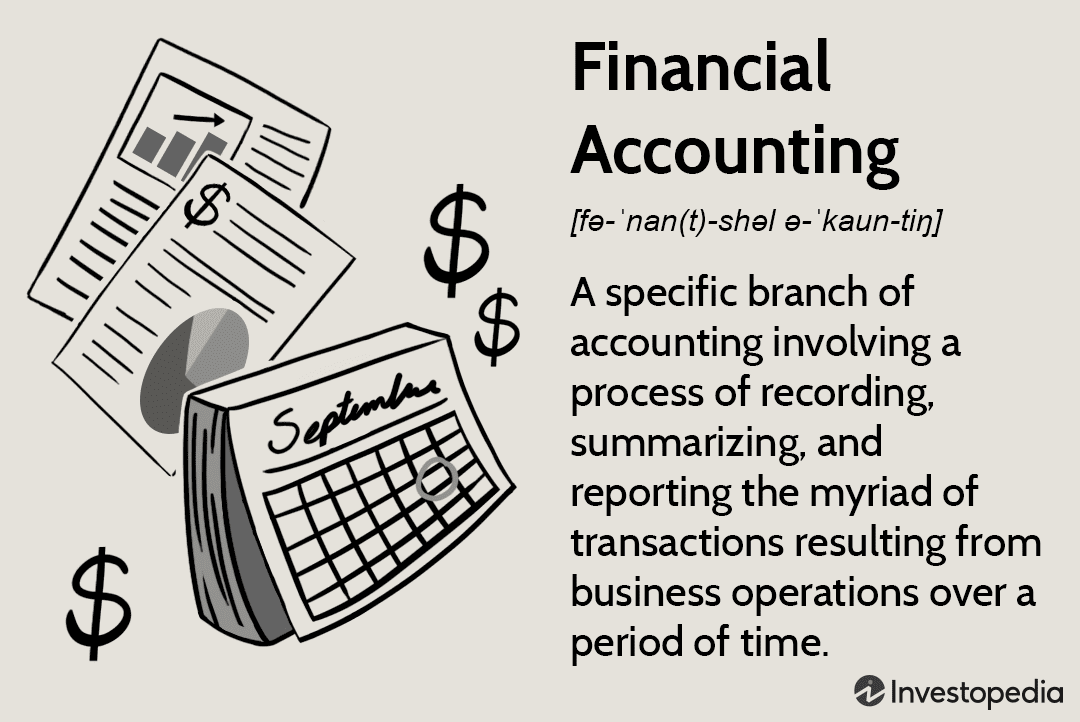

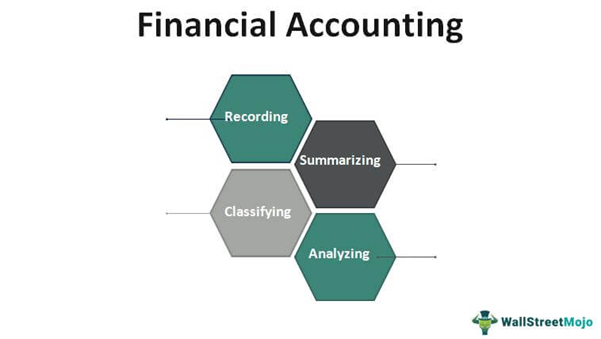

What is accounting? In its simplest form, accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions.

The goal of accounting is to provide financial information that is helpful in making decisions about how to operate a business. This information can be used by managers, investors, creditors, and other interested parties.

What is accounting?

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. The information provided by accounting is used in financial planning, decision making, and performance evaluation.

There are three types of financial statements: the balance sheet, the income statement, and the statement of cash flows. The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The income statement shows a company’s revenues and expenses over a period of time. The statement of cash flows shows how a company’s cash has changed over a period of time.

Accounting also provides information for management about where the company’s money is being spent and whether or not the company is making a profit. This information is used to make decisions about how to allocate resources within the company.

Generally accepted accounting principles (GAAP) are the rules that govern how financial transactions are to be reported in financial statements. GAAP are established by professional organizations such as the Financial Accounting Standards Board (FASB).

Why do people need to know more about accounting?

