If you’re running a business, you’re going to need an accountant. An accountant is a professional who helps businesses and individuals manage their finances. They can help with a variety of tasks, such as preparing financial statements, tracking expenses, and filing taxes.

While you can do all of these things yourself, it’s usually best to leave it to the professionals. accountants have the training and experience to get the job done right. Plus, they can offer valuable insights into your finances that you might not be able to see on your own.

So, what is an accountant? An accountant is a financial professional who can help you manage your money. If you’re looking for someone to help you with your finances, an accountant is a good option.

Definition

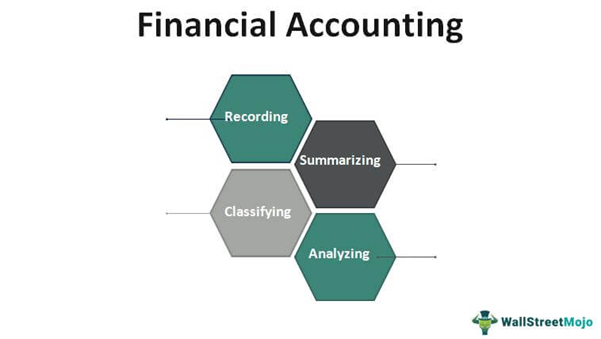

An accountant is a professional who helps companies and individuals track their financial records. This includes recording, classifying, and summarizing financial transactions to prepare financial statements, assessing financial risks, and providing advice on financial planning.

Accountants typically have a college degree in accounting or a related field. Some countries also have professional accounting bodies that offer certification for accountants.

Examples of Accountant in Practice

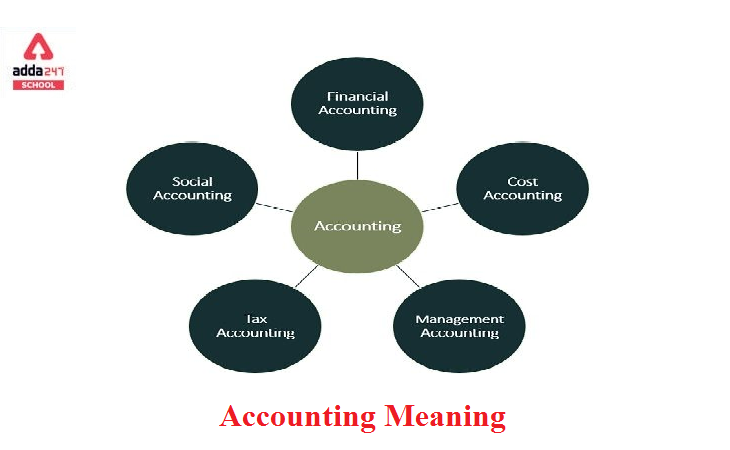

There are many different types of accountants, but they all share one common goal: to ensure that businesses and individuals have accurate financial records. Here are a few examples of accountants in practice:

1. Certified Public Accountants (CPAs) are licensed by their state to provide accounting services to the public. They often work as auditors, reviewing financial records to ensure accuracy and compliance with laws and regulations.

2. Management accountants work within businesses and organizations to help managers make informed decisions about where to allocate resources. They prepare financial reports, analyze business trends, and develop budgeting and forecasting models.

3. Government accountants work for local, state, and federal governments, ensuring that tax revenue is properly collected and spent. They may also audit private businesses to ensure compliance with tax laws.

4. Forensic accountants use their investigative skills to uncover fraud and embezzlement. They may work for law enforcement agencies or private firms, and their work often leads to criminal prosecutions.

5. Personal financial advisors provide advice on investing, saving for retirement, and managing debt. They typically work for banks, investment firms, or insurance companies.

Why Become an Accountant?

There are many reasons to become an accountant. Accountants are in high demand and the profession is expected to grow faster than average in the coming years. Accountants are also well-paid, with a median annual salary of $69,350 in 2016.

But beyond the financial rewards, accounting is a stable and challenging profession that can offer its practitioners a great deal of satisfaction. Accountants help businesses make sound financial decisions and ensure that they comply with laws and regulations. They also prepare and examine financial records, ensuring that they are accurate and complete.

For those who enjoy working with numbers and solving problems, accounting can be a very rewarding career. It is a field that is constantly evolving, as new technologies and regulations change the way that businesses operate. And because accountants play such an important role in business, they often have opportunities to advance their careers and take on leadership roles.

Summary

An accountant is a professional who performs financial accounting, auditing, and tax services. Accountants are employed in a variety of industries, including public accounting firms, government agencies, and private businesses.

The primary responsibilities of an accountant are to prepare financial statements and tax returns, and to advise clients on financial planning and investment decisions. Financial accounting involves the recording, classifying, and summarizing of financial transactions to provide information that is useful in making business decisions. Audit services involve the examination of an organization’s financial statements and practices to ensure that they comply with generally accepted accounting principles. Tax services involve the preparation of federal, state, and local tax returns.

Accountants must be licensed by the state in which they practice. Most states require accountants to pass the Uniform Certified Public Accountant Examination before they can be licensed.

What Is Accountant? – Accountant Financial Definition

An accountant is a professional who provides financial services to individuals, businesses, and other organizations. Accountants typically have a college degree in accounting or a related field, and they must be licensed by the state in which they practice.

Accountants provide a variety of services, including tax preparation, auditing, financial planning, and bookkeeping. They may also provide consulting services on issues such as mergers and acquisitions, estate planning, and corporate finance.

Most accountants work in public accounting firms, but many also work in private companies, government agencies, and nonprofit organizations. The job outlook for accountants is good, with employment expected to grow faster than the average for all occupations through 2022.