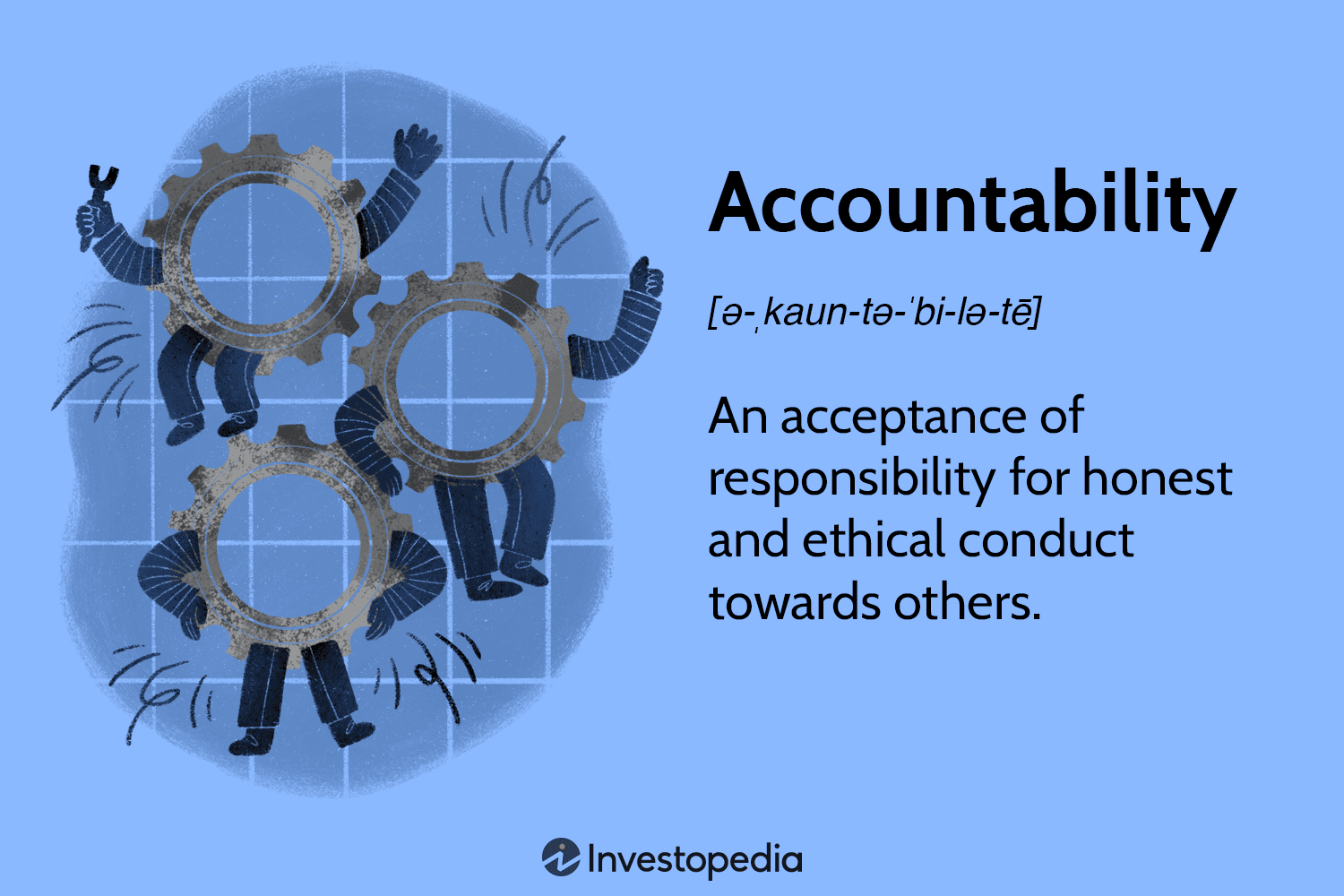

Accountability is a term that is often used but seldom defined. What is accountability? Most people would say that it is being responsible for your actions. But what does that mean?

In this blog post, we will explore the concept of accountability and how it applies to both individuals and organizations. We will also discuss some of the challenges associated with accountability and how to overcome them.

Accountability Financial Definition

Accountability is the state or quality of being accountable, liable, or answerable. In business and finance, accountability is the accepting of responsibility for one’s actions with the consequent requirement to report, explain, and be answerable for the results.

In a business or financial context, accountability often takes the form of financial reporting. Public companies are typically accountable to their shareholders, while private companies are accountable to their owners. Accountability can also extend to other stakeholders, such as employees, customers, and suppliers.

Generally speaking, businesses are accountable for their actions and must provide justification or explanation when things go wrong. This accountability can take many forms, such as financial reporting, audits, customer feedback, etc.

Being accountable requires businesses to be transparent in their operations and to have systems and controls in place to ensure that they are meeting their obligations. It also requires businesses to take responsibility for their actions and accept the consequences when things go wrong.

The Role of Accountability

When it comes to money, accountability is key. That’s why we have financial advisors and institutions like banks. They help us keep track of our money and make sure we are using it in the best way possible.

