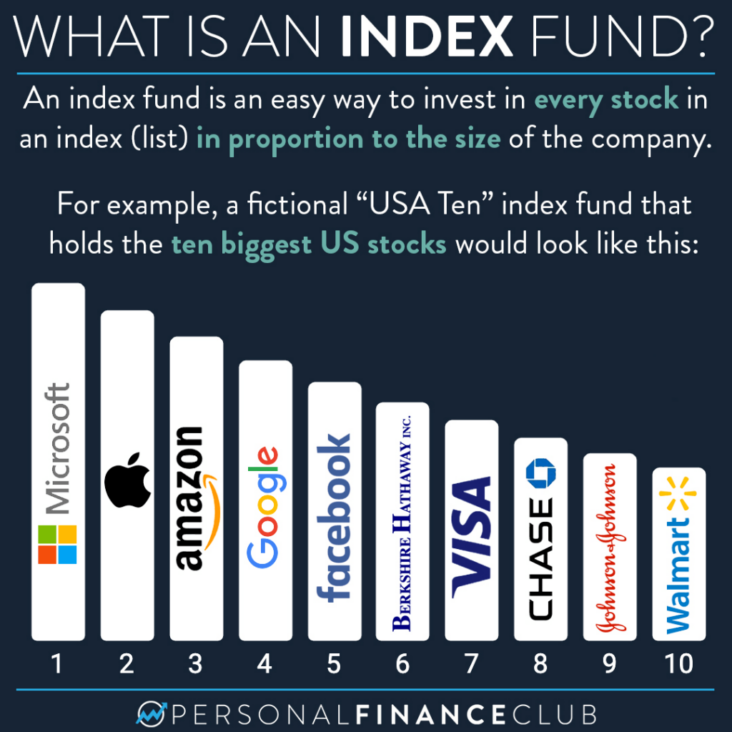

Discover the ultimate investment strategy for 2023 with our comprehensive guide to the best index funds on the market. As the go-to financial tool for savvy investors seeking long-term growth and reduced risk, index funds offer a diversified and cost-effective approach to building a robust portfolio. In this article, we’ll unveil the top index funds to buy in 2023, carefully researched and handpicked by our team of experts. Stay ahead of the game and maximize your returns by learning about these high-performing, low-cost investment options that are set to dominate the world of passive investing in 2023 and beyond.

Vanguard Total Stock Market Index Fund (VTI): This index fund offers broad exposure to the entire U.S

