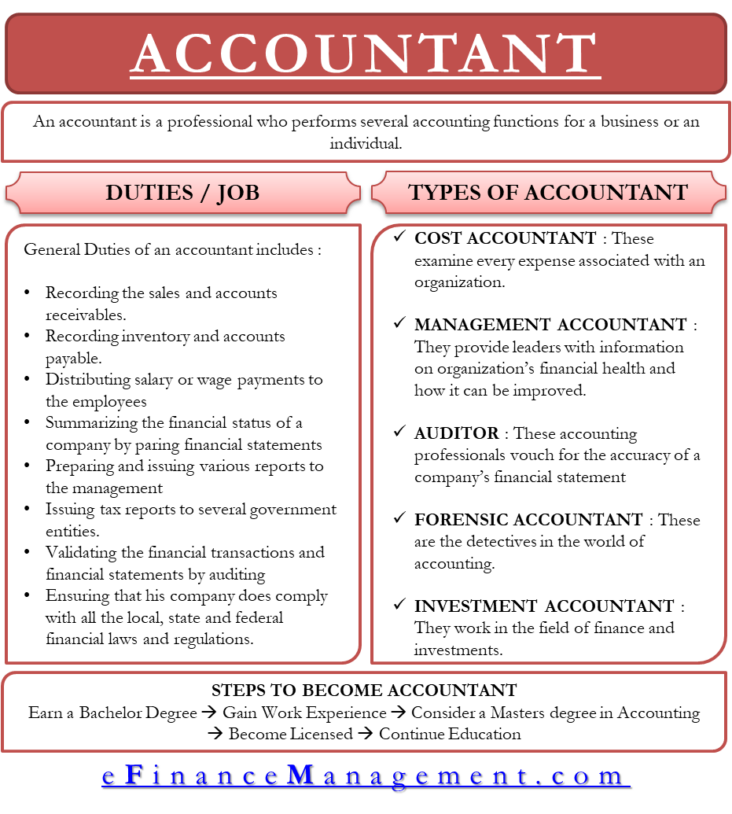

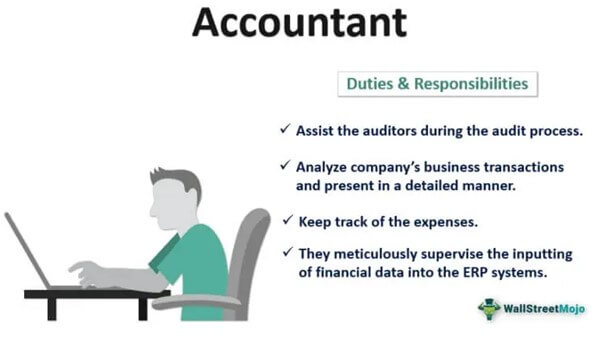

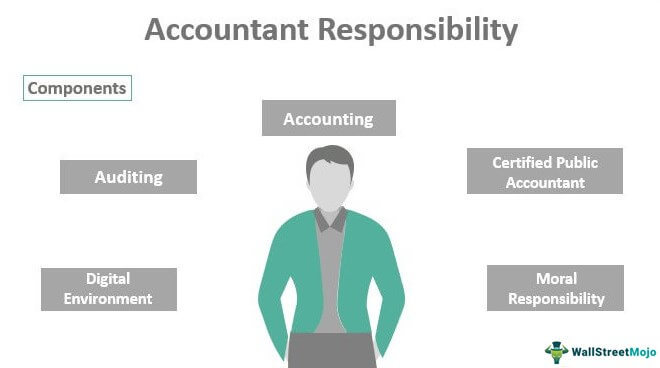

The responsibilities of an accountant depend on the size and needs of the organization they work for. In general, an accountant is responsible for recording, classifying, and summarizing financial transactions to prepare financial statements, as well as providing advice to management on financial matters.

While the specific duties of an accountant may vary depending on their employer, there are some common responsibilities that all accountants share. Read on to learn more about what accountant responsibility entails.

What is an accountant?

An accountant is someone who keeps and inspects financial records. They make sure that records are accurate and that taxes are paid properly and on time. Accountants can also be responsible for auditing financial statements and for providing advice on financial matters.

Accounting Internships

If you are considering a career in accounting or finance, an internship is a great way to gain experience in the field. Accounting internships can give you the opportunity to learn about the day-to-day responsibilities of an accountant and get a feel for the work environment.

Most accounting internships will involve working with a team of accountants on various projects. You may be asked to help with data entry, preparing financial statements, or conducting research. As an intern, you will be able to observe and learn from the experienced professionals around you.

While an internship is not required to become an accountant, it can give you a competitive edge when applying for jobs. An internship can also help you decide if a career in accounting is the right fit for you. If you are interested in pursuing an accounting internship, talk to your school’s career center or reach out to accounting firms in your area.

How to become an accountant

To become an accountant, you will need to have at least a bachelor’s degree in accounting or a related field. Many employers prefer candidates with a master’s degree in accounting or a related field. You will also need to pass the Certified Public Accountant (CPA) exam. Employers also prefer candidates who have experience working in an accounting or finance role.

What is accountants’ responsibility?

An accountant is responsible for ensuring that financial records are accurate and that taxes are paid on time. They may also be responsible for auditing financial statements and preparing tax returns.

What to do when you’re on an accountants’ work list

If you are on an accountant’s work list, there are a few things you can do to make sure that your accountant is able to properly and accurately do their job. First, be sure to keep accurate records of all income and expenses. This will help your accountant to track your finances and make sure that everything is accounted for. Second, be sure to communicate with your accountant regularly. This will allow them to ask questions and get clarification on anything they may be unsure about. Finally, be patient! Accountants have a lot of responsibility, and it can take some time for them to complete their work.

What Is Accountant Responsibility? – Accountant Responsibility Financial Definition

An accountant is responsible for maintaining financial records, preparing financial statements, and ensuring that taxes are paid in a timely manner. An accountant may also be responsible for auditing financial statements and providing tax advice.