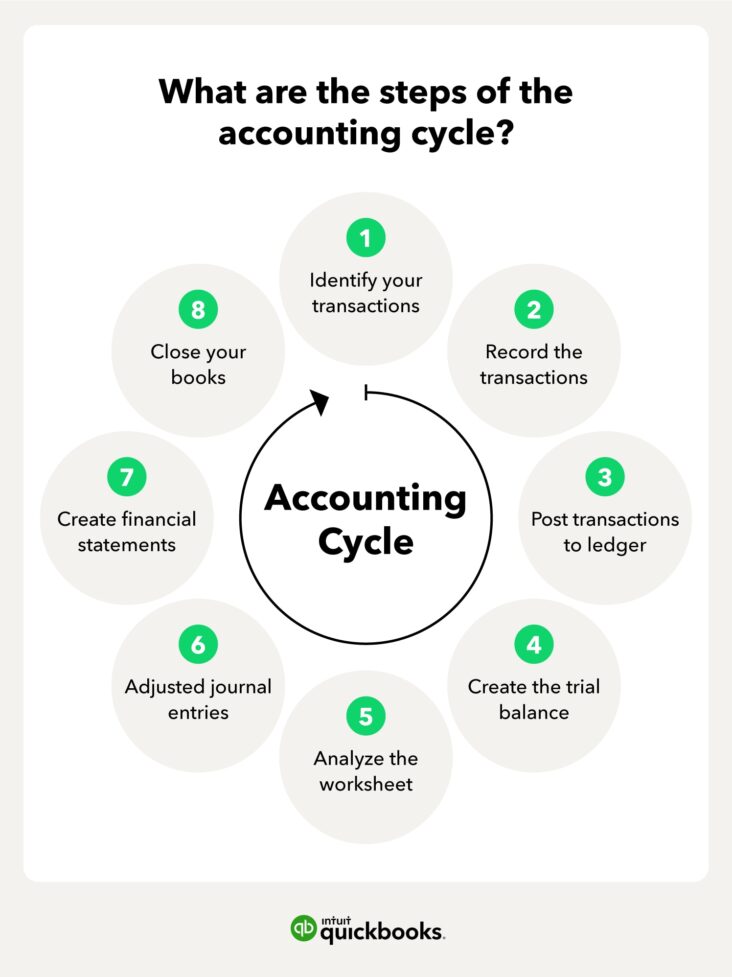

In essence, the accounting cycle is the process of recording and classifying financial transactions to prepare financial statements, as well as closing the books at the end of an accounting period. The steps in the accounting cycle include:

1. Journalizing transactions: This step involves recording transactions in a journal. A journal is a chronological record of all financial transactions that have taken place within an accounting period.

2. Posting to ledgers: Once transactions have been journalized, they need to be posted to the appropriate ledger accounts. A ledger is a record of all financial transactions that pertain to a specific account.

3. Adjusting entries: Adjusting entries are made at the end of an accounting period to ensure that all relevant financial information is included in the financial statements.

4. Preparing financial statements: Financial statements show a company’s financial position, performance, and cash flow.

5. Closing the books: At the end of an accounting period, temporary accounts are closed so that they can be reset for the next period.

Types of accounting cycles

There are four types of accounting cycles:

1. Merchandising accounting cycle

2. Manufacturing accounting cycle

3. Service accounting cycle

4. Non-profit accounting cycle

1. Merchandising accounting cycle:

The merchandising accounting cycle is the process that companies use to track inventory and revenue from the sale of goods. This type of accounting is often used by retailers and wholesalers.

2. Manufacturing accounting cycle:

The manufacturing accounting cycle is the process that companies use to track inventory, revenue, and expenses from the production of goods. This type of accounting is often used by manufacturers.

3. Service accounting cycle:

The service accounting cycle is the process that companies use to track revenue and expenses from the provision of services. This type of accounting is often used by service-based businesses, such as consultants, plumbers, and landscapers.

4. Non-profit accounting cycle:

The non-profit accounting cycle is the process that organizations use to track revenue and expenses in order to measure their performance against their mission statement or goals. This type of accounting is often used by charities and other non-profit organizations.

What Is Accounting Cycle? – Accounting Cycle Financial Definition

An accounting cycle is the process of recording and classifying financial transactions to prepare financial statements, as well as calculating taxes and other obligations. The accounting cycle typically starts with the recording of transactions in journals, which are then posted to ledgers. From there, trial balance sheets are prepared, and finally, financial statements and tax returns are filed.

The entire accounting cycle can take a month or more to complete, depending on the size and complexity of the business. Many businesses use accounting software to automate the process and keep track of their finances more easily.