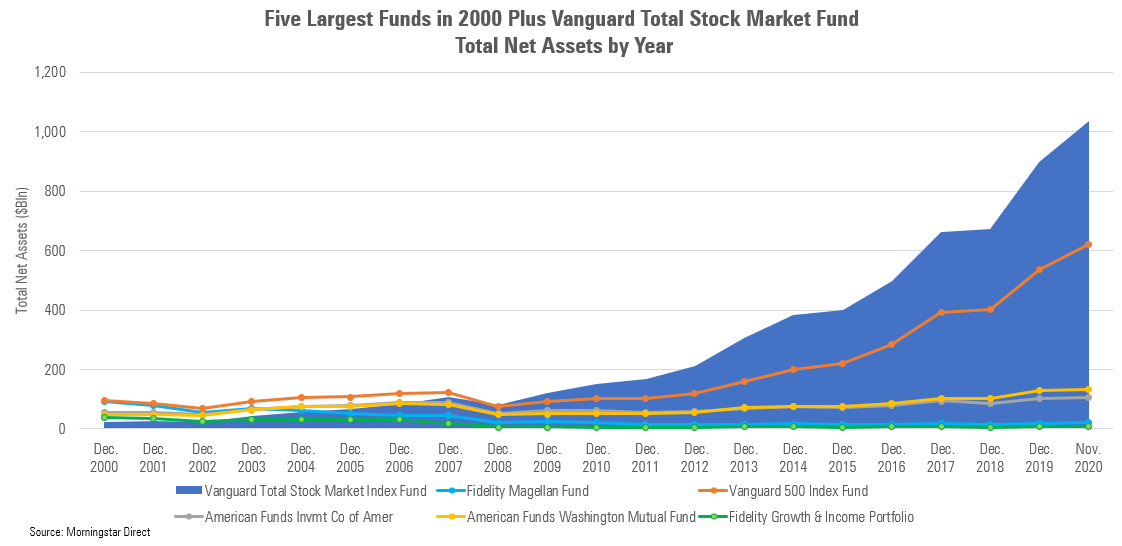

The Vanguard Total Stock Market Index Fund (VTI) stands out as one of the top index funds to consider in 2023, providing investors with comprehensive exposure to the entire U.S. stock market. This low-cost, diversified fund encompasses a wide array of sectors and market capitalizations, making it an ideal choice for those seeking long-term growth and stability. By replicating the performance of the CRSP US Total Market Index, VTI grants investors access to thousands of U.S. stocks, thereby reducing individual stock risk and ensuring a well-balanced portfolio. A proven track record and exceptional management further solidify VTI’s position as a must-have index fund for 2023.

stock market, including large-, mid-, and small-cap stocks

In 2023, diversifying your investment portfolio with the best index funds is a smart move, as they provide exposure to a wide range of stocks in the ever-dynamic stock market. To achieve optimal growth, consider allocating your funds across large-, mid-, and small-cap stocks. Large-cap stocks bring stability and reliability, while mid-cap stocks present a balance between risk and potential return. Small-cap stocks, though riskier, offer higher growth potential for investors seeking significant capital appreciation. By strategically investing in top-performing index funds that cover various market capitalizations, you can maximize your returns while minimizing risks, ensuring a well-rounded and robust financial future.