There are a number of reasons why people need to know more about accounting. First and foremost, accounting is the language of business. It is the basis upon which financial statements are prepared and business transactions are recorded. Without a basic understanding of accounting, it is very difficult to understand financial statements or to make informed decisions about business transactions.

In addition, many business decisions have an accounting component. For example, when considering whether to invest in a new piece of equipment, managers need to understand the accounting concepts of depreciation and amortization in order to make an informed decision.

Finally, individuals need to understand accounting in order to make informed decisions about their own personal finances. For example, when considering whether to purchase a home, individuals need to understand mortgage terms such as principal, interest, taxes, and insurance in order to make an informed decision.

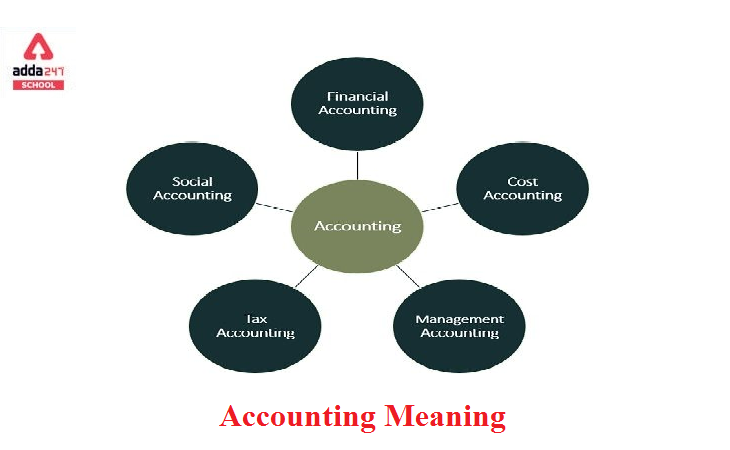

What are some of the different types of accounting systems?

There are three primary types of accounting systems:

1. Financial accounting – This type of accounting focuses on the financial statements of a company, which are used to provide information to external users such as shareholders, creditors, and tax authorities.

2. Managerial accounting – This type of accounting provides information to internal users such as managers and other decision-makers. It focuses on topics such as cost analysis and planning.

3. Tax accounting – This type of accounting focuses on preparing tax returns and ensuring compliance with tax laws.

Who is the average person who needs to understand what accountants do?

The average person who needs to understand what accountants do is someone who is interested in managing their finances and ensuring that their money is being used in the most efficient way possible. Accountants are responsible for keeping track of a company’s financial records and providing advice on how to best use the funds available.

How would this understanding help them?

An understanding of accounting would help individuals in a number of ways. For one, they would be able to better understand financial statements and other reports that use accounting data. This knowledge would also give them a better understanding of how businesses operate and the role that accounting plays in decision-making. Additionally, individuals would be equipped to discuss accounting topics with professionals in the field. Finally, this understanding could help people identify potential career paths in accounting or related fields.

What are some of the skills needed by an accountant?

Some of the skills needed by an accountant include:

-Analytical skills: Accountants must be able to analyze data and financial statements to identify trends and issues.

-Communication skills: Accountants must be able to communicate effectively with clients, colleagues, and upper management.

-Organizational skills: Accountants must be able to organize their work in a way that allows them to meet deadlines and client expectations.

-Detail oriented: Accountants must be able to pay attention to detail in order to accurately prepare financial statements and reports.

Which type of accounting may be right for me?

If you are running a business, or are thinking about starting one, you will need to decide which type of accounting is right for you. The three main types of accounting are financial, managerial, and tax.

Financial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. Financial statements are the primary products of financial accounting.

Managerial accounting is concerned with providing information that is useful in planning, decision-making, and controlling business operations. Managerial accounting reports often focus on specific areas of the business, such as production or sales.

Tax accounting is the process of preparing tax returns and other documents related to taxation. Tax accountants must be familiar with tax laws and regulations in order to ensure that their clients comply with them.

What Is Accounting? – Accounting Financial Definition

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. The main types of financial statements are the balance sheet, income statement, statement of cash flows, and statement of equity.

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The income statement shows a company’s revenue and expenses over a period of time. The statement of cash flows shows how a company’s cash changed during a period of time. The statement of equity shows the changes in a company’s equity during a period of time.