But what does accountability mean when it comes to our personal finances?

Simply put, accountability is taking responsibility for your own financial wellbeing. This means being proactive about your spending and saving, and making sure you are always aware of your financial situation.

It also means being honest with yourself about your financial goals and sticking to a budget. Accountability is about making smart choices with your money so that you can reach your financial goals.

So how can you be more accountable with your finances? Here are a few tips:

1. Keep track of your spending. This means knowing where every penny goes. Track your spending for a month and then take a close look at where you are spending most of your money. You may be surprised to find that you are spending more on unnecessary things than you realized.

2. Make a budget and stick to it. A budget is a helpful tool that can keep you on track with your spending. Once you know where your money is going, you can make adjustments to ensure you are staying within your budget.

3. Set financial goals and work towards them. What do you want to achieve with your finances? Do you want to save for a down payment on a house, or do you

Types of Accountability

There are different types of accountability, but they all share the common goal of holding individuals and organizations accountable for their actions.

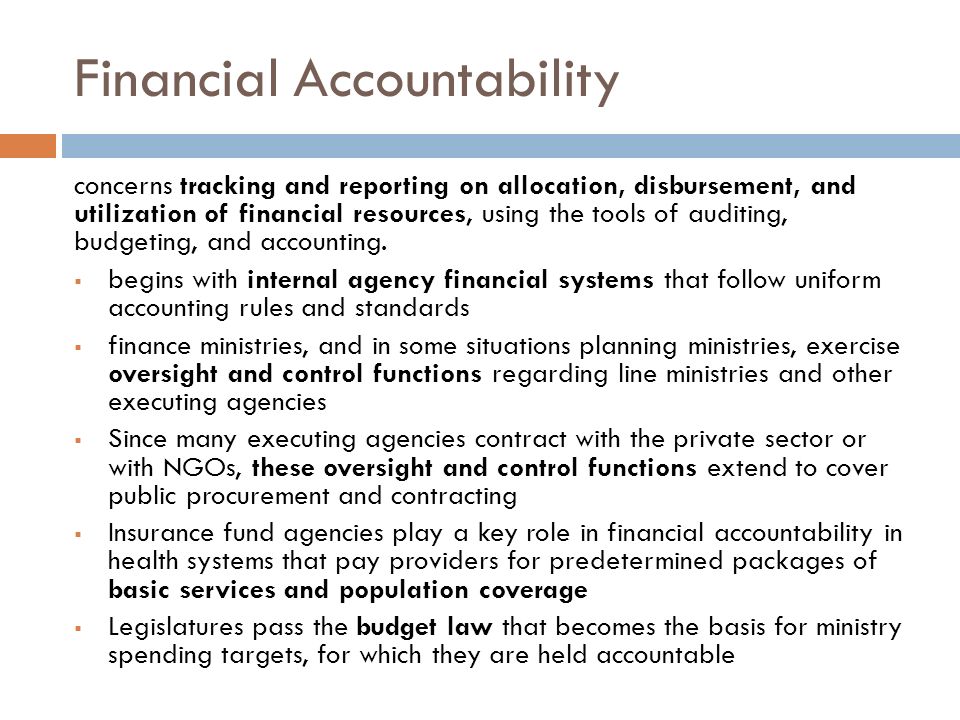

One type of accountability is financial accountability, which is the process of tracking and reporting on financial resources. This type of accountability is important for both public and private organizations in order to ensure that resources are being used appropriately and efficiently.

Another type of accountability is performance accountability, which focuses on assessing whether or not an individual or organization is meeting its goals. This type of accountability can be used to assess progress over time, identify areas of improvement, and hold individuals and organizations accountable for their results.

Finally, there is ethical accountability, which refers to the responsibility to uphold ethical standards in one’s personal and professional life. Ethical accountability includes being honest, transparent, and fair in all interactions with others.

What Is an Accountable Person?

An accountable person is somebody who is responsible for their actions and takes ownership of their results. They are able to be counted on to do what they say they will do, and they follow through on their commitments. Accountable people are reliable and trustworthy, and they set the example for others to follow. When something goes wrong, they take responsibility and work to make things right. Accountability is a key characteristic of successful individuals and organizations, and it is something that we all should strive for in our lives.

Why is Accountability Important?

Accountability is important because it is the key to ensuring that employees are meeting their obligations and responsibilities. It also allows managers to identify and address any problems or issues in a timely manner. Additionally, accountability can help improve communication and collaboration within an organization.

Tips for Building Accountability

Accountability is critical to the success of any organization, yet it can be difficult to achieve. The following tips can help you build a culture of accountability in your organization:

1. Define what accountability means to you and your organization.

2. Communicate your expectations for accountability to all members of your team.

3. Hold team members accountable for their actions and decisions.

4. Encourage feedback and open communication among team members.

5. Reward those who exemplify accountability in their work.

6. Be an example of accountability yourself.

What Is Accountability? – Accountability Financial Definition

Accountability is the state or quality of being accountable; especially : an obligation or willingness to accept responsibility or to account for one’s actions.