It seeks to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S

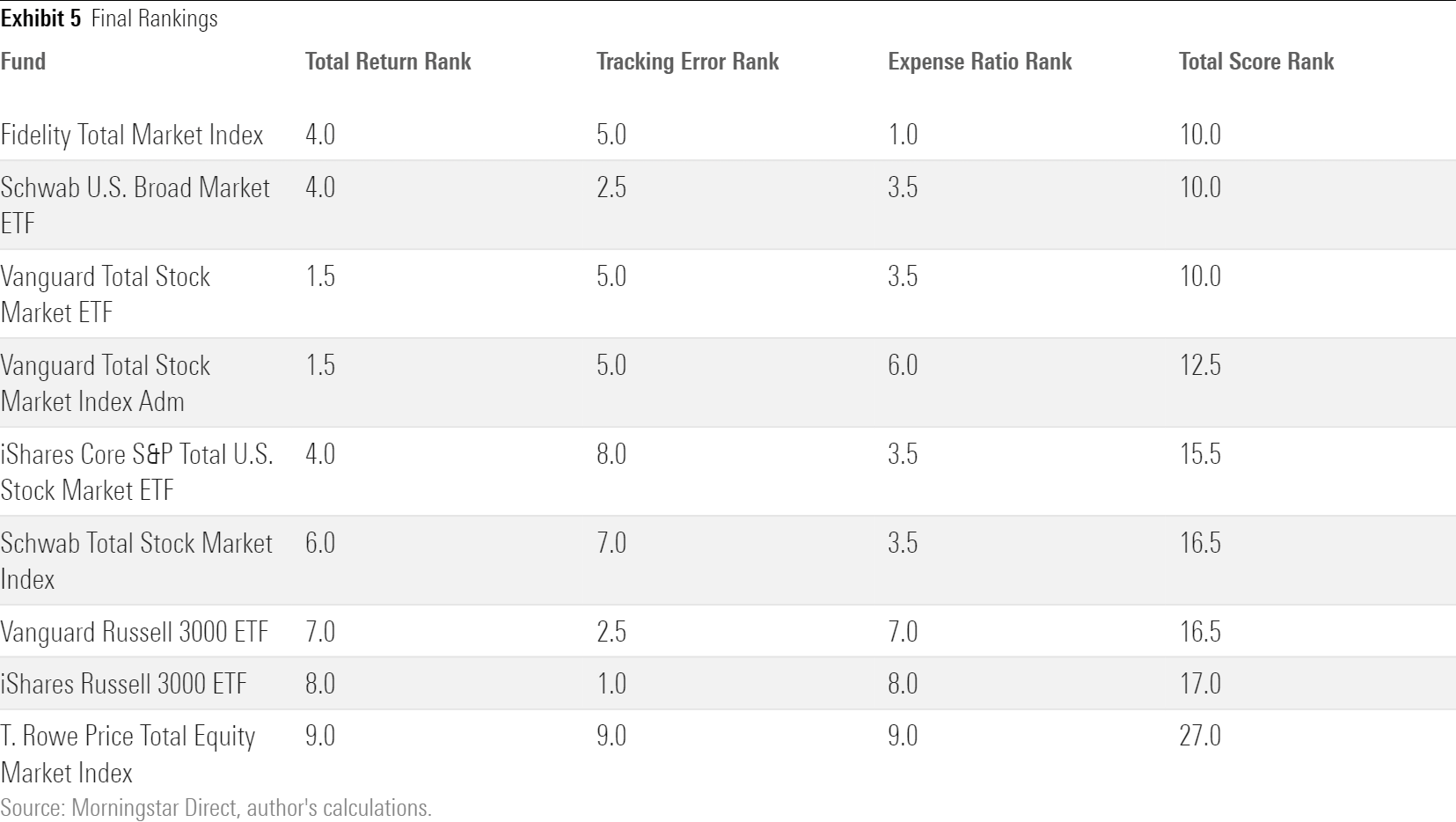

The CRSP US Total Market Index Fund is an ideal choice for investors looking to diversify their portfolio in 2023. This all-encompassing index fund provides exposure to the entire US stock market, capturing the performance of approximately 100% of investable US equities. By investing in this comprehensive fund, investors can enjoy the benefits of low-cost diversification, minimizing risk while maximizing potential returns. Additionally, the CRSP US Total Market Index Fund offers a competitive expense ratio, further enhancing its appeal as a top index fund to buy in 2023. Don’t miss this opportunity to invest in a fund that encompasses the entire US stock market for optimal growth and stability.

stock market

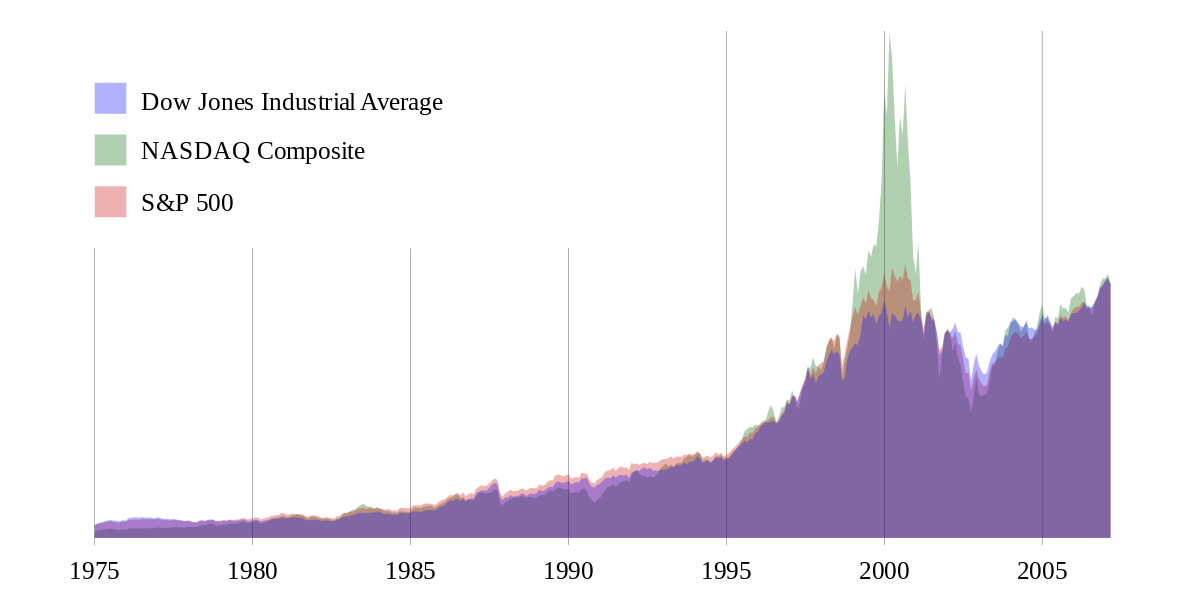

In 2023, the stock market offers a plethora of opportunities for investors seeking the best index funds to maximize their returns. As global markets continue to evolve and new sectors emerge, it’s essential to stay updated on the latest trends and top-performing funds. When choosing the perfect index fund, consider factors such as historical performance, expense ratios, and diversification. Some of the best options include S&P 500 index funds, total stock market funds, and sector-specific funds focusing on technology or healthcare. By investing in these top-rated index funds, you can harness the potential of the stock market while minimizing risks and ensuring long-term growth for your portfolio.

With low expense ratios and a solid track record, VTI is an excellent choice for long-term investors seeking exposure to the entire U.S

As we look ahead to 2023, the Vanguard Total Stock Market ETF (VTI) stands out as one of the best index funds for investors seeking broad exposure to the U.S. stock market. With its impressively low expense ratio of 0.03% and robust historical performance, VTI provides a cost-effective and efficient way to diversify your investment portfolio. This comprehensive fund tracks the CRSP US Total Market Index, encompassing large-, mid-, small-, and micro-cap stocks, ensuring that investors gain access to the full spectrum of the American equity landscape. Consider adding VTI to your long-term investment strategy for 2023 and beyond.

stock market.

In 2023, the stock market continues to offer promising opportunities for investors seeking long-term growth, and index funds remain a top choice for maximizing returns. By providing a diversified and low-cost investment strategy, index funds enable investors to benefit from the overall market performance, mitigating risks associated with individual stocks. As a result, these funds have become increasingly popular among both novice and experienced investors. To help you make informed decisions, our blog post highlights the best index funds to buy in 2023, focusing on factors such as expense ratios, historical performance, and market capitalization. Don’t miss out on the chance to grow your wealth with these top-performing index funds!

Fidelity ZERO Total Market Index Fund (FZROX): This index fund offers exposure to a broad range of U.S

The Fidelity ZERO Total Market Index Fund (FZROX) is an exceptional choice for investors seeking diversified, low-cost exposure to the entire U.S. stock market in 2023. With an expense ratio of 0.00% and no minimum investment required, FZROX makes it affordable for anyone to invest in a comprehensive portfolio of U.S. stocks. This index fund covers large, mid, and small-cap equities, ensuring investors are well-positioned to benefit from market growth across various sectors. As a result, FZROX is an ideal core holding for long-term investors looking to harness the power of compounding returns while minimizing fees.

stocks with zero expense ratios, making it an attractive option for cost-conscious investors

In 2023, savvy investors will be drawn to index funds with zero expense ratios, providing an excellent opportunity for cost-conscious individuals to grow their wealth. These no-cost funds eliminate management fees, allowing investors to keep more of their returns and maximize their earning potential. As more fund providers recognize the demand for low-cost investment options, the market will continue to expand, offering a variety of choices for individuals seeking long-term growth. By selecting zero expense ratio index funds, investors can take advantage of a diversified portfolio without sacrificing their hard-earned money to unnecessary fees, making it an ideal strategy for those seeking to bolster their financial future.

It seeks to track the performance of

In 2023, the ideal index funds to invest in are those that consistently track the performance of top market indices, offering investors solid returns with minimal risk. These stellar index funds tend to have low expense ratios, broad diversification, and a reliable history of performance. Investors should look for funds that mirror the performance of renowned indices such as the S&P 500, Dow Jones, and NASDAQ. By doing so, they can ensure their portfolio remains resilient in the face of market fluctuations and capitalizes on the growth of leading companies across various sectors. Stay ahead of the investment curve by selecting the best index funds in 2023 for steady, long-term gains.